Ground Reports

Inside India’s Quiet Drone Revolution: The Fight For Self-Reliant Subsystems

Ankit Saxena

Jun 16, 2025, 02:10 PM | Updated Jun 18, 2025, 11:08 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

In the quieter corners of Bengaluru’s tech jungle, Agam Robotics has grown from a solo effort into a team of eight engineers, working on creating and supplying Indian-made components for the country’s drone industry.

Back in April 2024, Swarajya covered the company’s early progress on its first working prototype — the ‘autopilot’ flight controller, built from scratch over nearly three years of research and development (R&D).

A flight controller is a key subsystem in drone operations, combining electronics and software to automatically manage a drone’s flight path.

As interest in drone capabilities grows, and India works towards its goal of becoming a global drone hub by 2030, the story of Agam Robotics represents one of many Indian companies working to build locally made drone components and subsystems.

These efforts are together supporting the mission to reduce reliance on imports and encourage innovation within India’s drone industry.

A year on since the last Swarajya story on Agam, the company’s founder Karthik Rangarajan is now taking the next steps — scaling and streamlining production, as well as venturing into other critical drone subsystems.

“Once we finished the prototype for autopilot, we moved to the production of the pilot batch,” Karthik tells Swarajya. “That’s when I realised that mass production brings its own challenges. Scaling up introduced a completely new set of problems.”

Even designing something as small as the foam components was complex. “I was the only one who knew how to do it right,” he said. “It’s not easy to teach, especially in such a young industry. A small misalignment can lead to system errors.”

The team began refining the design to make assembly and mass production easier.

“One big lesson from manufacturing is the importance of designing systems in a way that prevents mistakes. There’s a Japanese concept called Poka-yoke, which means designing parts so they can only be assembled the right way—like a plug that fits only one way into a socket. That’s the goal.”, Karthik adds.

Today, Agam Robotics has advanced to version 1.1 of their autopilot, with a more streamlined, scalable manufacturing process. What once took the team two or three boards a day can now be done at a pace of 20 to 50 boards daily.

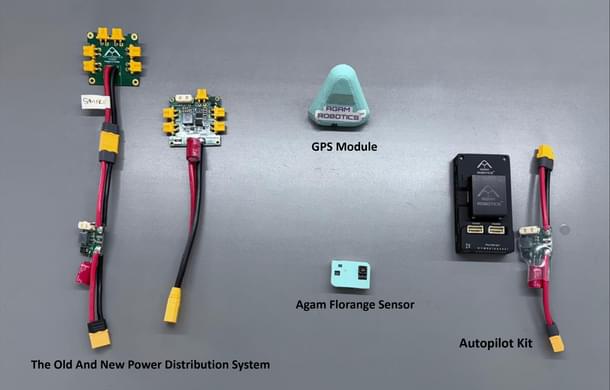

The team is also working on other key components like floor sensors, GPS modules, and power distribution systems.

These technologies are essential for moving towards a self-sufficient drone manufacturing ecosystem in India, which has traditionally relied heavily on imports, especially from China.

Understanding Drone Subsystems

Drones rely on a complex network of subsystems working together—these include propellers, motors, wings, electronic speed controllers (ESCs), batteries, flight controllers, telemetry units, GPS modules, and safety systems.

Drone technology is now widely used in sectors like defence, agriculture, logistics, disaster response, mining, and infrastructure development. As a result, there is growing interest in building a self-reliant drone ecosystem in India.

As per a white paper released by Drone Federation India (DFI), the Indian drone market is projected to be a $11.06 billion opportunity by 2030.

The Government of India, through the Drone Rules 2021 eased operational approvals and opened more than 90 per cent of Indian airspace to drone operations.

This was followed by Production Linked Incentives (PLIs) in 2021 to support drone and component manufacturers, along with a ban on importing fully built units (CBUs) and semi-knocked down (SKD) kits, to encourage local assembly.

While complete drone systems can be certified under the Drone Rules 2021, for an Indigenously Designed, Developed and Manufactured (IDDM) pathway, there is currently no similar framework for certifying individual subsystems or modules.

As a fallout of the same, the country continues to rely heavily on imported subsystems. Critical components are still mostly sourced from China and other foreign suppliers.

Apart from core electronics, India also continues to import battery cells, advanced sensors, motors, and camera gimbals.

These components are cheap and readily available, however, this reliance has slowed investment in high-value domestic alternatives and limited local innovation. It also raises concerns about the security and reliability of the supply chain for drone components.

“The need for a strong local supply chain became clear during critical national operations, when demand for drones suddenly surged,” an industry expert told Swarajya.

“During Operation Sindoor, the government’s overnight demand was nearly 10x of what the domestic industry could supply. If India had a well-established local supply chain, it would have been possible to meet these demands within days instead of scrambling for foreign alternatives,” he added.

As China grows closer to countries that do not align with India’s strategic interests, relying on imported drone components poses not only supply chain risks but also national security concerns.

This makes it even more important to assess two things:

--One, how far India has come in developing its own drone parts and systems.

--Two, what more needs to be done to ensure that even the subsystems are locally made and developed.

Today, over 100 companies—from startups to seasoned firms from aerospace and related sectors—are working to build a reliable domestic supply chain, and proving capabilities to design and manufacture critical drone components within India.

Startups Developing Drone Subsystems

Agam Robotics Expands To Flow Sensors, Power Modules And More

One of Agam Robotics’ key recent developments has been the power module.

“We started by creating different types of power modules in various form factors,” says Karthik. “One of our engineers took over a board I had previously designed, which was already integrated with the autopilot system we were selling.”

“I asked him to merge that design into the power distribution board to remove unnecessary connectors, cables, and wires. The aim was to create a more compact unit,” he adds.

In drone systems, a power distribution board is used to connect and supply power to multiple motors—similar to how a spike buster allows one plug to power several electronic devices.

“But in doing so, you also introduce multiple points of failure. It also adds unnecessary weight and requires precise wiring—from the battery all the way through the system, which can get messy and inefficient.”, Karthik adds.

“We have developed a single, integrated component. If the battery is nearby, it connects directly through built-in connectors. If it’s farther away, you just use an extension of the right length.”

Karthik does not rush to call it innovation, but rather a targeted refinement to the needs of the Indian market. “Many users want to reduce weight—but they go about it the wrong way,” he adds.

“They will ask, ‘Can we remove the enclosure?’ or ‘Can we cut out a few cables?’”

“So, we started thinking, where is the real excess? For example, for a water-resistant autopilot, the enclosure is critical. It protects the system. People try to remove essential parts while keeping non-essential ones—basically solving the wrong problem.”

This is also a major advantage of designing and building locally, he points out. “Because we are developing these components in-house, we have the flexibility to adapt them based on user requirements.

“We had been thinking about these upgrades for a while. But it was only after new funding came in—and we started receiving more orders—that we were finally able to execute these ideas".

What is to be highlighted is that a strong foundation of innovation exists in India. But these startups need the right support to expand.

The Agam team is also developing a flow sensor. “It’s essentially a hybrid of a rain sensor and an optical flow sensor. Mounted on the underside of a drone, it continuously measures the distance between the drone and the ground”, says Karthik.

The system combines two technologies: the rain sensor functions as a rangefinder, offering precise vertical distance measurements, while the optical floor sensor—similar to the one used in a computer mouse—tracks lateral movement by detecting changes in X and Y coordinates.

“These coordinates are fed directly into the autopilot system, allowing the drone to maintain its position relative to the ground. This is especially useful in GPS-denied environments—indoors, under dense tree cover, or in areas with poor satellite signal,”, Karthik adds.

“Many companies are working to reduce drones’ dependence on GPS, and our Flow Sensor is a step in that direction,” he adds.

The team has named it Agam Florange Sensor.

At present, most of these components are sourced from China.

“So, while we are designing our own, we also make sure that it serves as direct replacement to imported parts without needing to redesign or rewire their systems,” says Karthik.

Vector Technics Developing Complete Propulsion Systems For Drones

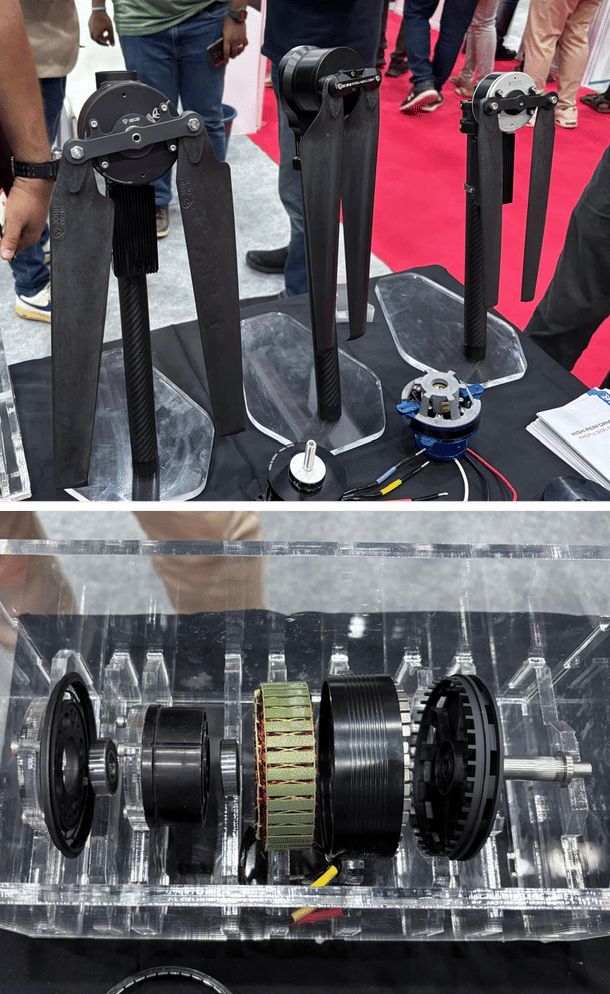

Meanwhile, in Hyderabad, another team is working toward the same goal— as they develop propulsion systems for drones. A propulsion system for drones includes motors, controllers, wings, and supporting electronics.

Vector Technics, founded in 2019, began with a focus on precision motion control. The team soon identified drones as a key application where motion control plays a crucial role.

“Drones demand extremely high-power density and minimal weight. Apart from space systems, few platforms have such tough requirements. So, we decided to start with the hardest problem,”, Prudhvi Raj Pakalapati, co-founder of Vector Technics, tells Swarajya.

“In 2020, we built our first motor. When we introduced it to the market, a few supportive drone companies tested it and gave us valuable feedback,” he adds.

“They told us that the motor alone won’t be enough. You’ll also need to build a motor controller—the electronic part that actually runs the motor.’”

The team went back to the drawing board. Their work soon evolved into developing a complete, integrated propulsion system. Since then, Vector Technics has grown into a key supplier of propulsion solutions for drones.

“We naturally expanded into making power distribution boards too, since they’re closely linked to the motor controller. That’s now a regular part of our product lineup,” Prudhvi adds.

Propulsion is the second most expensive part of a drone, after the battery. “We’re committed to building high-quality, local alternatives—especially because nearly all of these components were previously imported, mostly from China.”

Bringing a motor from design to production was far from easy. “We work with BLDC motors that need to deliver high power while remaining extremely lightweight. These are nothing like the motors used in everyday appliances,”, Prudhvi adds.

One major challenge was sourcing 0.2 mm magnetic steel—a rare material typically used in aerospace and medical applications. “Although India has a strong metals supply chain, most local suppliers couldn’t meet our specific requirements, so we had to import it from Japan,” he says.

There were also manufacturing hurdles. Local vendors did not have the stamping tools needed for such precision work. After months of discussions and shared risk, they convinced a vendor to develop custom moulds.

“We went through six to seven months of back-and-forth. We had to prove that it was not just one-off prototype. We gave the vendor the confidence to invest in the tooling by placing a firm order.”

“Today, we are producing around 300 motors per day, and we are on track to scale that up to 800 motors daily.”, he adds.

With changing trends in drone design, the company is also expanding into new areas. “So far, we’ve focused on propulsion systems for larger drones. But there is a market for smaller drones—especially those under 250 grams. Designing for that segment requires a completely different approach.”

Vector Technics has already built prototypes for these ultra-light drones and plans to launch them within the next two months. Looking ahead, the company is also preparing to enter the hybrid propulsion space, with plans to launch its own drone engines by January 2026.

Just like these two component manufacturers—located nearly 600 kilometres apart but united in purpose—a growing number of companies across India are now developing critical drone components locally— NitPro Composites and SVMFG are into airframes, MotionMatics is working on sensor gimbals, and Zetta Watt is building motor winding machines.

Challenges With Procurement and Unclear Regulations

Each company is finding its own path in the industry, but they still face many challenges. There are gaps in infrastructure, complex government rules, and limited support as issues remain, especially around procurement and unclear regulations.

To list the list the primary challenges:

One, certifications for components and advanced inputs needed to develop these subsystems. This starts with the sourcing of basic electronic components—such as integrated circuits (ICs), capacitors, inductors, and connectors.

Says one founder from the industry: “Some companies label their components as ‘Made in India’ even though key parts like PCBs are made in China. There should be full transparency—like purchase orders and bills of materials—to clearly show where components are sourced from before we place any orders.”

These checks and standards should be enforced early in the product development cycle, not after the product is built. This would help streamline the process and create a formal checklist of authorised vendors for component manufacturers to use during procurement.

Also, this is not just a problem for the drone sector—it affects the entire electronics manufacturing ecosystem. These components are not specific to drones alone but are essential across various industries including medical devices, automotive, industrial automation, transportation, and aerospace.

The founder also adds a note of caution: “The government’s restrictions on component imports can be counterproductive. Banning fully built drones or sensitive parts like GPS modules from countries like China makes sense, but applying the same rules to basic components makes it harder for Indian companies to build their own systems".

Two, procurement delays along with difficulties in securing financing like bank loans for imports. Most key components—sensors, ICs, and connectors—are not available locally and must be imported from countries like China, Singapore, Malaysia, Thailand, the Philippines, and Taiwan.

This creates a long, multi-step process. Startups first request a quote from a foreign distributor, agree on a price in USD, and then raise a purchase order. To make the payment, companies must visit the bank in person, submit several documents, and follow RBI regulations.

“This alone can take two to three weeks, whereas it should ideally take just a day or two,” says Karthik from Agam Robotics. “If the system were streamlined, much of this could happen online—saving time and effort for startups already stretched thin.”

After the payment is made, there's still a lead time of 10 to 20 weeks before the components arrive, depending on availability and type. This delay becomes a serious bottleneck.

During this time, funds are locked in undelivered inventory, which slows down progress.

“Some distributors offer faster delivery in two to three weeks—but at a much higher cost,” he adds. “For small companies, this premium option isn't sustainable.”

As a result, startups often have to split their orders—paying a high price for a portion of parts to avoid a complete stall of operations, while waiting months for the rest.

Three, smaller companies and startups face major challenges when it comes to accessing funding support from central schemes.

Prudhvi from Vector Technics shares with Swarajya, “We wanted to apply for the PLI scheme for drones, but we didn’t qualify because we could not show enough revenue. At that time, we were focused only on research and development.”

The government had approved a Rs 120 crore PLI scheme for drones and their components, implemented during 2022-23 to 2024-25.

He adds, “The government should revise the criteria. Many startups like ours are building deep-tech products now, and even two years down the line, they might still not qualify under the current rules. This financial pressure could force some of them to shut down.”

According to him, the PLI scheme needs to be more inclusive of component makers, who usually operate with low revenues in the early stages.

“It should have more criterias, and not just be based only on revenue. It should also recognise the value of design, development, and manufacturing capabilities,” he says. “We may not be generating big numbers yet, but we’re building technology that’s crucial for the country’s future.”

Four, many manufacturers developing components to replace imported components, still faces several roadblocks—especially around type certification, approvals, and scaling up in India.

Type certification is a process where the Directorate General of Civil Aviation (DGCA), India’s aviation authority, checks and approves a drone’s design and performance, to ensure safety and quality standards set by the government.

“We have to be realistic. Without the right systems to help Indian manufacturers scale, the investment won’t be sustainable. You can try once, maybe twice—but if there are no returns due to process barriers, people will give up,” says Kartik Shah, co-founder of SVMFG Unmanned Systems.

Further, he points out that the problem is not quality—Indian products are not known for being substandard—but cost. “Competing on price will only happen when there is scale. And for that, you need volume and infrastructure. Without that support, India will stay dependent on China.”

Thus, infrastructure support is one key aspect for this growth. “Even something as basic as land is hard to get. And if you do get it, it is often far from talent hubs.”, he adds.

“In China, the government builds infrastructure. If you need 20,000 or 40,000 square feet, they assess your needs and provide space. They even offer subsidized equipment loans—at 2 per cent to 4 per cent interest—through a single agency. You don’t have to run from bank to bank.”

“To truly develop a drone ecosystem, strong government support is essential,” he adds.

“The intent behind indigenisation is noble, and it’s encouraging to see more companies building components locally. But if we’re aiming for scale, diversity, and a mature ecosystem, we still have a long way to go.”

The Way Forward

While early challenges are expected in any emerging industry, it’s crucial to define a clear roadmap and vision from the start.

While government attention is crucial given the sector's growth and the visible gaps, several stakeholders together have also taken a major step forward with the launch of the Bharat Drone Stack by the Drone Federation India (DFI).

This initiative aims to improve coordination across stakeholders, including component manufacturers, OEMs, researchers, and government agencies.

“The initiative targets a Rs 15,000 crore market for Indian drone components, aims to cut imports by 75 per cent, create over 5,000 jobs, and support more than 500 Indian drone component and material suppliers,” says Smit Shah, President of DFI.

The Bharat Drone Stack follows a vertically layered framework that covers the full drone development lifecycle—from sourcing raw materials to actual deployment. It includes:

--Integrated Platforms: Complete drone systems

--Subsystems and Payloads

--Components and Modules

--Raw Materials and Advanced Inputs

While we extend focus to subsystems and components, beyond just complete drone platforms, the next shift will be towards raw materials and advanced inputs — as it will bring a new set of challenges for component manufacturers as they scale.

At the same time, it is also important to clearly define and assess the goals of localisation and indigenisation.

“Many people confuse indigenisation with localisation,”, Vipul Singh, CEO of AEREO, tells Swarajya.

“Localisation is about copying existing components and manufacturing them locally. Indigenisation, on the other hand, means designing products from the ground up and having full control—creating intellectual property within the country.”

Industry experts say India’s drone component ecosystem must rest on four pillars:

--policies that prioritise design and R&D instead of focussing solely on revenue

--sustained focus on growing the local market beyond the China+1 approach

--long-term capital and testing infrastructure to support production

--strict enforcement to curb false indigenisation claims and ensure credibility

India’s ambition to lead in drone technology depends not just on flying machines, but on building the components that power them. The path to the dominance of the skies goes through circuit boards.