Insta

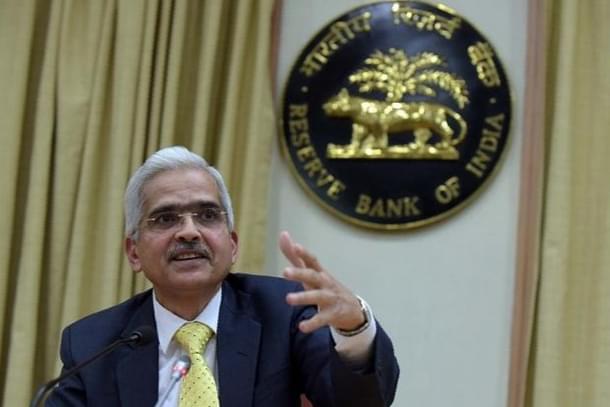

RBI To Penalise Banks For Failing To Ensure Cash Availability At ATMs

Tarkesh Jha

Aug 11, 2021, 03:21 PM | Updated 03:21 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Penalties will be imposed upon banks and white label ATM operators (WLAOs) in case their ATMs aren’t replenished for over ten hours as per one of the new proposals of the Reserve Bank of India (RBI).

These entities have been ordered by the RBI to make sure that their ATMs have a minimum duration of cash outs.

The central bank has made it clear that non-compliance on this front will result in monetary penalties being levied on these banks and the WLAOs.

“It has been decided that the banks and White Label ATM Operators (WLAOs) shall strengthen their systems and mechanisms to monitor availability of cash in ATMs and ensure timely replenishment to avoid cash-outs,” the RBI’s official statement was quoted in a report by the Economic Times.

Fines amounting to Rs 10,000 will be imposed if there is a cash-out at any ATM for more than 10 hours in a month. With regards to the White Label ATMs, the banks that fulfill the cash requirement of that specific ATM will be bearing the penalty.

The RBI will enforce these new rules from 1st October. Apparently, the central bank noted that cash-outs leading to unavailability of cash negatively impact ATM operations and cause inconvenience to the public.