News Brief

RBI Keeps Key Lending Rate Unchanged At 6.5 Per Cent For Ninth Consecutive Time— All About It

Kuldeep Negi

Aug 08, 2024, 10:17 AM | Updated 10:17 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

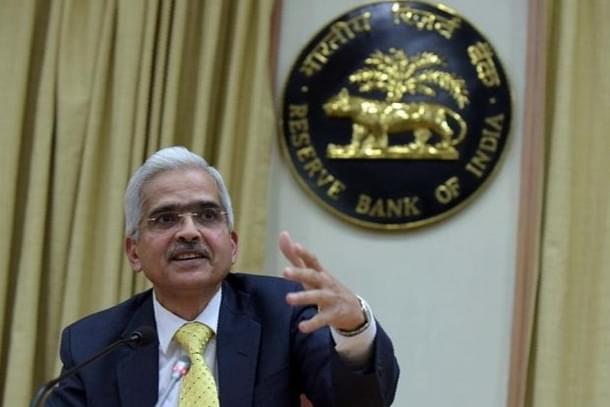

The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) on Thursday (8 August) decided to keep the repo rate unchanged at 6.5 per cent for the ninth consecutive time.

During a press conference, RBI Governor Shaktikanta Das also announced the GDP growth projection for FY25 to remain unchanged at 7.2 per cent.

Further, the GDP growth for FY26 is also expected to touch 7.2 per cent.

Das said that the global economic outlook is exhibiting uneven expansion.

There has been tightenging by a few central banks while demographic shifts, geopolitical tensions, rising public debt pose new set of challenges, he added.

On domestic front, Das said that the manufacturing PMI at 58.1 in July remain elevated.

He added that the PMI for services stood strong and has been above 60 for seven consecutive months, indicating robust expansion.

The government has tasked the RBI with maintaining Consumer Price Index (CPI) inflation at 4 per cent, with a margin of 2 per cent on either side.

In June, the Central Bank opted to keep the repo rate unchanged at 6.5 per cent.

The repo rate was last hiked in February 2023 and since then, it has remained at the same level for the previous eight bi-monthly policies.

The unchanged repo rate means that external benchmark lending rates tied to the repo rate will remain stable, providing relief to borrowers as their equated monthly instalments (EMIs) will not increase.

Kuldeep is Senior Editor (Newsroom) at Swarajya. He tweets at @kaydnegi.