Economy

Now Deflationary Woes Too Are 'Made in China'

Tarun Dang and Priyanka Raju

Sep 04, 2015, 09:21 PM | Updated Feb 24, 2016, 04:30 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The global slowdown just got worse as the contagion spreads across mutually dependent economies. A chart heavy walk-through of what could be the fallout of the China devaluation conundrum

Last few days saw stock markets plummet, commodities continue their decline, currencies weaken, GDP projections whittled! Only the CBOE Volatility Index (VIX), also known as the fear gauge, rose. And it rose sharply. China triggered this rout on equities. The Shanghai Composite Index was falling steadily the last few days.

But Monday,August 24th, was different because, unlike the last few day when the People’s Bank of China (PBoC) was actively buying to stem the fall, it didn’t intervene to stop the slide. The Bank had already spent nearly $200 Billion trying to prop up the markets and finally realized that this was a futile attempt, akin to trying to catch a falling knife. The panic spread like wildfire across the global markets.

Stock markets have a penchant for over-reaction. It will go through its typical cycle of peaks and troughs. While fears and volatility look currently overdone, however to overlook the underlying message would be unwise.

China is important:

Yuan is not a freely floating currency and its movement is tightly controlled by the Chinese authorities against the US dollar’s value. It was a means to maintain their currency from rising too much since Chinese economy is largely built on its exports. Early August, in a surprise move, China devalued its currency leading to the biggest one-day change in thevalue of theYuan since China began daily adjustments a decade back. It was seen as a tacit admission that its economy is staring at a slowdown. The exact reasons for devaluation have been a topic of plenty of speculation. While it can be argued that the devaluation came at a time when China’s exports have drastically reduced and was an attempt to boost exports, it could also be merely explained as a technical change in how the Yuan is managed.

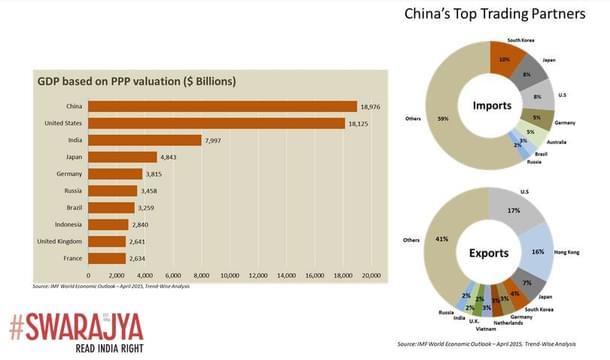

Why does China matter so much to the world economy that everyone is on tenterhooks? It’s because China is the largest exporter in the world catering to the requirements of almost all countries. To cater to that output, it imports commodities, minerals and metals from across the globe. Numerous economies, big and small, are dependent on those Chinese imports. The world was used to decades of stable and rising growth from it. In prior periods, when the global economy was showing signs of deflation, China managed to spur growth. Now, the dragon itself is showing signs of weariness.

Deflationary conditions:

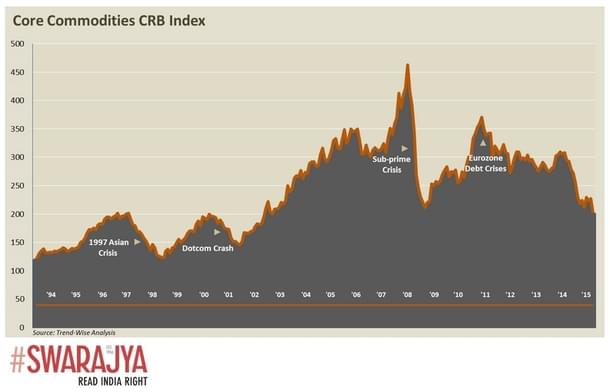

Commodity prices are a fair reflection of global demand. Commodities typically fall before slowdowns and economic crisis (as evident from the CRB chart). Global commodities are in a cyclical multi-year bear market that began around the 2007-2008 financial meltdown.

Crude oil was not impacted by the China crises but the fall was largely due to Saudi Arabia’s excess surplus and the shale oil revolution in the U.S. However with China being the 3rd largest importer of oil, slowdown fears only add to the headwinds in oil prices. China is also the world’s largest importer of copper and coal. No surprise that copper prices saw a steep decline since May 2015. Other major commodities like Iron ore, coal and gold have seen similar declines. Given this environment, the slowdown in commodity prices looks likely to continue.

All this is unfolding with a backdrop of a potential U.S. Fed rate hike, signals further capital flight. As Emerging Market’s (EM) start cutting their rates, in a bid to spur their economies by reducing the cost of capital, money will flow out in search of higher yields. U.S. treasuries, considered most stable, become a preferred destination. Emerging markets again are the most vulnerable at the moment in light of low global demand, falling commodity prices, high Debt-to-GDP ratios and weaker currencies. Developed nations are unlikely to be affected as much.

While a question mark remains if the U.S. will reach its inflation target till it raises rates, other developed economies like Japan, Eurozone and Britain are still struggling. Their respective QE programs (quantitative easing) continue at the moment. The current slump in commodities has brought about some succor to developing and underdeveloped nations that are perennially battling inflation.

The deflationary effect brought about by low commodity prices and low growth forecasts for China, provides headroom for EM Central Banks to ease rates in an attempt to lower borrowing cost and revive consumption. A central banker’s tool kit has two key components, managing the exchange rate and interest rates.

Countries that have healthy foreign reserves, which can help them defend volatility in their currencies, may exercise the option to cut rates. India, South Korea and Taiwan fit that bill. In this time of a global slowdown, interest rate cuts (depreciates currency) can help support exports but more importantly spur domestic consumption. While it is a difficult choice to make, EM’s should take this plunge if their debt and inflation scenario allows for it.

Emerging market equities have already seen a steady outflow of capital for the last few months. That situation is unlikely to reverse and further capital flight can be expected. But even when EM markets fall out of favor with global investors, India, South Korea and Taiwan, countries that have strong fundamentals, will still present opportunities with their high growth rates. As Winston Churchill famously said ‘never let a good crisis go to waste’. Despite contrary beliefs, economic downturns also bring opportunities in their wake.

It will be premature to write off the current turbulence in China as a failure of its leadership. After all it’s the same leadership that delivered a steady growth trajectory for more than two decades. This crisis provides an opportunity to economies like China, to move away from its dependence on exports and focus more on its own domestic consumption. That is the path to move from a developing country to a developed one. The recent policy moves by China to a more market driven economy are actually positive signs that could bring long-term benefits. But till that happens expect short term pain for the rest of the world.

Tarun Dang is the Managing Partner at Trend-Wise Capital Management. He has chiefly been a Management Consultant specializing in the Financial Services industry. His articles on the Economy and Markets are a regular feature in key financial publications. Priyanka Raju has an extensive background in research, primarily in finance, markets and macroeconomics.