World

Why Trump's Economic Honeymoon May End Even Before He Takes Office

Shanmuganathan Nagasundaram

Nov 14, 2024, 11:40 AM | Updated 05:04 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

—Victor Hugo

Donald Trump’s victory in the recent United States (US) elections was a complete landslide. It was an extraordinary one as Trump won all of the seven states considered swing/battleground states in the current election cycle. But then just consider another fact: in the 2024 elections held in the developed world, more than 80 per cent of the incumbents lost the elections.

That said, Trump has been through an extraordinary election cycle –

Much of the mainstream media was pro-Kamala;

Kamala outspent Trump by almost 2:1 in this election cycle;

Washington DC, which is very symbolic of the Deep State, voted 92.5 per cent in favour of Kamala — the second highest margin of victory was a very distant 64 per cent in Vermont.

Two very close attempts on life and a loss in this election would have meant a possible jail term and bankruptcy for Trump.

Despite all of the above, this was not a vote “for Trump.” It was not even a vote against Joe Biden or Kamala. It was just a vote “against the incumbent.”

As I have written previously, the policies of both Democrats and Republicans are similar, if not the same, on the key issues (loose monetary policy through the Federal Reserve system, exploding National Debt, expanding government involvement in the economy, and wars), which is deteriorating the US economy. Given the duopoly political structure in the US, all that the people can do to express their displeasure is to remove the incumbent and get the other party back.

This happened in 2016 (Democrats were thrown out to get the Republicans in), 2020 (Republicans were thrown out to get the Democrats in), and 2024 (Democrats were thrown out to get the Republicans back). At this point, the meltdown that lies ahead for the US Economy and the US dollar would imply that the Republicans will be thrown out in 2028 yet again. People continuously vote for change, yet, they continue receiving the same policies packaged under a different label.

Let us look at what Trump is likely to do. As was evident in the election cycle, Trump pretty much riled the Deep State at every possible opportunity. Post the victory, he even stated that the two Neocons in his previous administration (Nikki Haley and Mike Pompeo) would not be part of his current administration. All this raised hopes that the US was indeed set for a historical deviation from a policy perspective. And a much-required one at that.

But all that hope of the non-interventionists/libertarians lasted for less than a week. Consider Trump’s key appointments made so far.

Marco Rubio, as the Secretary of State, would be a continuation of Mike Pompeo.

Elise Stefanik would be a continuation of Nikki Haley for the role of US ambassador to the UN.

Mike Waltz, as the National Security Advisor, is as Neocon as one can possibly be. Waltz had worked as an Advisor to both Donald Rumsfeld and Dick Cheney — the two most war-mongering Republicans of the recent past.

Pete Hegseth, Trump’s choice for Secretary of Defence, is far from Trump’s stated anti-war position. Pete is an outright military expansionist and has advocated for “rewriting the rules of war” to ensure the US military’s success.

After these four appointments, objective observers should have little doubt that Trump 2.0 will continue Trump 1.0 from a policy perspective. Whatever ideological chasms they had imagined between Trump and the previous administrations are non-existent in the current setup. There cannot be any doubt remaining after these appointments.

What Remains Of DOGE?

Among the Republican Presidential candidates, Vivek Ramasamy came the closest to understanding the predicament that lies ahead for the US Economy. His statement after the election results, “once in a century… chance to radically downsize the size, scope, and mission of the federal government,” reflects his understanding of the imminent crisis ahead for the US Federal government.

But he and Elon Musk have been relegated to a secondary role leading the “Department of Government Efficiency.” While Musk has promised to reduce national spending by $2 trillion, this will be impossible to achieve. Ronald Reagan, who campaigned and won on such a platform, could not deal with and clamp down on the bureaucracy, though it was much smaller and substantially less powerful back then.

The only relevant question is how long Musk and Ramaswamy will take to realise that “government efficiency” is an oxymoron. I guess both would recognise the futility of dealing with government machinery and return to their roles in the private sector within 12 to 18 months. All formal positions filled with war-mongers and big government advocates will be the primary driver of government expenses, and there is hardly anything that these two can do against such an onslaught. Within a few months, they will realise that they have a stark choice to make, like what happened to Larry Kudlow in the previous administration — either toe the line of Trump or walk out of the administration. Larry Kudlow did the former, but I suspect both Musk and Ramaswamy will do the latter, and this would be far better than singing in favour of policies they have explicitly advocated against.

Trump’s Honeymoon — How Long Will It Last?

We still have a good two months to go before Trump becomes President on 20 January 2025. But since 4 November, the DXY (which measures the US dollar against the currencies of the US’s biggest trading partners) has been up about two per cent, which is a huge change in the foreign exchange markets in 10 days.

Consequently, the Dow is up about two per cent, and the most DXY-correlated asset, Bitcoin, is up about 25 per cent. On the flip side, gold is down, indicating the market perception of a strong dollar under the Trump administration.

How long will this market honeymoon for Trump 2.0 last? My guess is that it will be over well before Trump even formally takes charge next year. The markets should not take long to comprehend that Trump will be more of the same from an economic perspective.

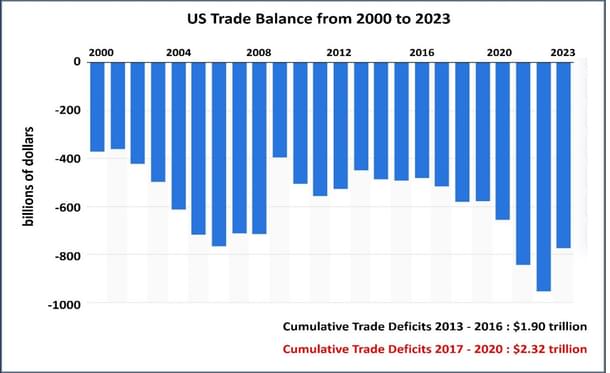

Tariffs: Trump’s Silver Bullet of higher tariffs as a negotiation tactic against China is a non-starter. He ought to have realised it in his first term when the trade deficit increased by 20 per cent compared to the previous four years. Despite this, Trump continues to live with the illusion that the exporter pays for tariffs.

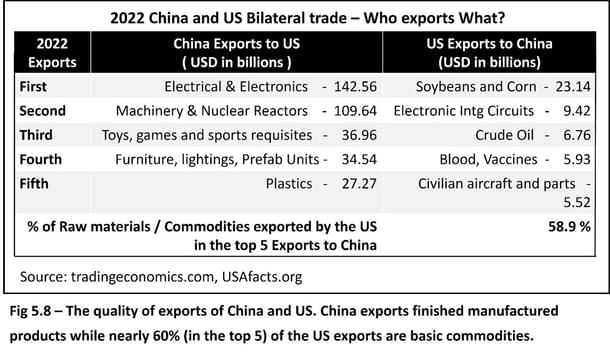

Whether Trump realises it or not, China knows very well that Trump has weak negotiating power. Almost nothing at all, to be more accurate. The trade data between the US and China are given below, and it should be very obvious that what the US imports from China cannot be done from any other country, or at least at the rates offered by China. Any tariff by Trump on Chinese imports is going to hurt the US far more than it hurts China. At the end of the day, it is an economic truism that the importers pay for tariffs.

To add insult to injury, what China imports from the US (soybeans, corn, crude oil, etc.) can easily be imported from other countries. If readers are in doubt, one has to look at what happened to Canada’s canola seed exports to China after Justin Trudeau’s 100 per cent tariffs on Chinese electric vehicles (EVs). China will develop other producers, and it's only a matter of time before South American countries become alternate suppliers of these agricultural commodities. Does anybody believe that the US and Canada’s auto manufacturers will become competitive with Chinese companies over the next few years? If applied on a material scale, Trump's tariffs will kill the meagre exports of the US.

The Ticking Time Bomb — National Debt

As I write this, the US national debt is at $35.99 trillion, and the US will end calendar 2024 with about $36.5 trillion. In another 12 months, we should be looking at $40 trillion, assuming that the global currency crisis I outlined in my book RIP USD: 1971-202X doesn’t manifest itself. In the very likely event that it does, we should look at a debt much closer to $42 trillion. But even in the best-case scenario of $40 trillion and an interest rate of four per cent on the national debt, the US would be looking at $1.6 trillion of Interest payments.

But the odds are overwhelming at this juncture for the economic/currency crisis to play itself out. What would it do to finances? The national debt would explode on the basis of shrinking revenues.

We could well be looking at interest payments of $1.7 trillion (based on a $42 trillion national debt at a 4 per cent interest rate) on revenues of $4.5 trillion (assuming a 10 per cent contraction in Federal revenues in 2024; after the 2008 global financial crisis, revenues contracted by nearly 20 per cent). This scenario would imply that nearly 38 per cent of Federal revenues could go toward interest payments alone.

The US is inching towards a finality, and nothing Trump has done so far has remotely indicated a reversal of the economic trends of the last few decades. But the worst part is not what Trump does; it is what Trump is perceived to be doing. He is viewed as a Conservative candidate, and all of the blame for what happens under Trump would be attributed to “capitalism.” That indeed would be the most unfortunate outcome for the US and the world.

I hope that when the US dollar crisis plays itself, the US will make a hard shift to the right — toward free markets, limited government, and individual liberty. But as things stand, it will likely be a hard shift towards the left, embracing more authoritarianism and central planning.

Shanmuganathan N (aka Shan) is an Economist based in India. He is the author of the recently published book "RIP U$D: 1971-202X …and the Way Forward" and can be contacted at shan@plus43capital.com