Ideas

5G, IoT And More: What Chips Can $1.2 Billion To $2 Billion ‘Analog’ #FabInIndia Make?

Arun Mampazhy

Aug 19, 2020, 03:50 PM | Updated 03:50 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Mercedes Benz, one of the world's oldest car manufacturers, has its origins in 1883. India's earliest car manufacturer, Hindustan Motors, started production 75 years later, that is in 1958. Maruti Udyog Limited was founded in 1981, nearly a century after 1883.

As per this report, as of year 2001, India was still manufacturing only 1 per cent of global numbers, but come 2018, it stands at over 5 per cent and growing, a graph shown in this article, confirms the same.

India's start was not just late but with 'lower end', 'low cost' cars like Ambassador and Maruti, but currently the list of "foreign manufacturers building or are in a JV" in India includes almost every high end car manufacturer. There may be some lessons to be learned from this for India's yet-to-fully-take-off #FabInIndia journey too.

One may argue that semiconductor chip manufacturing is in many ways different from automobile manufacturing — and I don't disagree — but a deeper analysis will show why some of those differences will actually favour even more strongly the pitch of "Let India stand up first, then walk, before it tries to run" with respect to semiconductor manufacturing fabs too.

It is still not too late and for India to be truly aatmanirbhar (self sufficient) in electronics, semiconductor fabs (or foundries) are a must have.

In my previous articles in Swarajya available here , as well as in my ORF article, I have consistently pitched for the need for an 'Analog' #FabInIndia, which will be relatively lower investment as the technology nodes needed are still in 130/180nm or at best 45nm/65nm, greater return on investment (RoI) and yet, will demonstrate commercial semiconductor fab capability for India, as the "needs" like water, electricity, cleanliness, safety etc are of similar standards of the high end fabs.

In this article, I take a deeper look at that subject keeping in mind "Make in India, for the world", note that my usage of 'analog fab' does not mean that they can do only analog chips (in fact, towards the end of the article, I will slowly drive in the "mixed signal" piece as well) or that they process only SOI (silicon of insulator) wafers, however, examples quoted here may predominantly speak about those.

Let us start with some basics — when I studied the basics of computers in my high school 25 years ago, it said "CPU, memory, keyboard, monitor, mouse".

Recently, as I saw my child's first and second standard textbooks, I see that nothing much has changed in that "model".

What these textbooks and perhaps many general electronics enthusiasts too seem to be missing is the revolution in smartphone and other "computer-like" electronic devices and the increased usage of "communication modules", "sensors" and so on in both what can be called as the conventional computers as well as the 'smart' electronic devices.

To put it bluntly, I will use a quote from this small write-up on the basics and history of analog ICs — “every 'digital' consumer product, from appliances and cell phones to music players, has analog ICs feeding its digital heart”.

Let us take a deeper look at some of the communication related semiconductor components or chips that are needed, say in smart phones.

I will quote from this article which talks about challenges associated with 5G implementation. However, the following lines are relevant in general.

The front-end module consists of several components in the same unit, including power amplifiers, low-noise amplifiers (LNAs), filters, and RF switches. Power amps provide the power for a signal to reach a destination. LNAs amplify a small signal, while filters block out the noise. Switch chips route signals from one component to another. In the module, the dies are sometimes put in IC packages. Typically, though, they are bare dies that reside on a board.

Many of the analog chips (ICs) or components needed for the communication modules are still manufactured in technology nodes in three digit nanometers and so are many in the high voltage application space.

The power and voltage levels needed from such chips is best achieved with 130 or 180 nm nodes. So these nodes are still dominant in the communication modules (4G, WiFi, Bluetooth etc).

Advanced nodes with low voltage and power are less optimal for such application space.

For the sensors and the IoT driven chips and components, in general the power needed is lesser and denser digital part is required, but even there 65nm (or 55nm for TSMC) and 45nm (40nm for TSMC) are going strong.

In fact, a December 2019 news said how TSMC will do image sensors for Sony in 40nm node.

In spite of all this, some even in the semiconductor design world in India mistakenly call anything above 20nm as "outdated".

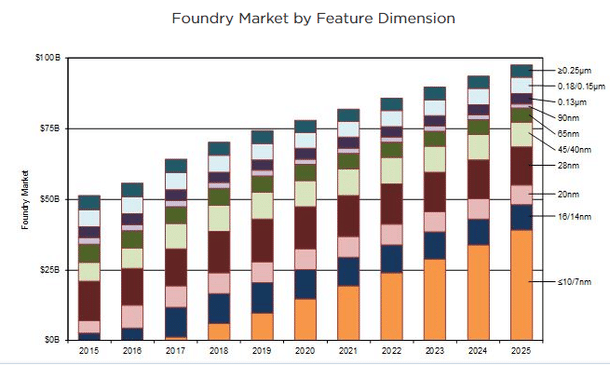

How on earth can that be when market studies and predictions like the one below have shown that >20nm tech-nodes will have a healthy $40 billion market (>40 per cent in the foundry market) even in 2025?

Motives, ignorance or refusal (to take a look at data) — I don't know, but it looks like how much ever one tries, the loose and incorrect talk of "anything above 20nm is outdated by 2020 already" does not stop, so beyond a point, it is best to ignore such and move on.

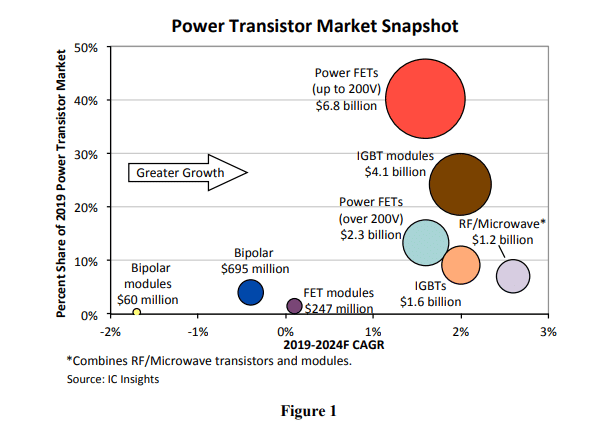

In this IC insights bulletin released on 23 July 2020 which primarily focuses on power transistors, there are some interesting data points, graphs and conclusions, useful for a study of what 'analog' fabs can offer.

Notice the lines:

Growth in radio-frequency and microwave power transistors is expected to lead the market recovery in 2021 because of the build-out of fifth-generation (5G) cellular networks that will use a range of new transmission frequencies, including those in the millimeter (mmWave) spectrum. New 5G base stations are also employing more antennas and multiple signals to secure high-speed connections with smartphones and Internet of Things systems — such as self-driving cars — that need real-time communications. RF/microwave devices are forecast to lead power transistor market growth through 2024.

Figure 1 from the bulletin is reproduced below.

If 5G and IoT can boost just one type of semiconductor product — viz power transistors in this case — imagine the case for the overall semiconductor market.

Now, to get an idea of some of the foundry players, the technology nodes and wafer sizes they use, I will quote from this 2018 article which talks about the SOI-based chips heavily used in the analog chip world:

- GlobalFoundries, the leader in RF SOI, is ramping up 300mm RF SOI in two fabs. The processes include 130nm and 45nm... For some time, GlobalFoundries has been running 200mm RF SoI.

- TowerJazz has been shipping 200mm RF SOI for some time. The company is ramping up 300mm RF SOI in its fab in Japan. The process is based on 65nm, although the fab is capable of 45nm.

- Both UMC and TSMC have been shipping 200mm RF SOI for some time with plans to enter the 300mm race

Indeed that article was published a couple of years ago. However, it is quite clear that both in terms of technology node (predominantly 180/130nm ) as well as in terms of the wafer size used (predominantly still 200mm), the analog side of fabs is not yet in to an 'ultra advanced' mode like digital and they continue to cater to most of the current needs of communication related chips.

In fact even with 5G, one can expect initial few years of roll out to happen around the 6 GHz band and 200 mm fabs with 130/180 nm nodes are capable enough for this purpose.

Additionally, they are also capable of making many other kind of chips — for example some of the control chips used in many sensors (camera, touch screen, display, light sensor, microphone, battery power management IC etc).

In my opinion, India should immediately start with one such commercial fab with a good production (wafer per month) capacity.

The technology is less complex to implement, yield ramp up is relatively faster, up front investment is cheaper.

Additionally, most of these 200 mm fabs could also do MEMS later on.

In the scenario where global players are planning to move more into 300mm fabs for analog chips, there may be used equipment from the 200mm facilities available at lower prices that may reduce the cost even further — perhaps with a little over $1 billion even, may be $1.2 billion (that is Rs 9,000 crore) or a $1.5 billion depending on the throughput (wafers per month) planned.

The 45nm/65nm tech-node, 300mm wafer size handling fab, will add mixed signal capability also — that is faster and denser (though not cutting edge) digital part that goes with the analog aspect — and will add on capability in at least two more areas in general:

(a) The sensors and IoT markets and

(b) possible solutions for higher band 5G rollout

In fact, for many of the established foundries doing analog, the motive to move to analog's 'advanced nodes' (that is 45/65 nm and 300mm) is driven by expected 5G roll out in 28 GHz or 60 GHz bands (in some select countries).

While the 180/130nm 200mm analog fab can cater to the telecom/RF needs of local Indian market, the sensor and IoT aspects of the analog/mixed signal 300mm fab at 45nm/65nm and MEMS capability provides more opportunity for export also (boosting Make in India initiative), in addition to catering to the local market.

Most fitness bands, smartwatches, body sensors and IoT or industrial/automotive sensors are largely supplied by foundries with such capability.

Cost advantage (labour and others) can benefit India in this segment and can also provide a boost to local fabless startups — say Indian versions of Fitbit, Garmin, Xiomi etc.

A December 2019 India-Israel forum report, excerpts of which were published in Swarajya recently echoed similar thoughts as it said: "an analog and mixed-signal foundry at a technology node of 45/65 nm, could be a starting point for India...." and spoke about sensors, IoT and so on also.

Since it is a study in collaboration with Israel, possibly TowerJazz was the one who 'powered' the study along with some members likely from India, especially to look at the market.

In the absence of further details of the study coming out in public domain, one has to assume that the near $2 billion aid (subsidy plus interest free loan) requested from the government of India, is likely for a 300mm fab, given that 45nm/65nm tech-nodes are proposed.

The wafers per month capacity for the proposed fab is also not yet clear.

A combined 180 or 130nm tech-node using 200mm wafers and a 65nm or 45nm tech-node using 300mm wafers under one roof too is a possibility and some aspects of the cost could end up being shared or optimised under such a model.

It is not clear if the India-Israel study also had proposals along this twin approach, but that is also a plausible $2.x billion fab possibility for India.

On a side note, IIT Bombay developed Dhruva — a navigation receiver RF front-end integrated circuit — as per this article was fabricated using 65nm tech-node quite likely in a foundry outside India.

Let me also note that prototypes of any tech-nodes can 'in theory' be made in India using e-beam writers available in premier institutes in India, but they are not good for bigger scale production.

All this is not to say that India should ignore the digital aspect and not aspire for an 'advanced node' commercial 'digital fab'. If a global player has such plans for India, they should be welcomed. However, it may be more practical and time critical to start with an analog or an analog/mixed signal first as detailed in this article and the same seems to be confirmed by the India-Israel study.

It is also extremely important to #FabInIndia from a security perspective — both the data security of 'common man' as well as defence security — and there too analog/mixed signal fabs play key roles.

However, "the purely security related reasons to have a #FabInIndia" will need an exclusive study or article, perhaps in the future.

I would like to acknowledge and thank Dr Veeresh Deshpande, Deputy Institute Head at Helmholtz Centre Berlin, for his key inputs, Aabid Husain, currently VP of Global Business Development at Atomera, for some pointers and a few others who did a quick review.

Arun Mampazhy has a BTech from IITM and MS from University of Maryland in semiconductor fabrication and over a decade of industry experience. His dreams of seeing a commercial fab takeoff in India has changed from black and white to colour over two decades. He can be reached via email nanoarun(at)gmail(dot)com or @nano_arun on twitter. Views expressed are personal.