Infrastructure

Indian Real Estate Got $26.6 Billion In Foreign Investment In 2017-22, Thanks To Policy Reforms: Report

Ankit Saxena

May 22, 2023, 06:22 PM | Updated May 23, 2023, 12:25 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

A recent Colliers report reveals that the real estate industry in India has witnessed a remarkable surge in foreign institutional inflows, amounting to $26.6 billion.

This represents a three-fold increase between 2017 and 2022.

The report titled "India- High on Investors' Agenda" by Colliers thoroughly examines the factors that make India an attractive investment destination, while also analysing the recovery and expansion of the real estate sector.

Additionally, the report emphasises the potential opportunities in different asset categories such as Global Capability Centres (GCC) and Data Centres.

The substantial growth in the sector can be attributed to structural and policy reforms that have significantly improved transparency and the ease of conducting business.

According to the data, total institutional investments in real estate rose to $32.9 billion during 2017-22 period from $25.8 billion in the 2011-16 period.

Foreign investments comprised 81 per cent of real estate investments due to favourable foreign direct investment (FDI) policies, increased transparency, and higher investment caps.

Out of the total inflow — foreign institutional inflow rose to $26.6 billion from $8.2 billion — driven by inflows from USA and Canada with a share of 70 per cent.

Office Sector Leading The Investments Share

"Foreign investments in India have been on the rise over the last few years as the industry underwent an overhaul, with major structural and policy reforms inducing transparency and ease of business operations," the report said.

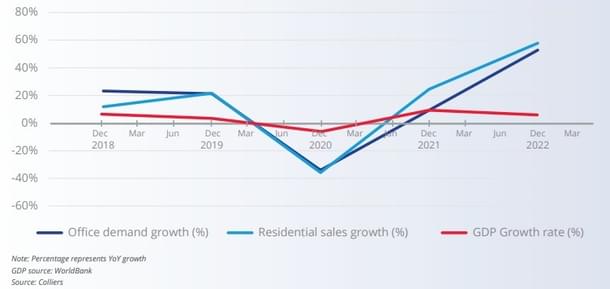

During the first quarter of 2023, institutional investments surged with a $1.7 billion investment and 37 per cent Y-o-Y growth.

This was led by office sector at 55 per cent share, followed by residential sector at 22 per cent share.

The report further shows that the office sector remained the most popular in investments during 2017-22 — accounting for about 40 per cent of the total foreign inflows.

Sankey Prasad, Chairman & Managing Director, Colliers India, said, “The strong economic and business fundamentals are enhancing institutional investors’ sentiments, forging strategic partnerships to expand their portfolios. The office sector saw the highest investments during 2017-22, accounting for about 45 percent of the total foreign inflows".

He added, "While investors remain buoyant on office assets, their interest in alternative assets is surging".

India Emerging As Preferred Investment Destination In The APAC Region

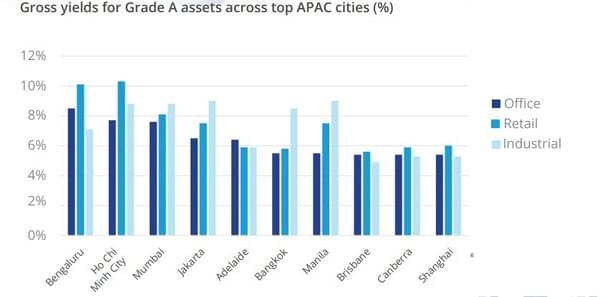

Global and Asia-Pacific (APAC) investors are finding the Indian property market particularly appealing due to its attractive pricing, favorable valuations, and higher yields.

This is primarily because Indian cities provide higher yields compared to other cities in the region, while still maintaining relatively lower pricing points.

The APAC market includes East Asia, South Asia, Southeast Asia, and Oceania, along with 20 countries, including China, India, and Indonesia.

Major Indian cities like Bengaluru and Mumbai occupy the 2nd and 3rd positions, respectively, in terms of commercial yield across the APAC region.

While Bengaluru leads office yields in the region, Mumbai leads in industrial assets yield, as per the report.

In the same period, foreign investments in industrial assets have grown, representing the major portion at 87 per cent of investments in industrial and warehousing.