Economy

Big Bang Tax Cut: India Now Has One Of The Most Optimal Corporate Tax Rates In World

Karan Bhasin

Sep 20, 2019, 01:56 PM | Updated 01:55 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

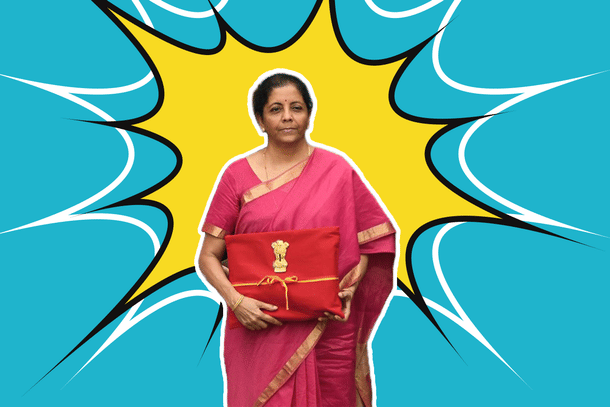

The announcements made by Finance Minister Nirmala Sitharaman today (20 September) are a lot more significant than would appear at the moment. These announcements will act as a counter-cyclical policy response and help in revival of sentiment and economic spirits.

For starters, the reduction in corporate tax rates to 22 per cent without exemption is an important announcement.

Why is this rate at 22 per cent — and say not at 25 or 21 or 23? The answer is simple, 22 per cent is the optimal corporate tax rate. That is, it is the tax rate at which tax revenue will be maximised as government will get greater revenue from improved tax compliance than the revenue forgone from tax rate reductions.

This is the famous Laffer Curve analysis that was jointly done with Dr Surjit Bhalla for an Indian Express article published in July. The article can be read here.

For a long time, our tax babus thought that to increase tax revenue we got to increase tax rate. This will perhaps become a thing of the past.

This move is a recognition of what has been argued by tax experts and economists for a long time. That lower levels of tax rates can be instrumental in ensuring higher tax revenue for the government.

Moreover, it comes as a strong recognition that we need to move away from our taxation policies based on morality but towards tax revenue maximisation.

As far as its impact on corporate sector is concerned before this announcement, India had one of the highest effective taxation rates.

Now, it has one of the most optimal taxation rates. What this means is that firms will now have more retained earnings which can be utilised by them for either deleveraging or for fresh investments. Both are welcome at a time when we are just starting to see early signs of recovery of our growth rates.

But the icing on the cake is the fresh provision in the income tax rates to allow for 15 per cent tax rate for new manufacturing firms that will be set up and start manufacturing by 31 March 2023.

This ensures India has one of the most competitive corporate tax rates when it comes to manufacturing sector, and at a time when firms are looking for an alternative to China it will be instrumental in getting most of those firms here in India.

The ramification of these measures can be gauged from their impact on the stock markets as sentiment has been revived instantly with these announcements. The underlying message behind them was simple — we have opened the doors for the world to come and do business in India. It is only a matter of time before we start seeing its positive impact being reflected in our statistics.