Insta

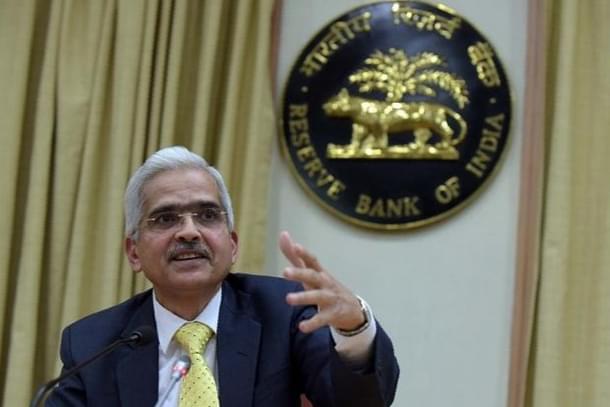

RBI Extends TLTRO Facility To 26 Industries To Infuse Liquidity In Stressed Sectors

Swarajya Staff

Dec 06, 2020, 09:47 AM | Updated 09:47 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The targeted long-term repo operation (TLTRO) is an exercise through which the Reserve Bank of India (RBI) prompts banks to lend by giving them cheap refinance for bond investments and loans. The central bank has now extended this facility to 26 stressed industries recognised by the KV Kamath-led committee for loan relief, Times of India reports.

The beneficiary sectors include power, textiles, realty amongst others. However, the bankers reportedly believe that the emergency credit line guarantee scheme (ECLGS) that can be availed by the same 26 industries will resolve the credit risk issue.

Care Ratings chief economist Madan Sabnavis noted, “There is a clear signal to align the TLTRO with the emergency line of credit with government guarantee, which is a good step. Hence, banks can take money from the RBI under the TLTRO and use these funds for lending to these sectors as identified by the Kamath committee, and also get a guarantee from the government based on the terms of the scheme.”

ICRA vice-president Anil Gupta mentioned that the banks have significantly repaid the funding that they received from the RBI given the situation of surplus liquidity and a reduction in the short-term rates below the reverse repo rates.

Gupta further said, “The outstanding against the past LTROs stood at Rs 77,000 crore as on December 3, 2020 against the total LTRO operations of Rs 2.12 lakh crore. Hence the availability of on-tap TLTRO funding to banks is unlikely to be an incremental incentive for banks from a funding point of view.”

On the other hand, Punjab National Bank (PNB) MD and CEO CHSS Mallikarjuna Rao explained that the upward revision of the GDP estimation for FY21 will result in a better growth rate. “The credit offtake is expected to get a boost, we expect it to top at least 8 per cent in the days to come,” Rao quipped.