News Brief

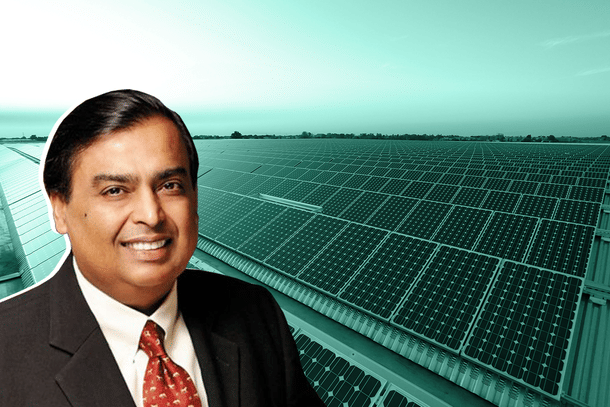

Mukesh Ambani Looking To Compete With Chinese Behemoths In Clean Energy Space

Bhaswati Guha Majumder

Oct 15, 2021, 04:21 PM | Updated 04:32 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Solar photovoltaic energy (PV solar energy) directly converts sunlight into electricity, using photovoltaic effect-based technology. Over the years, concerns related to climate change have helped to boost this industry around the world.

Currently, in India, there are more than a dozen of solar PV module manufacturing companies, including these top names—Vikram Solar, Waaree Energies, Tata Power Solar, Risen Energy and Adani Solar.

But there is another name, Reliance Industries. Mukesh Ambani’s company is now preparing to compete with Chinese solar PV manufacturers.

When it comes to the top PV module manufacturers in the world, JinkoSolar, LONGi Solar and JA Solar are considered as the top companies in this field with the largest global market share—and all three are based in China.

However, a report stated that with the acquisition of REC Solar Holdings AS (REC group)—a leading international solar energy company headquartered in Norway—from China National Bluestar (Group) Co. Ltd for $771 million, Reliance Industries Limited (RIL) can use its capabilities in panels and polysilicon, as well as gain access to a global client base.

This should be supplemented by NexWafe's technology to offer competitively priced PV panels. RIL's Reliance New Energy Solar Ltd (RNESL) has recently decided to contribute $29 million as a lead investor in NexWafe GmbH of Germany in a fundraise, and it completes the technologies needed for end-to-end solar PV module production.

RIL will use its 40 per cent interest in EPC (Engineering, Procurement and Construction) player Sterling and Wilson Solar, a Shapoorji Pallonji (SP) Company, to install solar panels.

In terms of storage, the collaboration with energy storage provider Ambri Inc. is expected to aid in the completion of solar value chain solutions.

The investment banking company Morgan Stanley said in a report published on 13 October: “RIL’s ability to compete with Chinese players has been a key investor task over the past few weeks, and we believe NexWafe helps RIL not only get lower PV manufacturing cost (once implemented at large scale) but also helps lower hydrogen product cost and eventually improve green ammonia economics materially."

The American company, Goldman Sachs said in 11 October report that RIL would gain a global footprint as a result of the REC acquisition, allowing it to profit from increased global module demand, which we project to treble by 2025.

Additionally, it noted: “The acquisition would help provide technology to drive integrated module manufacturing in India, where we expect solar installation to grow from the current run rate of 5.5GW to 31.5GW by 2030, driven by duty protection as well as government PLI incentives."

RIL is striving for clean energy by establishing the Dhirubhai Ambani Green Energy Giga Complex on 5,000 acres in Jamnagar, which now produces more than half of its earnings from refining and petrochemicals. Giga factories for integrated solar PV modules, electrolysers, fuel cells, and energy storage would be housed in this facility.

Additionally, RIL would also create a solar capacity of at least 100 GW by 2030 as a part of the new green energy business, according to billionaire Mukesh Ambani, who spoke to his shareholders at a virtual meeting. Over a fifth of India's renewable energy target of 450 GW by 2030 would be covered by this. By the end of this decade, India wants green energy to account for 40 per cent of all electricity generated.

Through its relationship with the Denmark-based Stiesdal—whose wind turbine designs in the late 1970s helped to begin the modern wind industry—RIL has also secured technology for hydrogen electrolysers. Electrolysers are used to generate green hydrogen (through the electrolysis of water).

Stiesdal's method has the potential to produce significant cost savings when compared to currently existing technologies such as Alkaline, Proton Exchange Membrane and Solid Oxide, where electrolysers cost between $800 and $1200/KW.

Switzerland based investment banking company, Credit Suisse in a recent report, said that RIL had reaffirmed its goal of producing green hydrogen for $1/kg in a decade, compared to the industry's current cost of $5/kg. It noted that “Stiesdal’s technology is called HydroGen and claims to convert electricity to hydrogen at a cheaper rate than other electrolysis technologies on the market. The first demo project will be installed in early 2022".

For its fuel cell Giga plant, RIL is considering extending the scope of its deal with Stiesdal. Fuel cells convert hydrogen into electricity, which can be used to generate both mobile and static electricity. Electrolysers are effectively reversed in the process of fuel cells.

However, it is worth noting that Reliance's move into renewables comes at a time when the country is experiencing a power constraint due to a coal shortage. It is expected that the Ambanis would clash with another key player in the market—Adanis—as Adani Green Energy Ltd has also committed to developing a portfolio of 25GW of renewable energy assets by 2025.