News Brief

Income Tax Bill 2025 Gets Parliament Nod; Fewer Sections, Clearer Rules, ‘Tax Year’ Concept Introduced

Arzoo Yadav

Aug 13, 2025, 03:47 PM | Updated 03:47 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Parliament on Tuesday (12 August) passed the Income Tax Bill 2025, replacing the six-decade-old Income Tax Act, 1961, with effect from 1 April 2026.

The new bill addresses confusion over the taxation of rental income and deductions on home loans for both self-occupied and let-out properties, reported The New Indian Express.

The concerns emerged after the bill’s introduction in February, when homeowners questioned whether rental income tax would apply on gross annual value or net annual value (after deducting municipal taxes), and whether pre-construction interest deductions would apply only to self-occupied properties.

Under the 1961 Act, tax applies on the net annual value of rental income—gross rent minus municipal taxes—with a standard 30 per cent deduction, regardless of whether the property is self-occupied or rented.

The new bill reportedly provides that standard deduction of 30 per cent will be calculated on Net Annual Value after deduction of Municipal Taxes.

The bill clarifies that pre-construction interest deduction will be allowed for let out properties also.

The new Bill also clarified that there will be nil TCS on Liberalised Remittance Scheme (LRS) remittances for education purposes financed by any financial institution, a provision that had gone missing in the earlier version.

The new Bill introduces the concept of “tax year”, which has been defined as the 12-month period beginning April 1. The concept was introduced in the first draft in February. The new Bill removes redundant provisions and archaic language and reduces the number of Sections from 819 in the Income Tax Act of 1961 to 536 and the number of chapters from 47 to 23.

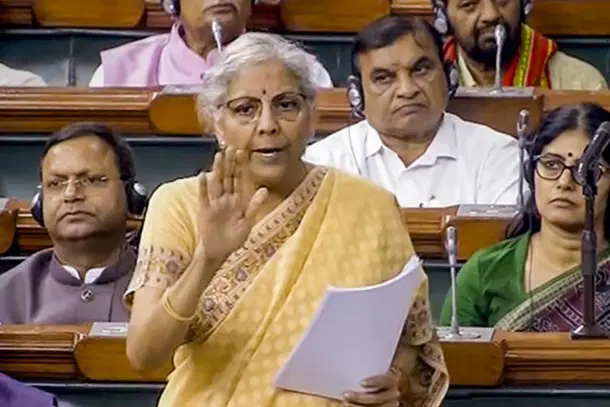

Also Read: Nirmala Sitharaman Tables Revised Income Tax Bill 2025 In Lok Sabha, Accepts Most Panel Suggestions