Insta

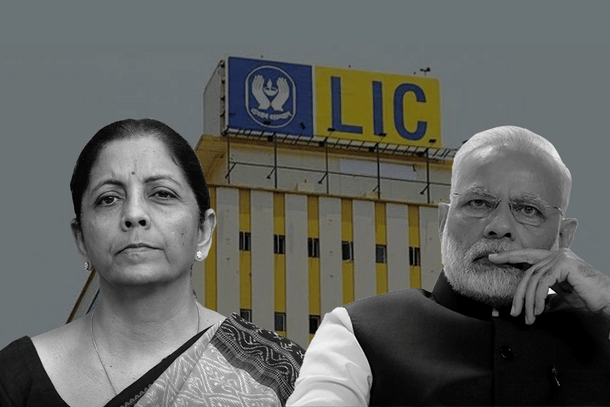

LIC Disinvestment: Govt Planning To Invite Bids From Merchant Bankers This Month; IPO Likely By January Next year

Swarajya Staff

Jul 04, 2021, 01:27 PM | Updated 01:27 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The central government is set to call for bids from merchant bankers in July to manage the disinvestment of the Life Insurance Corporation of India (LIC), as the government plans to launch its initial public offering (IPO) by January.

Milliman Advisors LLP India was appointed by the Department of Investment and Public Asset Management (DIPAM) in January to evaluate the LIC’s embedded value prior to the IPO.

As per this method, the insurance company’s current value of future profit is also included in its present net asset value (NAV).

“We will invite bids for appointment of merchant bankers in the next couple of weeks, the official said, adding discussions are going on with institutional investors. We are hoping to get regulatory approvals by November-end,” an official in the know of the developments was quoted in a report by the PTI.

Around 10 per cent of the LIC IPO issue size will be reserved for policyholders and this is likely to be the biggest public issue in the history of the corporate India.

So far, SBI Caps and Deloitte have been nominated as the pre-IPO transaction advisors for the life insurer. The public listing of the LIC is integral for the central government to meet its massive Rs 1.75 lakh crore disinvestment target for FY 2021-22.