Economics

Russian Oil Imports Surge: A Dual Victory For The Modi Government

Tushar Gupta

Jun 14, 2022, 04:46 PM | Updated 04:46 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

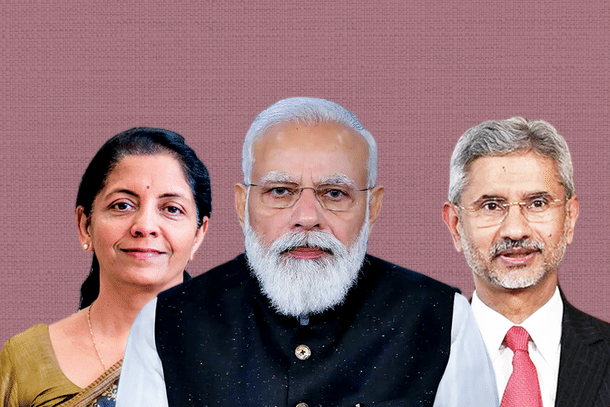

In the history of independent India, no Finance Minister has faced the unique challenge of three consecutive budgets across three consecutive years going for a toss before Nirmala Sitharaman in 2020 when her budget was put on a nationwide lockdown in the wake of a pandemic.

In 2021, the Delta wave and the subsequent Omicron wave dented the prospects of her otherwise on-track V-shaped recovery.

Sitharaman's strongest challenge came in 2022, when Russia invaded Ukraine days after the budget was released, resulting in the oil calculations going haywire, from $70-$75 a barrel to more than $120.

External Affairs Minister Dr S Jaishankar faced another set of diplomatic challenges in the wake of the crisis in Ukraine. India has only begun discovering trade and military closeness to the West, and therefore, to let go of a strategic partner, one critical to India's defence imports, was not an option on the table.

In the early days of the invasion, India was pressured to denounce Russia and snap all trade and diplomatic ties as the Europeans were promising. Better sense prevailed, however, with Jaishankar, in his charismatic fashion, reminding the West, time and again, that India would deal with each nation on its terms.

The Russia-Ukraine crisis has added to the inflation woes across the world, complemented, at the worst possible time, by the Covid-zero lockdowns in China and the resulting supply chain crisis. The slowdown comes with the central banks across the world tightening the liquidity taps to curb inflation resulting from the sudden spike in prices of key commodities, especially wheat, corn, barley, sunflower oil, and palm oil crude. Prices of sunflower oil, for instance, have gone by four times.

The real crisis, however, has been on the oil front. Between Q1 2021 and Q2 2022, oil prices have more than doubled, with some fearing crude to breach the $150 mark.

Global inflation, driven by high oil prices, also hurts Western economies. Between May 2020 to April 2022, consumer price inflation (measured as an annual per cent change in the consumer price index) has gone from 0.1 per cent to 8.3 per cent in the US, 0.5 to 9.0 in the UK, 0.6 to 7.4 in Germany, 0.4 to 4.8 in France, -0.2 to 6.1 in Italy, and collectively, from 0.1 per cent to 7.4 per cent for the entire Eurozone.

For the far more vulnerable economies, inflation has been a death knell. For instance, in Turkey, for the same period, it has gone from 11.4 to 73.5, 1.9 to 12.1 in Brazil, and from 5.2 to over 33 per cent in Sri Lanka. For India, however, it has gone from 6.3 per cent to 7.8 per cent.

Therefore, the government needed to stress the importance of securing its energy interests, which it did on two separate occasions.

Sitharaman, at an event in Mumbai, stated that if the supply was available at a cheaper price, why should India be wary of making a purchase.

Speaking to the media, External Affairs Minister Dr S Jaishankar elaborated on the volume of energy imports from Russia, stating that India's month's worth of energy imports from the Putin regime was equivalent to what Europe imported in one afternoon. This, however, was before India started increasing its oil imports from Russia.

As per the news reports, Russia has become India's second-largest oil exporter, trailing Iraq and pushing down Saudi Arabia at three. From constituting less than 2-3 per cent of India's oil imports in 2021, Russian oil made up 16 per cent of it in May 2022.

The Indian government benefitted from the discount at which the Russian crude was available, steadily increasing its imports from March to May. As per another report, India received over 24 million barrels of oil in May 2022, up from 7.2 million barrels in April and merely 3 million barrels in March, and is expected to increase its import shipments to 28 million barrels for June 2022.

To steadily increase the import of oil, even in the face of mounting Western pressure against Russia, amounts to a critical victory for Jaishankar. As the Eurozone toughens the sanctions against and prepares to decouple from Russian energy, the Finance Ministry could be in the position to serve as one of the new buyers for Russian crude, along with China.

Even as the Russian share in India's oil imports lingers below 20 per cent, increasing it from less than 2 per cent a year ago is no mean feat. An underrated victory for the Modi government as crude-drive inflation rages through global markets.

Also Read: Limiting Inflationary Pressure Will Hold The Key To India’s Growth In FY23

Tushar is a senior-sub-editor at Swarajya. He tweets at @Tushar15_