World

Year-End Roundup: Biden’s Gambles Sink Europe And Wreck Ukraine

Venu Gopal Narayanan

Dec 20, 2022, 06:52 PM | Updated 07:04 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Two years ago, when American President-elect, Joe Biden, was preparing to take charge, his country was caught in the grips of the Wuhan virus.

The economy was in tatters, demand was abysmally low, geopolitics had taken a merciful pause, and the world looked to America to propel a recovery.

By May 2021, it looked like Biden would be following the Trump playbook – using the domestic hydrocarbons industry to prime the economy, recommence exporting oil and gas to major importers like India and China, generate meaningful employment in large numbers, and gradually put the horrors of the pandemic behind.

The price of crude oil began to obediently rise from almost immediately after his election, and Biden even lifted sanctions on Russia’s Nordstream-2 gas pipeline to Germany.

But then, one after another, everything started falling apart. First, inflation began to rise. It was ignored for months. Cries of concern were waved away as alarmist political ploys.

Then came an abrupt, reckless, poorly-thought-out, and shoddily-conducted exit from Afghanistan, which handed the land back to the Taliban, sent America-loyalists to the gibbet, and gravely destabilised the region.

This was followed by a slowing of the American economy and a recession which lasted into the summer of 2022. The American Federal Reserve (their Reserve Bank) was forced to raise their rates. That only made the inflation problem worse.

But through 2021, drilling refused to pick up pace in America. One problem was of low demand exacerbated by a global oil glut. But since global oil prices were on the rise, consumers in America were hit by rising gasoline costs. This in turn reduced spending and spurred inflation to record levels.

The situation was roughly the same in Europe, with the additional economic pain caused by China, so central to Europe’s fortunes, still mired in its pandemic.

It is in this backdrop that Biden triggered a proxy war in Ukraine. His stated objectives were dutifully portrayed as noble by a pliant Western press – preserving Ukraine’s sovereign right to join the North Atlantic Treaty Organization (NATO) military alliance and the European economic sphere, and ending Europe’s dependency on Russian oil, gas, and coal.

The press left out two bits:

One, that this was a red line for Russia from at least as far back as Vladimir Putin’s momentous Munich speech of 2007, when he railed against the enforced unipolarity of America, and certainly since 2014, when America forced a regime change in Ukraine.

Two, that reducing European dependency on Russian energy offered America a huge market for the oil and gas from its tight sands (known colloquially as ‘shale plays’) – a market it could supply and control on its own terms.

By this, America would, in effect, underwrite both Europe’s security and energy needs, while gaining exactly the fillip its economy needed.

Swarajya repeatedly said through the spring of 2022, that while this grand American plan to replace Russia as Europe’s principal energy provider was ‘technically’ feasible (American oilmen are sans pareil), it was extremely doubtful if Biden’s gamble would work – not least because of the prevailing glut, uncertainty over crude prices, the risk that this plan could be shattered by a price war with other major exporters, and policy myopia (stemming from the influence of the green lobby on Biden’s Democratic Party).

So, where does Biden’s gamble stand as 2022 draws to a close? Ten months after the Ukraine conflict began, here are the facts:

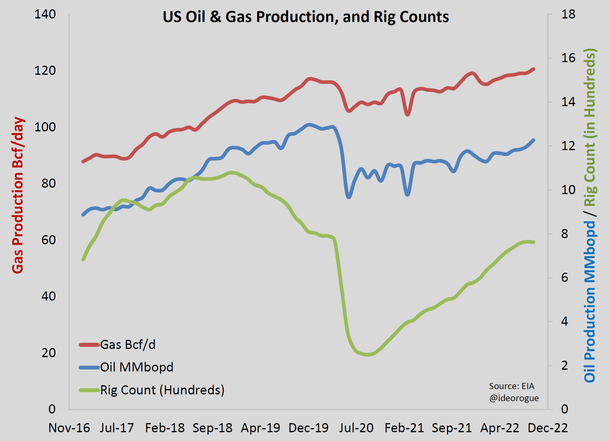

First, America has failed to ramp up domestic hydrocarbon production and exports to anywhere near requisite levels.

While production of oil and gas has increased, neither has reached materially upon pre-pandemic volumes. In fact, oil production has yet to even cross the levels hit in 2019.

Second, and most crucially, the rig count (a direct measure of drilling activity) is lagging well behind pre-pandemic levels. The most recent data also indicates that it could be a long while before drilling activity climbs back up to the peaks America hit in 2019 – if at all it does.

Third, a sluggish rise in rig counts has a direct impact on America’s ability to produce higher volumes of oil or gas, for the simple reason the bulk of their production comes from tight sands.

This requires a swift and continuous addition of wells if levels are to be maintained, since it is the nature of wells completed in tight sands that production volumes decline quite significantly in the first year of operations itself.

Further, although America is blessed with considerable hydrocarbon reserves located in conventional sands, the country does not have the luxury of falling back on these, because most of those large fields have already touched their peak, and have entered into a mature phase of slow, terminal decline.

Therefore, simply put, if America doesn’t drill like it did before the pandemic, forget about ramping up production dramatically, it will not even be able to maintain current levels beyond a year or two – if that.

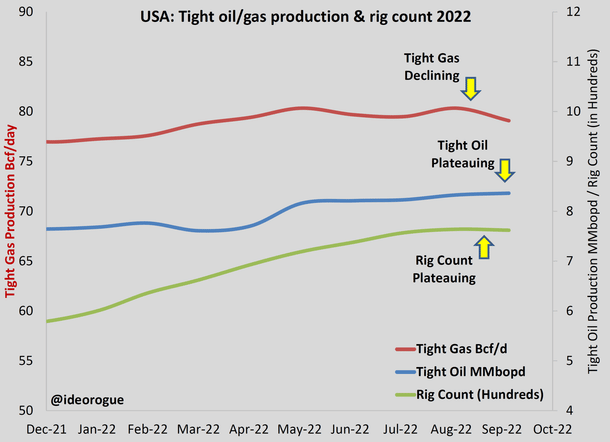

Fourth, this vital contribution from tight sands is demonstrating unsettling trends of late. Tight gas production has actually declined, and tight oil production has hit a clear plateau.

As a second chart below shows, the effect of a plateauing rig count is showing in the inability to increase production.

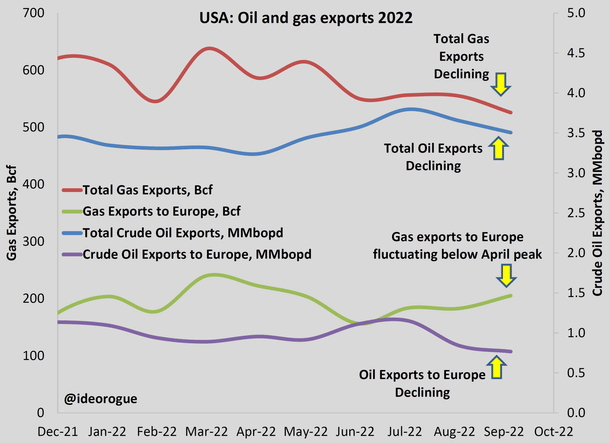

Fifth, as a result, American exports of oil and gas (the latter is compressed and shipped as Liquified Natural Gas, or LNG) have stagnated. In fact, average monthly exports of LNG since April 2020 are less than what America was exporting in late 2021.

Specifically, LNG exports from America to Europe in the past four months (data cut-off is September 2022) are less than March and April 2022. Total oil exports have also declined, as have exports to Europe.

And in-between, there is also a curious matter of delayed publication of hydrocarbon production and trade data.

These are supposed to be published monthly, but as this piece goes to press in late December, the last official data point on the American Energy Information Administration website is still September 2022. Why is that, and what purposes such delays serve, remain unknown.

What conclusions may we draw?

Biden’s gamble to replace Russia with America as Europe’s primary energy supplier has failed catastrophically. As a result, Europe is in a mess, struggling to cope with soaring inflation and energy shortages in winter. It may be uncharitable to say that we told you so, but we did.

All data from EIA website

(The strategic aspects of this debacle, a detailed analysis of its impact on Europe, and a review of the ongoing conflict in Ukraine, will be covered in forthcoming pieces)

Also Read: Five-Part Series On Biden’s Next Gamble

Venu Gopal Narayanan is an independent upstream petroleum consultant who focuses on energy, geopolitics, current affairs and electoral arithmetic. He tweets at @ideorogue.