Economy

Why Sovereign Bonds Are The Leap That Must Be Taken

Karan Bhasin

Jul 28, 2019, 06:07 PM | Updated 06:06 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

The Budget announcement to issue sovereign bonds in foreign denominated currencies signalled a positive departure from our conventional approach towards public finance. However, it led to a stark divide amongst economists and commentators who advised the government to reconsider this decision.

In my previous articles, I’ve explored concerns regarding sovereign bonds and highlighted how they’re not relevant for the case of India. A favourite example of the critics has been the case of East Asian Crisis as they harp on the problem of the ‘original sin’ but they forget the context in which the East Asian Crisis occurred and how it is in contrast with India’s present economic scenario (You can read more on this by clicking here.)

India’s low levels of external debt, robust domestic frameworks combined with strong macro fundamentals are likely to ensure prudent borrowing practices that mitigate the possibility of a debt crisis. It must also be stated that India’s record of debt servicing has been one of the best and, therefore, critics are being overly pessimistic.

There are multiple reasons to explore the option of borrowing from other countries, and to make such borrowing viable, it is important to issue bonds in foreign currency. Foreign rupee bonds can also be issued but they’re unlikely to generate the same level of interest as a Yen or a Euro-denominated sovereign bond issued by India.

As is the case, India is a capital starved country and it has limited savings to fund investment activity. Therefore, when the government borrows domestically, it pushes up the cost of capital and uses up a major proportion of our domestic savings. This, thereby, constrains the capacity of banks to finance private investment and the government has rightly acknowledged the role of private investment towards sustaining a high growth rate. The decision of external currency denominated bonds is an attempt to free up domestic savings and channelise them towards private investment, which is critical for our economy (You can explore more on the rationale behind the decision by clicking here).

Over the last couple of days, there has been a new concern regarding the impact of sovereign bond on exchange rates and it is important to explore this issue in detail. Some people have argued that the foreign denominated bonds are likely to depreciate the value of the Indian Rupee. Others have mentioned that if the rupee continues to depreciate at the same rate at which it depreciated since 2000, then it will cost more to borrow from abroad than to borrow domestically. Let us explore both these arguments in detail.

It is important to appreciate the fact that exchange rates and forex markets depend on a diverse set of variables. A simplification, and one that works reasonably well, is to consider that exchange rates depend on interest rates and inflation rates across the two countries that are being considered. An increase in domestic interest rates when the foreign interest rate is fixed is likely to appreciate the domestic currency, while a decrease is going to result in depreciation of the currency.

It is evident that the decision to borrow in foreign bonds is likely to lower yield, and, therefore, domestic interest rates will reduce. But foreign interest rates are not fixed, and the Fed, for instance, has already indicated that it is likely to cut interest rates, going forward. It is also interesting to note that repo rates in India have been on a downward trajectory since earlier this year, so irrespective of sovereign bonds, we are going to witness low interest rates, going forward.

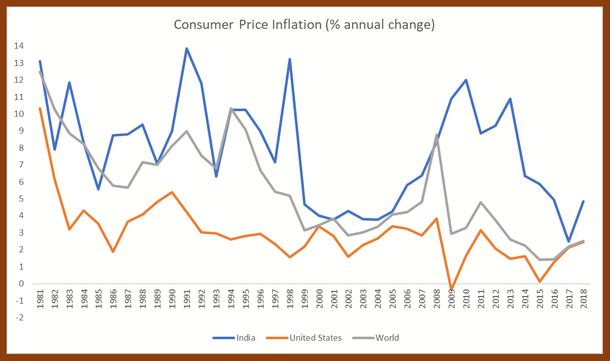

The reason for moderation in interest rates in India (and even in the US) is the low levels of inflation. The differential between world inflation and India’s inflation has narrowed down on an average over the last decade and this implies that the rupee is likely to depreciate at a lower rate than in the past.

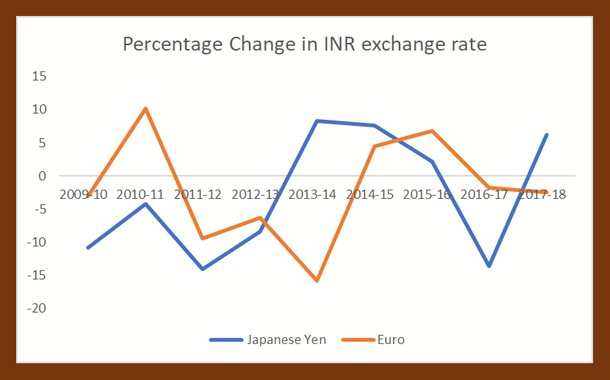

Combined with the Blassa-Samuelson effect and productivity gains over the next five years, we may well witness a real and nominal appreciation of the rupee, in which case the cost of external borrowings may be far lower than the rate of interest. As is the case, there’s some evidence of the Blassa-Samuelson effect when we look at India’s exchange rate movements with respect to the Japanese Yen or the Euro (The issue of exchange rate appreciation has been explored in detail by Harsh Gupta in an earlier article that can be read by clicking here).

Further, India’s sovereign issue is likely to be way too small to have a tangible impact on our exchange rates. Given the improvement in productivity levels, combined with the reduction in inflation gap, and overall reduction in nominal interest rates, India stands to gain from issuing these bonds. The world has changed, and it is about time we challenge our traditional outlook as we review our policy choices regarding public finance.

The only criticism of this decision should be on the small size of bond issue that the government is planning, but overall, we should welcome the departure from conventional wisdom and applaud the Finance Ministry for taking this giant leap forward.