Economy

Nirmala Sitharaman Interview, Part Three: 'GST Rate Rationalisation Is On, Only Timing Is The Issue'

- In this third and final part of her interview to Swarajya, Finance Minister Nirmala Sitharaman speaks about the GST regime and the reforms that are being worked on related to that.

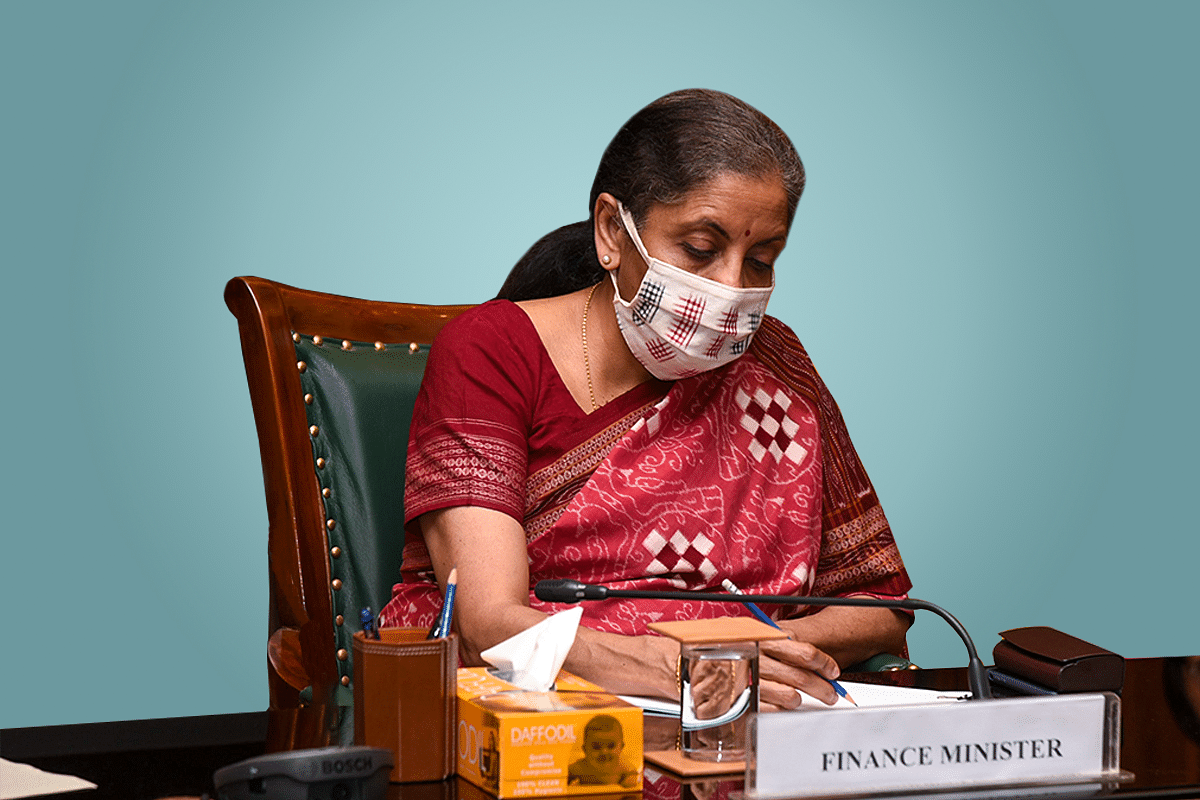

Union Finance Minister Nirmala Sitharaman.

This is the third part of the finance minister’s interview to Swarajya. Read part one here and part two here.

Swarajya: What is the status on Goods and Services Tax (GST) reform? Especially on rate structures and compensation to states?

States have very clearly shown an interest in discussing the rationalisation of rates. GST is heading for a good stabilisation period. In the last two or three meetings of the GST Council, rate rationalisation was consciously not taken up, particularly the correction of inverted rate structures. Many states said we agree, but this may not be the appropriate time for this. Nobody questioned why there should be a correction. They understand that inversion costs a lot to the exchequer, where you are refunding more than collecting. So, the principle is agreed, and on some items, like mobile phones, they decided to go ahead. They have agreed to look at footwear and textiles. If there are any inputs coming from affected parties or sectors, we will look at them…So on the question of correction, the GST council is one, there are no differences. It is only a question of timing the correction.

On rate slabs, we have not come to any view. Should there be only one slab, should slabs be reduced to two, no discussion has happened on that because we want to first get the corrections done.

Then there is the question of compensation to states (who have been promised 14 percent annual increases in revenues till June 2022). This is being paid with borrowed money, which, by law, has to be paid for from the cess. The Council extended the cess period to 2026. The cess collected from 2022 to 2026 will go to pay back borrowed money and servicing the interest.

Swarajya: GST revenues seem be steadying well above Rs 1 lakh crore now…

We have plugged loopholes where false input tax credits were claimed and the system was being gamed. Some were collecting refunds and disappearing. We have extensively used big data and AI and found trails going to the last point. Every day you will find in newspaper stories saying that Rs 320 crore has been found, Rs 260 crore found, and even Rs 800 crore. There are some one-room operations with no activity, who were just collecting refunds and disappearing. We are benefitting by closing the loopholes.

Swarajya: Will matching invoices be the ultimate way to plug loopholes?

That is a matter on which a lot of discussion has happened. Let us see how the Council sees it.

Swarajya: Will compensation to states beyond June 2022 be discussed?

The existing law is what we have explained, all of them (i.e., states) are aware…But with revenues going up, many of the states, particularly the north-eastern ones, are getting the 14 percent growth. Now, with monthly revenues going up, we are compensating as per the formula.

After Reading This Interview, Don't Forget To Check Out Our Recently Held Special Webinar Series:

This was the final part in a series of Swarajya conversations centred on the principles and policies guiding Aatmanirbhar Bharat, and was powered by Vedanta. For other parts in the series, follow the link here.

Swarajya: Will the Cairn and other retrospective tax cases be settled this year? Have discussions happened with the companies?

Yes, it (should happen). They (the companies involved in litigation) do consult to understand how the law is framed and how it will be implemented. We hardwired quite a few things into the law itself so that parliament should know every aspect of it. We made it a part of the law itself without putting it all in subordinate legislation. Yes, there will be subordinate legislation, but largely it is all in the act itself. Yes, people are showing interest (in settling the cases) and discussing with our officials. The Department of Revenue has a cell dealing with it.

Swarajya: Can you speak about the account aggregators reform, which will make small customers access credit by releasing their private data?

On the one hand, the data privacy bill is happening. But much before that, and without waiting for it, the department of financial services and the Reserve Bank came up with this idea of account aggregators. Every customer can now go to the system and say, I am quite willing to let this much of my data be used, so that without compromising on my privacy I will be able to economically benefit from the data I give. Credit will be given based on a higher rating…

Swarajya: How important has the PM’s support been for your ministry?

Absolutely. He is always available for discussion, always available for consultation, always available for me to go and voice my concern. He has been very active in keeping in touch with all stakeholders, both during the second wave and post the second wave. We are able to exchange thoughts with the PMO and ministries and come to decisions. This is not just about Covid, but also long-festering issues like the retrospective tax and the telecom reforms. These are very bold decisions made with the commitment that the Indian economy should not just be perceived to be better but also function better. That cannot happen without the political backing of the PM.

Support Swarajya's 50 Ground Reports Project & Sponsor A Story

Every general election Swarajya does a 50 ground reports project.

Aimed only at serious readers and those who appreciate the nuances of political undercurrents, the project provides a sense of India's electoral landscape. As you know, these reports are produced after considerable investment of travel, time and effort on the ground.

This time too we've kicked off the project in style and have covered over 30 constituencies already. If you're someone who appreciates such work and have enjoyed our coverage please consider sponsoring a ground report for just Rs 2999 to Rs 19,999 - it goes a long way in helping us produce more quality reportage.

You can also back this project by becoming a subscriber for as little as Rs 999 - so do click on this links and choose a plan that suits you and back us.

Click below to contribute.

Latest