Tech

How China's State-funded Semiconductor Chipmaker SMIC Is Overcoming US Sanctions And Developing A 5-nanometer Chip

Swarajya Staff

Sep 02, 2024, 11:48 AM | Updated Oct 03, 2024, 11:34 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Semiconductor Manufacturing International Corporation (SMIC), China’s flagship foundry, trails Taiwan Semiconductor Manufacturing Co (TSMC), the world's largest contract chipmaker, by just three years in advanced logic chip production, an analysis by TechanaLye, a Japanese research firm has revealed.

The research firm based its conclusion after deconstructing semiconductor circuit diagrams for two recent versions of the logic chip that powers the Mata series smartphones from the embattled Chinese tech behemoth Huawei Technologies.

Unveiled in April this year, the cutting-edge Kirin 9010 processor, built on a 7-nanometer architecture, powers Huawei's Mate 60 Pro smartphone. This latest iteration was preceded by Kirin 9000S, released in August 2023. Notably, both chips were manufactured by SMIC utilising its N+2 process technology. However, the Kirin 9010 represents a significant performance enhancements compared to the 9000S, showcasing SMIC's fabrication prowess.

SMIC is widely regarded as a ‘national champion’ for the pivotal role it is China’s ambition to turn self-reliant in semiconductors.

Founded in 2000, Shanghai-headquartered SMIC provides semiconductor foundry and technology services to global customers on 0.35 micron to FinFET process node technologies. SMIC has created a formidable innovation ecosystem by collaboration and partnerships with both industry and academia.

Over the years, SMIC has received billions in subsidies and investments from Chinese government and state tate-backed funds to fast track the development and production of semiconductor chips

In 2020, SMIC received $373 million in government subsidies, which constituted a fifth of the total subsidies given to Chinese semiconductor companies that year. In 2022, SMIC received over $270 million in subsidies.

Over the years, China Integrated Circuit Industry Investment Fund and the Shanghai Integrated Circuit Industry Investment Fund invested over $2.5 billion in SMIC.

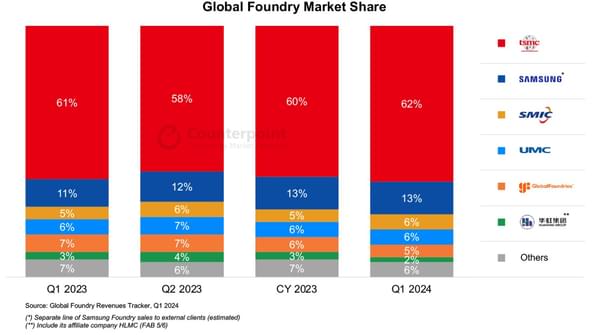

According to a recent report by Counterpoint research, SMIC is now the world’s third-largest foundry in terms of revenue (behind TSMC and Samsung). It overtook GlobalFoundries and Taiwan’s United Microelectronics Corporation

SMIC's achievement in delivering a cutting-edge, 7-nanometer processor to Huawei, despite years of US sanctions, has significantly bolstered its role in China's quest for semiconductor self-sufficiency. However, as the chipmaker strives to further enhance its fabrication capabilities, it encounters several obstacles, including:

- Limited access to advanced tools and technologies due to ongoing US export restrictions

- Challenges in achieving high yields and reducing defects at smaller nanometer nodes

SMIC's Capabilities And Challenges

SMIC has been capable of producing 7-nanometer chips since 2021 which is a remarkable achievement considering that it managed to reached such a level of process maturity despite sanctions.

In December 2020, the US government placed sanctions on SMIC citing national security concerns. The US Department of Defense added SMIC to a list of companies with close links to Chinese military, making it subject to restrictions on access to US technology and investment.

After losing access to leading-edge extreme ultraviolet lithography (EUV) lithography machines due to the sanctions, SMIC began stockpiling deep ultraviolet lithography (DUV) equipment from the Netherlands’ ASML and used it to make 7-nanometer semiconductors.

SMIC leveraged stockpiled DUV equipment and reportedly utilised "double patterning" to manufacture 7-nanometer chips. This technique employs multiple laser passes to achieve sub-20nm resolutions, enabling IC design etching. However, this process is time-consuming and costly, making volume production challenging. As a result, analysts predict limited production runs, such as 7 million MatePro phones in 2023 and potentially 40 million in 2024.

SMIC is now developing 5-nanometer chips, targeting 130 million transistors per square millimeter. Due to US export restrictions, SMIC cannot access EUV lithography machines. So it is exploring alternative method called 'self-aligned quadruple patterning' using old DUV machines to achieve 5-nanometer technology. The 'quadruple patterning' approach involves multiple etching passes on silicon wafers to increase transistor density and enhance performance.

"If nothing changes with current restrictions, we expect Huawei and SMIC to have a true 5nm-based chip in 2025 or 2026 with large scale AI chips not so long after" according to Dylan Patel of SemiAnalysis.

While SMIC's 5-nanometer chips will still be a generation behind TSMC's leading-edge 3nm process technology, it will mark a significant progress for China's semiconductor industry under the current U.S. export control regime.

According to semiconductor industry observers, China's long-term competitiveness in semiconductor manufacturing beyond 5nm nodes hinges on acquiring or developing Extreme Ultraviolet (EUV) lithography machines. If Huawei and its partners rely on alternative methods, such as quadruple patterning, to bypass EUV limitations, the resulting increase in production costs may render chip production economically unviable for commercial devices like PCs and smartphones.