News Brief

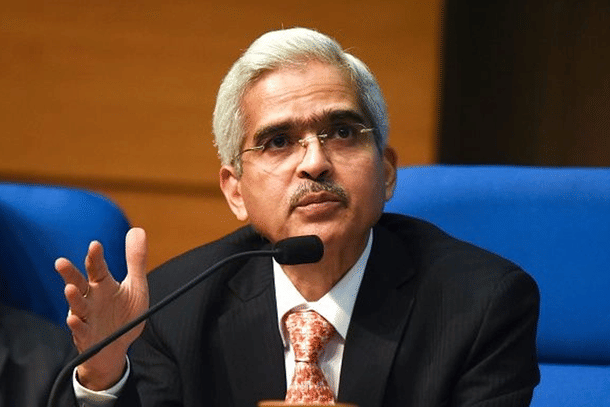

RBI Plans Governance Overhaul For Indian Banks: Higher Fines, Clawbacks, And Capital Charges In The Pipeline

Nayan Dwivedi

Nov 20, 2023, 04:50 PM | Updated 04:50 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

In a bid to fortify governance standards and underscore the importance of compliance, the Reserve Bank of India (RBI) is reportedly considering a comprehensive review of its penalty system.

Recent penalties, including a significant fine on Axis Bank, have set the stage for potential changes that could reshape the regulatory landscape for Indian banks.

The central focus of this review is to tailor penalties based on the size, importance, and frequency of offences by regulated entities.

As reported by Livemint, RBI aims to enhance corporate governance standards and emphasise their critical role within the banking sector.

Speculations suggest that the RBI is exploring avenues to increase penalty amounts, introduce clawbacks of payouts to key personnel, and impose additional capital charges on regulated entities.

These changes, if implemented, could mark a significant shift in the regulatory approach.

Recent penalties, particularly the Rs 90.92 lakh fine on Axis Bank for non-compliance, have served as catalysts for the RBI's contemplation.

The central bank's discussions with the boards of state-run and private banks in May, covering governance, ethics, and supervisory expectations, are viewed as precursors to this potential overhaul.

The proposed changes indicate a broader regulatory approach to ensure stringent adherence to guidelines across the financial sector.

Even major public sector lenders, including the State Bank of India, have faced penalties.

As the RBI mulls over these potential changes, the financial sector awaits further clarity on the specifics of the overhaul.

Nayan Dwivedi is Staff Writer at Swarajya.