Infrastructure

Centre Plans National Port Rankings To Gauge Performance, Amidst Minor Ports' Continued Growth

Amit Mishra

Dec 26, 2023, 03:07 PM | Updated 03:18 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The rapid growth in the number of non-major ports has prompted the centre to come up with a national ranking of all ports.

The proposed ranking framework would benchmark efficiency standards of major ports against non-major ports, and the Union Shipping Ministry has communicated to all port authorities its intent of setting up this database, writes Business Standard.

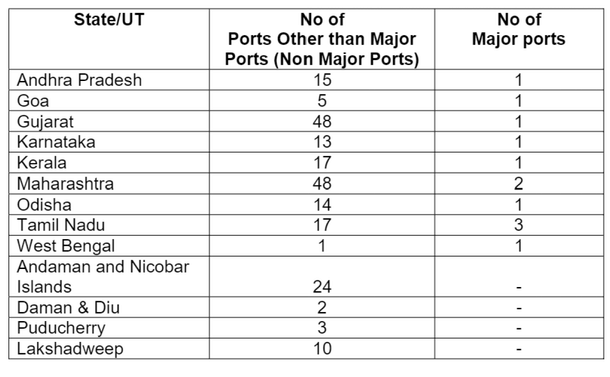

Approximately 95 per cent of India’s trade by volume and 68 per cent by value are moved through maritime transport facilitated by 229 ports (12 major and 217 minor ports) along its 7,517 km coastline.

The 12 major ports — Deendayal (Kandla), Mumbai, Mormugao, New Mangalore, Cochin, Chennai, Ennore (Kamarajar), Tuticorin (V O Chidambaranar), Visakhapatnam, Paradip and Kolkata (including Haldia) and Jawaharlal Nehru Port — are under the administrative control of the Ministry of Shipping, and are regulated under Major Ports Authority Act, 2021.

However, ports other than major ports (non-major or minor ports) and their concessionaires are regulated by state maritime boards under the respective state governments.

It's important to highlight that although the centre maintains an internal database containing performance indicators for all major ports, it does not undertake comprehensive assessment of the efficiency and performance of major ports compared to non-major ones, except for specific niche-based comparative studies.

As outlined in the report, the ranking system will primarily draw inspiration from the methodologies employed in preparation of the World Bank Logistics Performance Index and the Container Port Performance Index (CPPI).

It will incorporate a diverse set of criteria, including market-survey perceptions, cargo traffic handled, berth idle time, average turnaround time, pre-berthing detention, average ship berth day output, and the operating ratio of the port.

Rapid Rise Of Smaller Ports

Apart from rapid rise of private ports in the country, the performance benchmarking also underscores concerns that state-owned ports, despite substantial investments in capacity expansion, have struggled to match the pace of modernisation and the streamlining of port processes.

For example, Pipavav Port, operated by APM Terminals, has been ranked India’s most efficient port for the second consecutive year in the World Bank’s CPPI for 2022.

The port secured the 30th position globally in the CPPI rankings, while the first major port to feature in these rankings is Jawaharlal Nehru Port Trust (JNPT), at 76th position.

Notably, JNPT fell by over 20 ranks between the CPPI of 2021 and 2022.