Business

RBI Hikes Repo Rate By 25 Basis Points To 6.5 Per Cent, FY24 GDP Growth Pegged At 6.4 Per Cent

Swarajya Staff

Feb 08, 2023, 10:48 AM | Updated 10:48 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

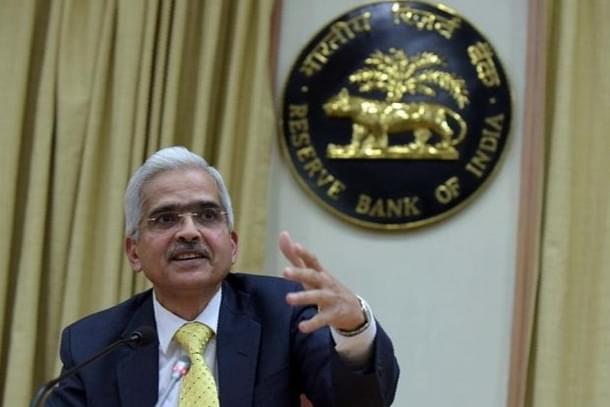

The Reserve Bank of India (RBI) on Wednesday raised the benchmark lending rate by a modest 25 basis points to 6.5 per cent, citing sticky core inflation.

RBI Governor Shaktikanta Das led monetary policy committee (MPC), which is made up of three members from the RBI and three outside members, hiked the key lending rate, also known as the repo rate, by 0.25 per cent to 6.25 per cent by a majority decision.

This is the sixth consecutive rate hike after a 40 basis points increase in May last year and 50 basis points hike each in June, August, September and December. In all, the RBI has raised the benchmark rate by 2.50 per cent since May 2022.

Announcing the bi-monthly monetary policy, RBI Governor Shaktikanta Das said the Monetary Policy Committee (MPC) by a majority decided to raise the policy repo rate by 25 basis points and keep a 'strong vigil' on inflation outlook.

'Policy rate at 6.5 per cent still trails the pre-pandemic level,' Das said, adding that core inflation will remain sticky.

Core inflation generally refers to inflation in manufactured goods.

The governor said the inflation will moderate in the next fiscal but remain above the 4 per cent level. The RBI is mandated to keep inflation at 4 per cent with a margin of 2 per cent on either side.

For the next fiscal, the RBI projected a growth rate of 6.4 per cent. In the latest Economic Survey of the finance ministry, growth projection was 6-6.8 per cent for 2023-24.

According to Das, the retail inflation will average 6.5 per cent in the current fiscal and moderate to 5.3 per cent in 2023-24.

Indian economy has remained resilient despite global headwinds, Das said.

(With inputs from PTI)