News Brief

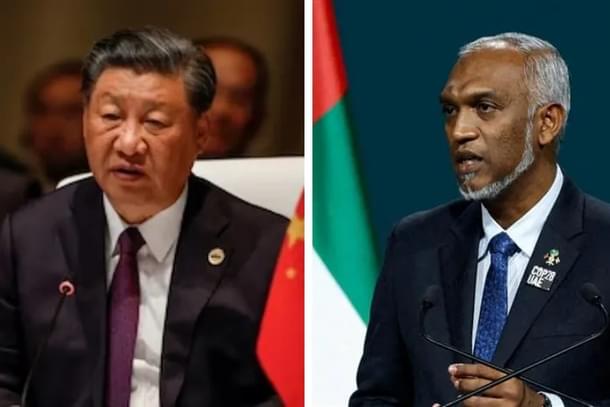

Another Sri Lanka? China's Unchecked Influence Leaves Maldives On Brink Of Financial Default—Here's All About Debt Crisis

Vansh Gupta

Mar 13, 2025, 04:44 PM | Updated 04:44 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Maldives is confronting a deepening debt crisis, with foreign exchange reserves plummeting and looming debt repayments threatening economic stability, reported ANI

The island nation's financial strain has been exacerbated by China’s lending practices and trade policies, which have significantly accelerated its fiscal decline, according to human rights advocate and journalist Dimitra Staikou.

Rising Debt Burden

The scale of the Maldives' debt problem is staggering. The country’s total debt stock surged from $3 billion in 2018 to $8.2 billion by March 2024, with projections indicating that it could exceed $11 billion by 2029.

Of the current debt, $3.4 billion is external, with China and India as the primary creditors.

The financial outlook appears dire, as the Maldives must service external debt worth $600 million in 2025 and a staggering $1 billion in 2026.

As a result, credit rating agencies have responded with downgrades. Fitch has slashed the country's rating three times between June and August 2024, while Moody’s continues to maintain a negative outlook on the government’s long-term credit position.

China-Maldives Free Trade Agreement Worsens Economic Fragility

Rather than alleviating financial strain, the China- Maldives Free Trade Agreement (FTA), implemented in January 2025, has further deepened the crisis.

Despite bilateral trade reaching approximately $700 million, China dominates 97 per cent of trade, while Maldivian exports account for less than 3 per cent.

Under the FTA, the Maldives eliminated tariffs on 91 per cent of Chinese imports, a move that has disproportionately benefited China while yielding little economic gain for the island nation. The consequences have been immediate and severe:

Imports from China surged to $65 million in the first two months of 2025, up from $43 million during the same period in 2024.

Government revenue from import duties plummeted by 64 per cent, falling from MVR 385 million to just MVR 138 million.

Additionally, the FTA has opened the Maldivian tourism sector to Chinese companies, leading to a scenario where the financial benefits of Chinese tourists increasingly flow back to Chinese corporations rather than boosting the Maldivian economy.

In a bid to avert a financial collapse, the Maldives has sought aid from various sources, but with limited success. The government has requested $300 million from each Gulf Cooperation Council (GCC) country, but these appeals have largely been ignored.

Further, President Mohamed Muizzu approached China for $200 million in budgetary support, refinancing of debt payments, and a currency swap, but no positive response has been received.

However, a $750 million currency swap from India has provided temporary relief, helping sustain import payments and government expenditures.

Staikou added that,"Without significant international intervention or debt restructuring, the Maldives risks following neighboring Sri Lanka into sovereign default", quoted as saying by ANI.

Vansh Gupta is an Editorial Associate at Swarajya.