Infrastructure

The National Monetisation Plan Is Beginning To Yield Results

Ankit Saxena

Jun 12, 2023, 12:07 PM | Updated 12:06 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

During financial year (FY) 2023, the government successfully monetised assets amounting to Rs 1.32 lakh crore.

However, it did not meet the intended goal of Rs 1.62 lakh crore.

Key ministries overseeing important sectors such as railways, road transport, power, and telecom were unable to achieve their individual targets, as per a Business Standard report.

According to the Business Standard report, the ministries and departments that did not meet their targets in FY23 included — the Ministry of Civil Aviation, the Ministry of Youth Affairs and Sports, and the Department of Food and Public Distribution.

In contrast, the ministries of coal, mines, petroleum and natural gas, and shipping successfully achieved their targets during the 2022-23 period.

Asset Monetisation Targeted Under The NMP

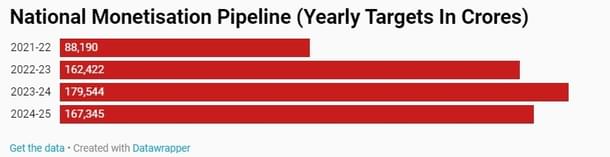

The target was set as part of the government’s ambitious initiative, National Monetisation Pipeline (NMP).

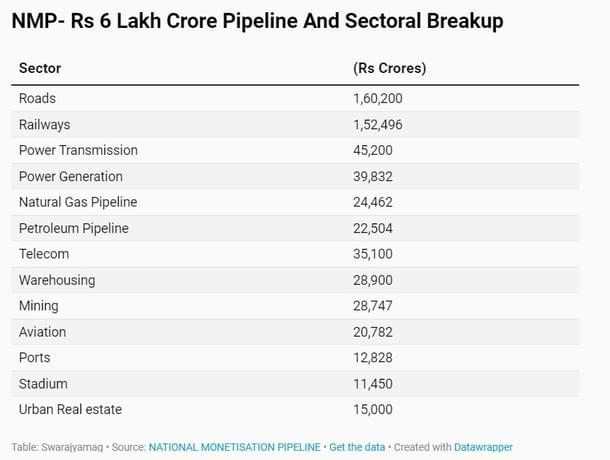

In September 2021, the Union Finance Ministry unveiled a four-year NMP worth an estimated Rs 6 lakh crore with the aim to unlock value in brownfield projects by engaging the private sector, transferring to them revenue rights and not ownership in the projects, and using the funds so generated for infrastructure creation across the country.

The sectors included for monetisation included roads, ports, airports, railways, warehousing, gas and product pipeline, power generation and transmission, mining, telecom, stadium, hospitality and housing.

During the first year, monetisation of public sector brownfield assets unlocked a value of Rs 97,693 crore, surpassing the target of Rs 88,000 crore.

Further, in preparation for FY 2023-24, a panel headed by the Cabinet secretary reaffirmed the target of Rs 1.79 trillion as originally set by the NITI Aayog.

To ensure the achievement of the FY24 targets, the panel has urged the infrastructure ministries and departments to prioritise asset monetisation as a significant means of raising capital.

Monetisation Plans By Different Ministries For FY24

In FY23, the Ministry of Road Transport and Highways — which had been leading in asset monetisation during FY22 — could only achieve 49 per cent of its target of Rs 17,384 crore.

This shortfall was primarily due to operational issues that prevented the conclusion of certain transactions.

For the current FY, the ministry has set a target of Rs 44,000 crore — planned to be met through the accruals from the toll-operate-transfer (TOT) model, two rounds of infrastructure investment trust (InvIT), and toll securitisation.

Out of this, the National Highways Authority of India (NHAI) intends to launch the third and fourth series of InvITs during the current FY — aiming to raise more than Rs 20,000 crore.

The Indian Railways fell short of its target — achieving a quarter of the set goal of Rs 7,750 crore. For the current FY, it has set its sights on asset monetisation amounting to Rs 30,000 crore.

This target will be pursued through activities such as colony redevelopment and involving private participation in the operation of wagons and GatiShakti terminals.

The Power Ministry achieved 62 per cent or Rs 9,436 crore of its asset monetisation target of Rs 15,308 crore in FY23.

The ministry has now set a new target of Rs 21,000 crore for the current fiscal year. This target is expected to be met through the development of the Badam coal mine and securitisation of cash flows from state-owned Power Grid and SVJN (Satluj Jal Vidyut Nigam) assets.