World

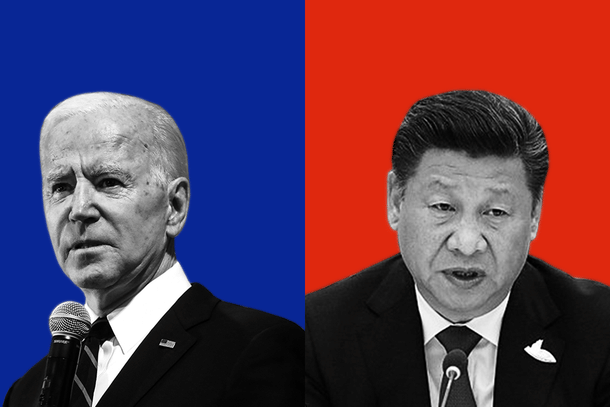

Biden-Jinping: A Tale Of Two Regimes And Recession

Tushar Gupta

Aug 01, 2022, 03:01 PM | Updated 03:01 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

On the hypothetical governance scales, US President Joe Biden and Chinese President Xi Jinping would find themselves on the extreme but idealistic ends.

For the Democrats running the White House today, Biden’s democracy would reflect the American spirit, celebrate the freedom of speech and expression, and be the stabilising force after four turbulent years of President Donald Trump.

Meanwhile, Jinping’s hushed dictatorship is about the Chinese civilisation and its rightful supremacy in the modern world after a century of humiliation, even at the cost of human rights. Thus, every move of the state, from crackdowns to lockdowns, only adds to the pursuit of the larger ambition.

Today, however, the two most powerful men on Earth (order of power best left to debate) are proudly crashing their economies in the garb of hurting an antagonist from the Cold War era and defeating a virus into submissiveness through Covid-zero lockdowns.

This has aggravated the pressure on the global supply chains, has ushered in inflation, a phenomenon quite alien in the West, and could well be the tipping point that descends Taiwan, responsible for over 50 per cent of the global share of semiconductors, into the equivalent of a Korean crisis of our times.

America: Mumbling, Stumbling, Tumbling

One of the most powerful visuals to emerge in the wake of the 9/11 attacks was that of president George Bush, his arms around an emergency rescue worker, speaking of retaliation against those who had attacked the land of the free and home of the brave. Twenty years later, a feeble Biden, on Twitter, was making a case before the gas station owners, almost begging them to tone down the fuel prices, for it was a time of war and global peril.

What Biden did not realise, however, was that it was his series of miscalculations that landed America in a technical recession.

In June, at 9.1 per cent, the United States hit a 40-year-high with consumer price inflation. The major thrust came from petrl prices, increasing 59.9 per cent over the last 12 months and 11.2 per cent over the previous month. Fuel oil prices went up by 98.5 per cent in the preceding 12-month period, electricity was up by 13-odd per cent, piped gas (utility) was up by 38.4 per cent for the same period, and even food prices had gone up by 10 per cent since June 2021.

For an average American household, this was economic decimation. Congratulations on the oil and grain export sanctions to the White House.

While the US and other members of NATO should have looked to broker peace between Russia and Ukraine, they can be termed guilty, in hindsight, of egging on the Kremlin to go for the invasion. Consequently, this has had a bearing on the grain exports from Ukraine.

In June 2022, the wheat, corn, and barley exports from Ukraine were around 1 million tonnes, 40 per cent down from June 2021. To put things in perspective, Ukraine accounts for 30 per cent of the world’s sunflower oil production and 4 per cent of wheat production. In 2019, Ukraine’s share in India’s sunflower oil imports was around 77 per cent.

As a result of the war, prices of key agricultural commodities shot up. Wheat prices almost tripled before cooling off. Corn and barley prices more than doubled. Sunflower oil, rapeseed oil, and palm oil prices increased by 200 per cent, adding to the global inflation woes.

If one were to look at the price of staples for the 27 European Union countries, bread prices have inflated by over 15 per cent year-on-year (YoY) while oils and fats have gone up by over 30 per cent annually. In Bulgaria, oil, fats, and bread prices have inflated by over 40 per cent in the last 12 months. Similar trends have been witnessed across key European economies.

In America, only last week, Walmart cautioned investors against expectations on profits for the second time in two months, citing unaffordability amongst consumers to buy products due to surging inflation. The personal savings percentage is a little over 5 per cent, the lowest in over a decade in the United States, bearing the inflation pain. For the Fed, the challenge is to usher in a soft landing where inflation can be tamed without hurting growth or having access to credit at much higher rates.

While the National Bureau of Economic Research may not want to call it a proper recession like 2008, the political writing is on the wall for Democrats for the November mid-terms.

On the foreign policy front, the challenge for Biden has been to keep the flock together, a task that is getting difficult by the day as Europe prepares for a hard long winter with inflated energy prices and, in some countries, even rationing.

For instance, Europe and the United Kingdom are not on the same page regarding prohibiting maritime insurance for vessels carrying oil from Russia. EU also eased the curbs on maritime insurance in late July, citing energy needs. From less than 50 euros per megawatt hour in Q3 2021, the gas prices now exceed 200 euros a year later, denting consumer pockets and making it difficult for the West to sustain the sanctions against the Russians.

In Twitter America, last week, an intense debate was unfolding around Biden, for an alleged deep-fake had taken over the White House as per some conspiracy theorists. While there is no way of verifying the rumours, there is little doubt that President’s Biden legacy will be way worse than his predecessor's.

To decimate the local economy, to widen the faults in a security arrangement that has outlived its utility, and give China a free pass after two years of the pandemic is what Biden would be remembered for. Mumbling, stumbling, and finally, tumbling.

China: The Emperor’s New Clothes

In China, an old literary folktale written by Hans Christian Andersen is playing out. The Emperor’s New Clothes is often read to children in kindergarten to instil an important virtue, speaking the truth even in the most difficult of times. However, today, in China, before the emperor (read Xi Jinping), no one in the Chinese Communist Party or the republic has the valour to point out the path of social and economic decimation the country has undertaken.

Unlike Biden, Jinping’s accountability doesn’t have to pass the test of the electorate, but the signs of chaos are as visible in Beijing as they are in Washington DC.

Against the goal of 5.5 per cent gross domestic product (GDP) growth, the Chinese economy only grew at 2.5 per cent in the first half of 2022, thus affirming that the economic objectives for the year would not be met. Covid-zero lockdowns have hammered the economy and disrupted supply chains.

For instance, in Shanghai Port, the number of containers processed in April 2022 was the third-lowest since January 2019, at around 3.1 million. In January 2022, before the lockdowns kicked in, the port processed 4.4 million containers, the highest in over three years. April 2022 has been the worst month for the Shanghai port since February 2020, when it processed merely 2.3 million containers.

Tesla, Toyota and Volkswagen have revised their projections for the current year as delay in delivering key raw materials disrupts their production. Tesla’s Shanghai plant, usually shipping out close to 60,000 cars a month, could only produce a little over 1,500 vehicles in April, given it was shut for three weeks. Due to supply-chain disruptions, Toyota has already cut its revenue forecasts by 20 per cent.

A survey released in May 2022 by the European Union Chamber of Commerce in China highlighted the concerns. Of more than 350 companies surveyed, nearly 60 per cent are looking at decreased revenue projections for 2022.

Amongst more than 200 companies looking at losses for 2022, almost two-thirds are looking at a revenue decrease of more than 10 per cent. About 15 per cent of the companies are looking at revenue losses exceeding 20 per cent for the year.

Thanks to the unpredictability of the lockdowns, a quarter of the surveyed companies are looking to move their investments outside China.

The economic ghosts of the past are also surfacing to haunt Jinping in his critical year. Last week, according to a Financial Times report, China’s central bank was looking to mobilise as much as $148 billion of loans for stalled real estate developers. The move is similar to what US Treasury Secretary Hank Paulson announced after the weekend of the Lehman crash, called TARP or Troubled Assets Relief Programme.

The crisis in the real estate sector pulled down the YoY GDP growth in the second quarter to 0.4 per cent, for an economy where real estate and related activities constitute one-third of the economy, the music is slowing down.

Jinping, for long, got away from the questions of economic fundamentals in China by citing real estate growth. Construction was booming, raw materials were in demand, and strong sales numbers were being anticipated. However, that is no longer the case.

Earlier this month, buyers launched a protest, unthinkable in China, stating that they would not make their monthly mortgage payments until the projects were completed. Even Evergrande, with over $300 billion in liabilities, defaulted on its restructuring plan, one it was supposed to share with the investors before the end of July.

The concerns are not limited to the developers alone, for bankers and promoters behind these projects, many of them local, could face a run on their deposits, triggering another crisis. Given that many buyers make 100 per cent payments before the houses are delivered, the consumption economy also suffers.

Together, nearly $590 billion can be attributed to unfinished real estate projects in China.

The authorities immediately swung into action, with the Chinese banking regulator assuring that the construction would be accelerated. Thus, it would not be the last loan China’s central bank mobilises to bail out the real estate sector.

Jinping’s claims of a strong economy are also being busted in the dollar-bonds sector. Issued mostly by real estate developers, some of these bonds were paying a 32 per cent yield in March 2022, higher than what was in 2008. In the last few quarters, the quantum of dollar bonds issued has decreased significantly compared to 2018 and 2019.

For Q1 2022, the issuance was down by 97 per cent compared to Q1 2021, thus triggering another crisis for the developers. The other worrying sign is the $13 billion payment in interest due for the next 12 months while defaults are rampant.

Not just economically, Jinping faces a social challenge within China, that of a declining population. In 2021, China allowed families to have three children, given the fertility rate in China was only 1.3 per woman. For Japan, it was 1.36 in 2019, and for the United States, it was 1.7. The education costs act as a deterrent to having more than one child for couples in China. Therefore, in a feeble attempt to arrest this development, Jinping launched a crackdown against the $100 billion private tutoring industry in 2021. The CCP went as far as regulating the prices of apartments near schools.

The CCP, under Jinping, may have been able to buy out the loyalty of the media, both in China and across the world, but the debt bomb is quite ready to explode. The GDP growth for the year stands permanently dented, the confidence in the local banks is shaky after the collapse of some small banks in the Henan province. Also, the real estate developers are in an urgent need of a bailout, companies are looking to diversify their investments out of China. To cap it all off, the Chinese population is getting old faster than it is getting rich, thus threatening a Japan-like situation in the 2030s and 2040s posing a threat to China’s manufacturing prowess in the long-term.

To sum up, that is what President Jinping would be remembered for.

Tantrums And Troubles In Taiwan

Later this week, the Speaker of the House and a key national leader in the United States, Nancy Pelosi, is expected to visit Taiwan. For Beijing, the prospects of her visit are an opportunity to flex its muscles, double down on its claims on Taiwanese territory, and conduct navy and air patrols. For the White House, however, her visit comes as another foreign policy challenge, for it could raise serious questions against US’s commitment to defend Taiwan if China responds. If it were to deter her from visiting, it would be Biden’s third embarrassment after Afghanistan and Ukraine.

To quote a famous line from The West Wing, Franz Ferdinand, the nephew of the Austro-Hungarian emperor, was killed by a group called the Black Hand. And because they were a Serbian nationalist society, the empire declared war on Serbia. Then, bound by a treaty, Russia was forced to mobilise, which meant that Germany had to declare war on Russia. Then France declared war on Germany, and that was the First World War. Because the emperor's nephew was killed.

These are two faulting men, one of unsound mind and the other of unchecked authority, leading two faltering economies.

What if, falling into the Thucydides Trap, the regimes in recession were to clash in Taiwan?

Tushar is a senior-sub-editor at Swarajya. He tweets at @Tushar15_