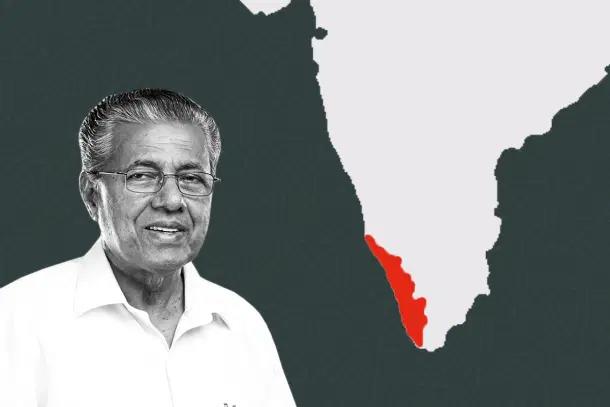

Kerala

Explained: Borrowing Limit Of Rs 21,253 Crore Granted By The Centre To Kerala Government

S Rajesh

May 28, 2024, 03:07 PM | Updated 03:07 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Union government recently granted Kerala a borrowing limit of Rs 21,253 crore till December 2024, almost two months after the Supreme Court refused to pass an interim order for the same in a plea filed by the state.

The court referred the case to a constitution bench stating that Article 293, which is regarding the borrowing done by states had not been authoritatively adjudicated upon and so it would be best to let a five-judge bench decide.

The Kerala government had contended that the article does not give the Centre the power to regulate all state loans and it could only impose conditions on borrowings from the central government.

The matter had reached the Supreme Court as the Kerala government contended that the Centre had reduced its net borrowing ceiling by introducing certain new aspects into the borrowings, which were earlier not considered as part of the state’s borrowings, as per a report by Moneycontrol.

These include the borrowings by state-owned enterprises and the tying of borrowings to certain reforms.

As per the recommendations of the 15th Finance Commission, states are allowed to borrow upto 3 per cent of their gross state domestic product (GSDP).

The figure for Kerala, thus comes to Rs 39,626 crore but this was reduced to Rs 28,830 crore, the state’s Finance Minister K N Balagopal said in his 2024-25 budget speech, the report mentions.

Chief Minister Pinarayi Vijayan led a protest against the Centre in New Delhi’s Jantar Mantar and received the support of many opposition parties.

The Supreme Court initially asked the two governments to speak to each other but as no solution could be found to the issue, the matter was heard again. The court nudged the Centre to give a one time package to Kerala and also stated that it should not insist that the state withdraw the suit in order to enhance the borrowing limit.

The Centre then offered the state to borrow Rs 13,608 crore in the financial year 2023-24 and an additional Rs 5,000 crore. The latter would be adjusted in the borrowing limit of the subsequent financial year.

The Centre also said that it would be subject to a number of conditions like submitting the requisite information/documents and a plan to improve the state’s fiscal situation.

Kerala rejected the offer, stating that it wanted at least Rs 10,000 crore and opposed the imposition of such conditions.

The state is facing a financial crisis with reports emerging that it was unable to pay salaries and social welfare benefits on time.

As per the figures of the latest budget, the state has a fiscal deficit of 3.4 per cent of the GSDP and a revenue deficit of 2.12 per cent. The fiscal deficit is thus just 0.1 per cent less than the upper limit of 3.5 per cent that has been set for the states.

A 2022 report by the Reserve Bank of India classified Kerala along with West Bengal, Bihar, Punjab and Rajasthan as a group of highly indebted states that needed to take significant corrective measures.

Further, it stated that the debt to GSDP ratio of Kerala along with West Bengal and Rajasthan were expected to cross 35 per cent in 2026-27.

Therefore, the announcement of this borrowing limit, two months into the 2024-25 financial year, even as the suit is pending in the Supreme Court, can be seen as a breather to the Kerala government.

Even so, the long term solution lies in getting more investments in the state, which could then drive up the revenue collections.

S Rajesh is Staff Writer at Swarajya. He tweets @rajesh_srn.