World

Explained: Implications Of Saudi-Iranian Rapprochement In Beijing

Venu Gopal Narayanan

Mar 14, 2023, 12:20 PM | Updated 12:20 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Chinese government pulled off a spectacular geopolitical coup in Beijing last week by successfully mediating a restoration of diplomatic relations between Saudi Arabia and Iran.

According to a tripartite joint statement released on 10 March, the two Middle Eastern energy giants will reopen their embassies within two months.

This is a momentous development with global ramifications, since Saudi Arabia and Iran had been at loggerheads for a variety of reasons ever since oil became the world’s most precious commodity early last century.

Apart from the old Shia-Sunni divide, ethno-cultural differences between Arabs and Persians, and a contest for regional supremacy, tensions between the two countries have also been persistently stoked by America, especially after Ayatollah Khomeini’s Islamic Revolution of 1979, in an effort to retain firm control of the region’s boundless hydrocarbon resources.

That is why the tripartite statement makes for interesting reading.

There is a reference in it to secret meetings in Iraq and Oman prior to the final round in Beijing.

This means that the discussions transcended traditional cultural and sectarian distinctions, and that is quite telling for multiple reasons.

First, Iraq, like Iran, is a Shia majority state with as much oil reserves, and which too yearns to double its oil exports — at the very least.

Second, Oman follows the Ibadi school of Islamic jurisprudence (possibly the oldest), and is quite different from both the Saudi Sunni Hanbali school, and the Iranian Shia Jafari school.

Third, it makes specific reference to the past two attempts at Saudi-Iranian detente, and their revival: a 1998 General Agreement on bilateral cooperation in various fields, which was stillborn, and a 2001 Security Cooperation Agreement, which went into cold storage soon thereafter.

Fourth, separately, the agreement was signed on behalf of the Chinese government by Politburo member and former foreign minister Wang Yi, and not his successor, Qin Gang.

This is a clear indicator that the negotiations were driven by Xi Jinping.

Equally significant is the fact that Xi will be visiting Moscow next week for in-depth discussions with his Russian counterpart, Vladimir Putin.

Thus, the agreement represents a coming together of disparate strands, stretching across Asia from Mecca to Manchuria; strands which had been kept violently apart by external forces for decades.

And, pertinently, it is a third attempt at burying the hatchet in the past quarter century.

What are the implications of the Saudi-Iranian agreement, and can it work?

One, whether anyone likes it or not, or concurs or not, this marks one more step in the rehabilitation of Iran.

There is an inevitability to this which started gaining momentum from the summer of 2022, when the Russia-Iran-India International North–South Transport Corridor (INSTC) was operationalised.

Two, it represents the Middle East’s collective intention to recapture their traditional market share for crude oil.

By corollary, that means a resurgence of OPEC (Organization of the Petroleum Exporting Countries), but with Russia leading the way.

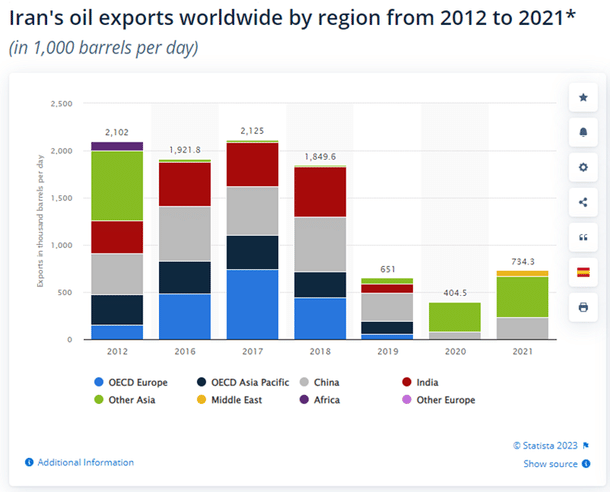

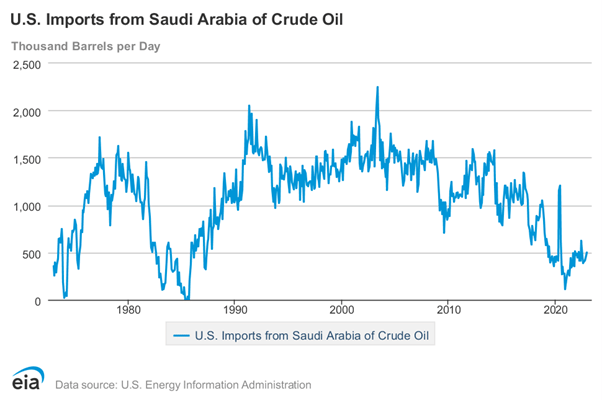

As a forthcoming piece will explain, both Iran and Saudi Arabia lost significant market access in the past two decades for America-driven reasons; as two charts below show, India has stopped importing oil from Iran, and American import of Saudi crude is down to a quarter of what it was for decades.

Three, both Iran and Saudi Arabia represent the advent of major new competitors in the world LNG (liquefied natural gas) market.

Iran has the world’s second largest natural gas reserves after Russia, and it recently announced the development of a mega LNG export terminal jointly with Russia.

Also, lest we forget, Saudi Arabia has vast volumes of natural gas which are yet to be fully commercialised. They have been consistently making new gas discoveries, and in 2019, established a large, new, deepwater gas play in the Red Sea.

Four, going back to the ‘innocent’ Iraq reference in the tripartite agreement, if Iran, Iraq, and Saudi Arabia can ever work together, to a common plan, the three countries alone could comfortably meet a third of the world’s oil needs for at least the next two decades.

That is the kind of potential which could be unleashed, and that is not even counting the rest of the Middle East.

Five, if this rapprochement works (and it is still a big if), it will directly affect the revival of America’s domestic shale oil and gas industry (which is already in the doldrums thanks to their President Joe Biden’s policy myopia).

This is because, like Japan’s decision to recommence purchase of Russian crude oil in spite of Western sanctions, other large markets such as India and Europe, too, will gladly purchase discounted volumes of Middle Eastern crude oil (and, increasingly, LNG) rather than much more expensive oil or gas from American shales.

This, in turn, would affect growth in America, since the past two decades have shown that nothing can get the economy revving like investment in the American upstream petroleum sector.

It is a direct correlation which Donald Trump understood, and tried to capitalise upon: the more they drill and produce from shale plays, the more well-paying jobs they create, and the more they capture foreign market share, the more the economy booms.

But very little of that would come to pass if Iran slips the sanctions leash and starts working in unison with Saudi Arabia, China and Russia. It would cut America out of the game.

Consequently, a rapprochement between Iran and Saudi Arabia is the last thing the Americans need.

They cannot allow this move to work, not just because it threatens their domestic petroleum sector, but also because, more importantly, it would only add to their further geopolitical enervation.

As it is, American relations with Iran, Russia and China are markedly adversarial; they have openly declared Iran as an ‘evil’ threat, are currently involved in a proxy war with Russia in Ukraine, and are hell bent on containing China.

They retain a veneer of cordiality with Saudi Arabia, in spite of Biden’s blunderings, but with the revelation of the Beijing agreement, America will now have to choose.

Do they try to run with the hare and hunt with the hounds while they monkey-balance their relations with Saudi Arabia, or do they decide that this is a step too far and try to stymie the resumption of diplomatic relations between Iran and Saudi Arabia?

But the bigger question is: does America even possess the capability anymore of pursuing either option?

After all, the ground reality is that they have comprehensively wrecked relations with three large countries, failed to impose effective sanctions on Russia because India chose not to join that bandwagon, created widespread dissonance in Europe over an absurd over-dependence on America, and are incapable of containing China’s rise unless India enters into a formal military alliance with them.

Or, perhaps, we are looking at this radical development the wrong way.

Perhaps, the very fact that Iran and Saudi Arabia could meet in Beijing to try and mend ties reflects the surprising extent to which America’s once-overweening influence on world affairs has dwindled.

What happens next is difficult to predict in the short term, but this much is clear: for perhaps the first time, oil is becoming a buyer’s market.

A century-old contest between exporters of fossil fuels is set to enter a new and turbulent phase, in which the only real winners will be the major importers.

Venu Gopal Narayanan is an independent upstream petroleum consultant who focuses on energy, geopolitics, current affairs and electoral arithmetic. He tweets at @ideorogue.