Insta

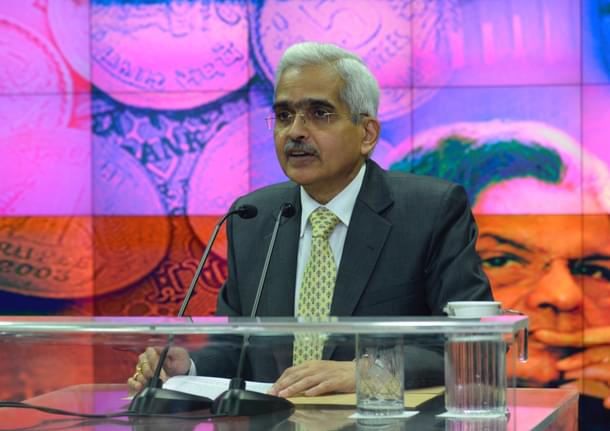

RBI Announces The Roll Out Of A New Digital Payment Index, To Be Available In Public Domain Beginning July

Swarajya Staff

Feb 07, 2020, 09:26 AM | Updated 09:26 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Reserve Bank of India (RBI) has announced the creation of a digital payments index (DPI) by July 2020. The index will assess and capture the extent of digitalisation of payments effectively.

“Digital payments in India have been growing rapidly. The Reserve Bank shall construct and periodically publish a composite “Digital Payments Index” (DPI) to capture the extent of digitisation of payments effectively. The DPI would be based on multiple parameters and shall reflect accurately the penetration and deepening of various digital payment modes. The DPI will be made available from July 2020 onwards” the central bank said in its statement on developmental and regulatory policies.

Conceptualised and developed as a composite scoring system, the digital payment index will enabled both consumers and stakeholders to gained informed insights on developments in infrastructure, access, demographic and acceptance related growth with reference to broader domestic and global standards in digital payments.

The index will have classification of urban, semi-urban and rural geographies to analyse the kind of digital payments that are gaining acceptance.

The DPI will help understand the impact of any policy interventions taken by the regulator or government on digital payment services. For instance, the government recently scrapped merchant discount rates (MDR) on payments made through Rupay debit cards and the Unified Payments Interface (UPI). The index will determine if the actions taken are helping in the growth of digital payments.

The government and central bank have been working in tandem on enabling the adoption of cashless payment modes that include, digital mobile wallets, debit and credit cards, internet banking and the Unified Payments Interface (UPI) system.

According to Soumya Kanti Ghosh, group chief economic adviser, State Bank of India, the introduction of Digital Payments Index is an excellent step and this will spread the benefits of a less-cash economy.