News Brief

Union Budget 2025: Customs Duty Revamp To Strengthen MSMEs, EV Batteries, Healthcare And Shipbuilding

Vansh Gupta

Feb 01, 2025, 05:59 PM | Updated 05:59 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

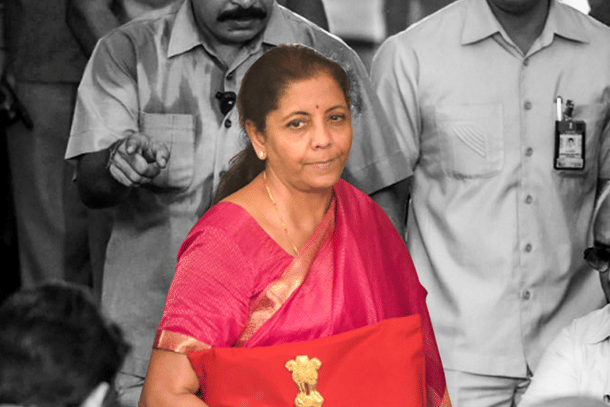

Finance Minister Nirmala Sitharaman, while presenting the Union Budget 2025 on Saturday (1 February) announced key measures to rationalise the customs duty structure, aiming to promote domestic manufacturing, streamline trade, and reduce costs for consumers.

Simplified Tariff Structure and Duty Adjustments

To create a more efficient duty structure, the government has removed seven tariff rates, reducing industrial goods tariffs to just eight categories (including zero rate).

This follows a similar reduction in Budget 2023-24, where seven tariff rates were also eliminated.

The Finance Minister stated, “These will also support domestic manufacturing and value addition, promote exports, facilitate trade, and provide relief to common people.”

Additionally, the Budget exempts Social Welfare Surcharge on 82 tariff lines subject to a cess.

Sitharaman said, “I propose to exempt Social Welfare Surcharge on 82 tariff lines that are subject to a cess.”

Encouraging Voluntary Compliance and Extending Time Limits

To encourage voluntary compliance, the Budget introduces a provision allowing importers and exporters to voluntarily declare material facts and pay duties with interest but without penalty, provided an audit or investigation has not already started.

The time limit for utilising imported inputs has also been extended from six months to one year, with importers now required to file quarterly statements instead of monthly reports.

Boosting Healthcare and MSME Sector

The government has expanded Basic Customs Duty (BCD) exemptions for healthcare, adding 36 life-saving drugs used for cancer, rare, and chronic diseases to the fully exempted list.

Additionally, six life-saving medicines will now be available at a concessional 5 per cent customs duty.

Further exemptions apply to bulk drugs used for these medicines, and 37 more medicines along with 13 new patient assistance programs will be covered, ensuring affordability for critical healthcare.

For manufacturing industries and MSMEs, cobalt powder, lithium-ion battery waste, lead, zinc, and 12 critical minerals have been fully exempted from BCD.

Sitharaman noted, “This will help secure their availability for manufacturing in India and promote more jobs for our youth.”

Supporting Apparel, Electronics and EV Battery Manufacturing

The Budget addresses concerns in the domestic apparel industry by revising the BCD on knitted fabrics from “10 per cent or 20 per cent” to “20 per cent or Rs 115 per kg, whichever is higher”.

Meanwhile, to correct the inverted duty structure, the BCD on Interactive Flat Panel Displays (IFPDs) will increase from 10 per cent to 20 per cent, while the BCD on open cells and components will be reduced to 5 per cent to encourage local manufacturing.

The customs duty exemption for electric vehicle (EV) and mobile phone battery manufacturing will now cover 35 additional capital goods for EV batteries and 28 additional capital goods for mobile phone batteries, boosting India’s domestic lithium-ion battery production.

Additionally, the BCD exemption for raw materials, components, and parts for shipbuilding has been extended for another 10 years, ensuring continued growth in India’s maritime industry.

Vansh Gupta is an Editorial Associate at Swarajya.