Lite

Why India Must Reduce its Corporate Tax

Swarajya Staff

May 14, 2015, 07:59 PM | Updated Feb 11, 2016, 09:34 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

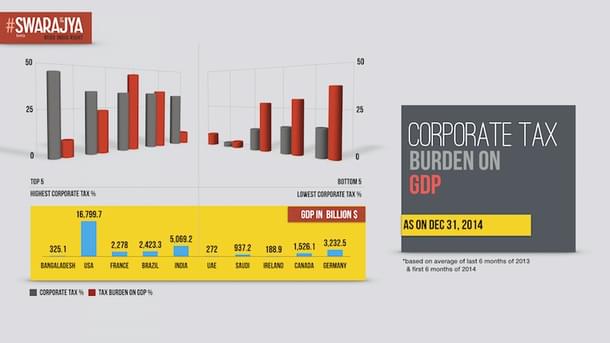

How does India’s corporate tax compare with other countries and why is it so high?

Corporate Tax to GDP percentage is the ratio of total corporate tax collections against the Gross Domestic Product of the country. When the percentage of corporate tax collections grows at a rate lower than the percentage of growth in GDP then this ratio decreases and vice versa. Thus this ratio is used to measure the efficiency of corporate tax collections.

In budget 2015, Finance Minister, Arun Jaitley put forth a proposal to reduce the Corporate Tax rate from the present 30% to 25% over the next 4 years. The reason provided for this by the Finance Minister was that India’s basic corporate tax rate at 30% is higher than the rates prevailing in other Asian countries and this makes our domestic industries uncompetitive. The Swarajya Research Team compiled a list of the existing corporate tax rates of various countries and compared the same with the rates of India.

Here we present to you the data of the top 5 and bottom 5 countries having the highest & lowest corporate tax rates:

- India occupies the 5th place in the list of countries having the highest corporate tax rate (30%). Despite this high corporate tax rate, its Corporate Tax to GDP percentage ratio is at a mere 7.30%. Even those countries with a lower Corporate Tax rate have a higher Corporate Tax to GDP Ratio than that of India.

- For example in the case of Germany, it’s Corporate Tax rate is 15.80% while its Corporate Tax to GDP ratio is 37.60%.

- In the case of Canada it is 15% and 30.70% respectively.

- In the case of UAE Corporate Tax rate is 0%. It follows transaction based tax regime, and such tax collected from Corporates account for 7.20% of GDP, very near to India’s 7.30%.

The reasons for India’s low Corporate Tax to GDP ratio despite its high corporate tax rate are leakages from tax collections, failure to capture various economic activities under tax net, extravagant concessions and tax holidays. It could also be due to the fact that majority of our economic & productive activities are concentrated in the unorganised sectors.

Will the Finance Minister’s proposal to reduce Corporate Tax rate and withdraw exemptions & undue tax holidays, improve our Corporate Tax to GDP ratio? Keep watching our stats column.