Insta

India’s Current Account Deficit Rises To 1.4 Per Cent Of GDP In December Quarter

Swarajya Staff

Mar 24, 2017, 05:07 PM | Updated 05:07 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

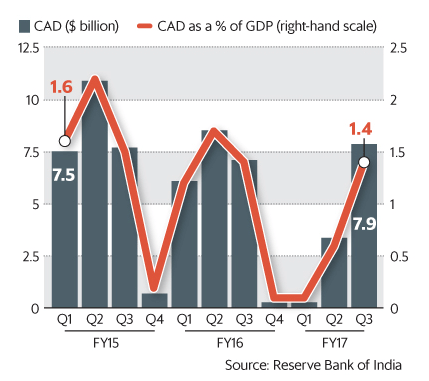

As India’s trade deficit widened, the country’s current account deficit (CAD) rose to 1.4 per cent of gross domestic product (GDP) in the December quarter. CAD stood at 0.6% of GDP in the September quarter.

According to Livemint, a marginal decline in remittances by overseas Indians contributed to the rise in CAD. However, India’s CAD came down from 4.8 per cent of GDP ($ 88.2 billion) in 2012-13 to 1.1 per cent of GDP ($ 22.2 billion) in 2015-16.

Credit rating agency ICRA in its report noted that it expects higher oil and gold imports to enlarge India's current account deficit to ~USD 30 billion (1.2 percent of GDP) in FY2018 from ~USD 20 billion in FY2017 (0.9 percent of GDP), arresting the trend of moderation recorded for four consecutive years since FY2014. However, the pressure related to the financing of a larger current account deficit would abate with the resumption of NRI deposits in FY2018.

With inputs from ANI