Ideas

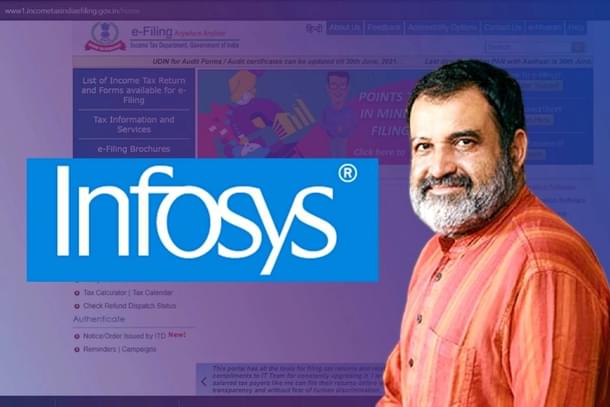

Interview: Mohandas Pai Explains Challenges Involved In Developing Complex Portals, Mistakes Made By Infosys And Government

Swarajya Staff

Sep 08, 2021, 11:39 AM | Updated 12:06 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

An article attacking Indian software company Infosys published in Panchjanya, a weekly magazine run by members of the Rashtriya Swayamsevak Sangh (RSS), has caused quite a kerfuffle, forcing RSS to issue a clarification that ‘Panchjanya is not mouthpiece of the RSS and the said article or opinions expressed in it should not be linked with the RSS’.

The article titled ‘Saakh aur aaghaat’ (Reputation and Attack/Jolt/Blow) is a litany of allegations against Infosys without backing those up with even a shred of evidence or fact.

Moreover, it provokes by assigning motives that the IT firm may be hurting India’s economic interests by intentionally bungling up important government contracts handled by the company in recent years like the GSTN, Income Tax or MCA portals.

Swarajya talked to former director of Infosys Mohandas Pai over phone to understand the challenges involved for a IT firm in developing a complex online portal for the government, what mistakes both Infosys and the government have committed in recent years while working on important projects together and what needs to be done to avoid such situations in future. Below are the excerpts:

What are the challenges usually for a tech company in developing IT systems like the GST portal or the Income Tax returns filing portal?

First, all such government projects are transformational and extremely complex. There are a lot of moving parts.

Second, the (Finance Ministry) department doesn’t have the necessary full expertise to understand the complexities involved to write the specifications. That’s because this is not their regular job. They have not written specifications before. They don’t have adequate technical expertise and they don’t understand the complexity of everything they are doing.

See, the government doesn’t have a stable set of people dealing with these things or systems or processes. They don’t have technology competence necessary because they are all used to dealing with files and not databases.

So, they don’t have skills or project management expertise to write the specifications or manage the project when the software comes, do the testing, etc. On top of it, not only are there a large number of rules and complexities of the Income Tax system itself, but also challenges of something like the GST regime, which none of the government departments have handled before.

That was a bluesky (new) system that was developed.

Third, and a very important point is that the government doesn’t have the same set of people to conceptualise the project, write the specifications, work with the vendor to test it and execute it because they keep transferring people frequently or they retire.

The government doesn’t have the system to pass on the knowledge when this happens. Not much institutional memory, if you will. People learn on the job and when they get transferred out, whatever they learnt goes out with them as well.

Fourth, the government doesn’t have any change or risk management system adequate to manage such large complex sophisticated systems in all departments.

When you are coming up with a new and complex IT system like the GST or IT portal, you are supposed to spend three-four months training users and officials, address the queries and difficulties that emerge, ensure that all the forms are designed and kept ready at the launch, have templates, frameworks and utilities to help users, assess, analyse the issues and so on.

But officials learn on the fly. You need a steady technical group.

Fifth, the government needs to have experts for User Acceptance Testing (UAT). These are the users who can test the software, run different kinds of permutations and combinations and give clearance.

Sixth, they set unreal expectations and then push people around. They don’t set up adequate grievance redressal mechanisms and there is a total lack of communication.

For example, what has been done to explain to the public how many forms are there, what are the utilities available and so on. This is a new system and people have to be trained. If you switch off the old system for one week and then launch a new one and expect it to work flawlessly, then that’s unrealistic. It's the wrong expectation setting.

Ideally, they should have launched the system, told the public what’s all available, keep updating new utilities, send out reports regularly informing the public about the latest additions, assure them of extra time in filing returns, set right expectations and in 3-4 months — it would’ve all worked out.

Software is not magic anywhere in the world. It needs continuous improvements.

What mistakes did Infosys make in executing the IT portal project?

See, the technology companies also don’t have the domain expertise that is required (for example, of the tax system in case of IT or GST portal). They are technologists, not deep domain experts in complex tax matters.

So, there is a gap between ability and expectations on both sides. And it’s a global phenomenon. If you remember, when Barack Obama launched the Obamacare website, it was a mess. So, it takes time.

Infosys also goofed up by not setting the right expectations. They should’ve gone to the government and told them that the UAT needed to be much more rigorous and for that it could get 200-300 chartered accountants with the help of the ICAI, and take the help of experts at portals like ClearTax to do proper UAT.

Because that’s where rubber hits the road. These people would’ve tested the system and relayed what works and what doesn’t.

The tech company can test the software side but can’t anticipate the problems at the user end. They should have trained these CAs on how to use the system because they are the people who interact with taxpayers and thus an important constituency.

Then there is the problem of server capacity which Infosys had also highlighted to the government and it persisted even in the old system and in the initial days of the GST system.

They didn’t add more servers when urgently needed. You should’ve excess capacity to handle the load.

So, Infosys should’ve made all of this clear to the government firmly, but I guess they were beaten by the department and got scared.

Even today, do you have any communication on what’s working and what’s not working in the IT system, how many queries have come, how many have been addressed, how many are pending and so on?

As per my information, as of today, around 75,000 queries have come and more than 72,000 of them have been addressed.

Did you know this? No. Do you know that more than 1.5 crore IT returns have been filed? No. Two and a half to three lakh returns are being filed every day. How many know this?

There is no transparency or communication about actual data.

I am not saying Infosys is blame-free. They should’ve put more senior resources to interact, better project management, better testing and over managed this project and inform everyone what’s happening.

There were issues with the MCA-21 and the GSTN portals developed by Infosys as well and the company got panned for it. Now, after facing the glitches in the IT portal, the critics are saying there is a pattern here, that maybe Infosys doesn’t have the capability and shouldn’t be allowed to handle these complex systems.

Infosys software has been handling 70 per cent of India’s banking system for the last 20-25 years. Do you see any large problems there? No. Even though the sheer number of transactions there are far more than what the IT portal will deal with. Because the banking software has been perfected and standardised over the years with proper risk and change management from the banks' side.

Let me tell you about the MCA portal. When Infosys took over the project, the handing over work and documentation wasn’t done properly. When a new vendor takes over from the old one, which has run it for 8-10 years, you must train them and handover all the documents, work together with the new vendor till the handover is complete.

I remember when Infosys transitioned the GE projects in 1995, they worked with the new vendor to make a seamless transition over a defined time.

There cannot be a sudden change, as happened in the MCA. This is a global process. It wasn’t done properly in this case.

As far as the GST portal is concerned, if you remember, the rate structure was announced by the then Finance Minister just 25 days before the system went live and revisions were made 15 days before and even till the last day of June 2017.

Second, they cleared the system a short while before the launch. Even then, in the first month, 56 lakh returns were filed and 82 lakh people registered. When you have a large complex system like GST, which is also new to everyone, glitches are not uncommon.

But where were the complaints coming from? Mostly, these were from kachha businesses which dealt in cash and were hesitant to file returns for fear of being caught for evasion or from traders who were not trained or had old computer infrastructure.

Also, the system itself was too complex because that is what the officials demanded. Was there a need for all to file monthly in the beginning, so many forms etc? The design was complex too. Today it is working very well, and people have got used to it and the government is using the enormous data to run AI algorithms to catch and expose tax evaders.

It is a world class system today.

But since Infosys has faced similar problems back-to-back in all these three projects, do you think the company should’ve known better in dealing with the government and setting the right expectations and not repeating the same mistakes?

Look, the people at Infosys also change over time just like with how officials in the government do. There are totally different teams by the time a new project comes. What do you do?

I think senior folks at Infosys have made a mistake in not communicating enough because these are not normal projects but highly transformational and there is a lot of complexity involved.

First the system itself is so complex, then the bureaucrats make it more complex via specifications in a certain way and when someone tells the bureaucrats to simplify the specifications to make the system better, they don’t listen.

They would just say, we want this, we want that.

The point is these issues are going to crop up in any large transformational complex project anywhere in the world. Both sides should understand history, get together, work out change management, communication, grievance redressal and set the right expectations.

Otherwise, let me tell you, the same thing will happen in the next project also. Because the government doesn’t learn. Who is there to learn in the government?

Those who have experienced it now will be transferred out by the time the next project comes up. You need institutional memory.