Economy

Why RBI Is Unlikely To Cut Repo Rates Anytime Soon And Why It Should

Swarajya Staff

Aug 19, 2024, 04:01 PM | Updated 04:15 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Inflation expectations are keeping the Reserve Bank of India (RBI) from slashing repo rates anytime soon.

This strict stance appears set to continue even at a time when Consumer Price Index (CPI) inflation is at a five-year low. The July 2024 CPI inflation came out to be 3.54 per cent and food inflation came out to 5.42 per cent.

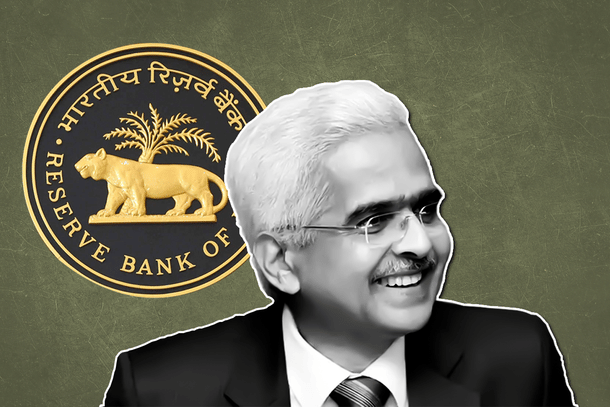

RBI Governor Shaktikanta Das, in his policy speech on 8 August, made it clear that a rate cut was unlikely to be seen anytime soon.

“The MPC (Monetary Policy Committee) reiterates the need to continue with the disinflationary stance, until a durable alignment of the headline CPI inflation with the target is achieved,” he said.

One of the reasons that the CPI number (3.54 per cent) has not changed the minds of the RBI is that it comes on the back of a high base effect. The July 2023 CPI inflation number was 7.44 per cent. The RBI appears to think that once the base effect wears off, the CPI would increase.

However, there is another reason behind the central bank’s reluctance to slash rates.

The RBI thinks that the consistently high food prices will impact inflation expectations and drive them upwards. At such a time, lowering repo rates will release more money in the hands of the consumers and spike inflation.

The RBI thus wants to slow down the economy and keep it below its natural level. Even at the cost of unemployment.

The question to consider here is if the RBI can really push its policy against the wishes of the government? Hence, if the central bank is sticking to its stance of not cutting the rates and tolerating unemployment at the cost of tackling inflation expectations, it is most likely implementing a choice made by the government itself.

Why RBI Should Cut Rates

There is no evidence to suggest that people indeed align their inflation expectations of the future with the inflation numbers of the past.

Additionally, it needs to be studied whether contemporary inflation expectations are being determined by factors which are temporary or those which are persistent.

What is known certainly is that the high real rates hurt investments. Which hurts capital formation. Which hurts employment. At the consumer level, high real rates subdue demand. The economy functions below its natural level.

The question for the RBI (Government) is — are the benefits from inflation control worth more than the growth foregone?