Insta

Relief For Startups Facing ‘Angel Tax’ Troubles

Swarajya Staff

Feb 08, 2018, 01:42 PM | Updated 01:42 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

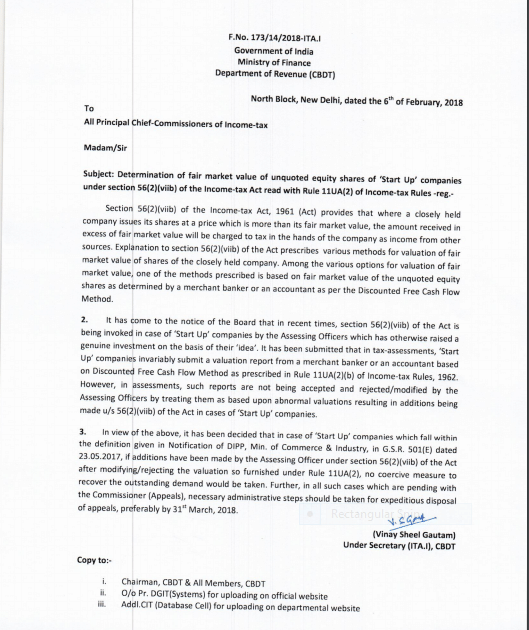

In a major relief to startups, the Income Tax Department through a notification stayed all recovery proceedings of the so-called 'angel tax' against startups as defined by the Department of Industrial Policy and Promotion (DIPP).

The Revenue Department directed the officials not to initiate any “coercive measure to recover the outstanding demand” in cases where additional income accrued on account of high valuations if the startups fall within the definition of the DIPP.

The notification has also directed that pending appeals be expeditiously disposed off by 31 March 2018.

The move will address the concerns of startups that received funding by angel investors. Startups incorporated after 2016 and recognised under the Startup India policy are spared this tax. The DIPP had initiated steps to work towards a regime that will provide the same relief to startups incorporated before 2016.

Introduced vis-à-vis the Finance Act 2012 by then finance minister Pranab Mukherjee, the ‘angel tax’ was sought to be levied on investments made in unlisted firms at valuations considered higher than fair market value. The purported aim of the tax was to prevent money-laundering through high premiums on shares.

On Monday (5 February), Finance Secretary Hasmukh Adhia assured investors that the tax department will be initiating proceedings against investors in unlisted companies where there is a suspicion that the transaction is a conduit for money-laundering. He also said, “We will protect genuine investors in start-ups. We are not asking questions from venture capitalists or non-resident investors who have invested in start-ups. Those start-ups registered with the department of industrial policy and promotion are also not under the scanner.”

The government is considering a proposal to exempt investments from recognised angel investor groups in startups from the so-called angel tax, two people aware of the matter said.

Mint also reported that the government may exempt funding by recognised investors in startups from angel tax. A committee has been set up under the Securities and Exchange Board of India to form a framework for regulating angel investments, the two people said on a condition of anonymity.