World

What Rahul Gandhi Needs To Know About China's 'Belt And Road Initiative'

Swarajya Staff

Sep 09, 2023, 05:43 PM | Updated 05:43 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Ten years after China introduced the Belt and Road Initiative, its ambitious global investments have expanded trade and bolstered its international presence.

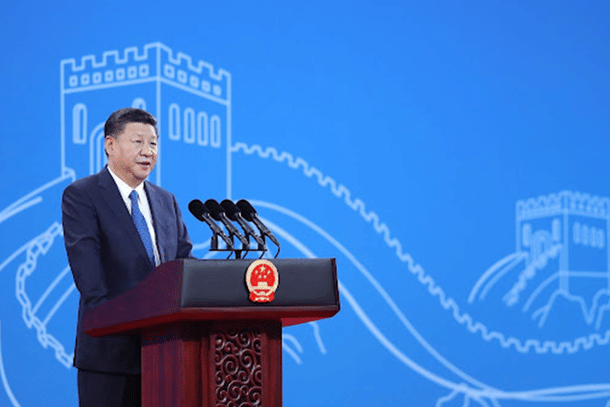

However, this infrastructure-focused endeavor is facing headwinds due to a domestic economic slowdown and a surge in defaults, exacerbated by factors like COVID-19. In response, President Xi Jinping is advocating for greater profitability in Belt and Road projects.

Xi initially outlined his vision for a Silk Road Economic Belt connecting China and Europe in September 2013 during a visit to Kazakhstan. The subsequent month, he proposed a 21st-century Maritime Silk Road, spanning the Indian Ocean and South China Sea, forming the basis of the Belt and Road Initiative.

Over 150 countries have since signed agreements with China, including cooperation on investments.

Notably, China's trade with Belt and Road participant nations surged by 76 per cent from 2013 to 2022, surpassing the 51 per cent overall trade growth. This strengthened economic ties with emerging economies have bolstered China's influence on the global stage.

Despite concerns raised by Western nations about issues in Xinjiang and Hong Kong, more countries have aligned with China than the West in these matters, demonstrating the diplomatic benefits of the Belt and Road Initiative.

China's trade surplus with Belt and Road countries has also seen substantial growth, reaching $197.9 billion for the first seven months of 2023, comprising about 40 per cent of China's total, reducing reliance on US trade amidst escalating bilateral tensions.

However, Belt and Road countries are grappling with mounting trade deficits, while hopes for expanded access to the Chinese market dwindle. Italy, the sole G7 member to join the initiative in 2019, witnessed its trade deficit with China double within three years through 2022, prompting deliberations about its continued involvement.

Stringent Chinese conditions on Belt and Road-related financing have led to complications, with Sri Lanka ceding control of the Hambantota port to China on a 99-year lease due to debt repayment difficulties. Concerns about falling into a "debt trap" have made countries increasingly cautious, though China refutes this notion.

COVID-19 played a pivotal role in China's reevaluation of its approach. The pandemic hit emerging economies hard, resulting in a surge of debt renegotiations and write-offs, with around $76.8 billion in loans involving Chinese lenders going sour between 2020 and 2022.

Although China is escalating financial aid to Belt and Road countries, including currency swaps, new investments have declined.

This drop in investment can be attributed, in part, to China's economic deceleration. Its foreign reserves, which underwrite new investments, have remained relatively stable at just over $3 trillion, and its capacity to invest in emerging countries is not projected to see a substantial increase.

Furthermore, inward-focused policies are contributing to this trend. Following China's announcement of debt forgiveness for African nations in August 2022, there was a surge of calls for similar relief for domestic medical expenses and mortgages.

If frustration mounts over the sluggish economy, China may face challenges in allocating resources abroad.

China is now exploring more sustainable approaches to economic assistance. In the autumn of 2021, Xi emphasized the importance of profitability in Belt and Road projects and outlined plans for collaboration with development banks. Much interest surrounds his forthcoming statements at the upcoming Belt and Road Forum.