Infrastructure

How The National Infrastructure Pipeline Can Be India’s Ticket To Destination ‘5 Trillion’

Rouhin Deb

Sep 30, 2020, 02:22 PM | Updated 02:22 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

As there seems to be some consensus on the Covid-19 pandemic panning out by end of the year and more recently with the gross domestic product (GDP) figures for the quarter out in India at -23.9 per cent, the focus seems to have shifted again to economic recovery, at least for the last few days in India.

Many argue, Indian economy is on a free fall and it’s not all due to the pandemic. India’s economic growth has been declining from 2016 and since then seen continuous a decline for the last five consecutive years.

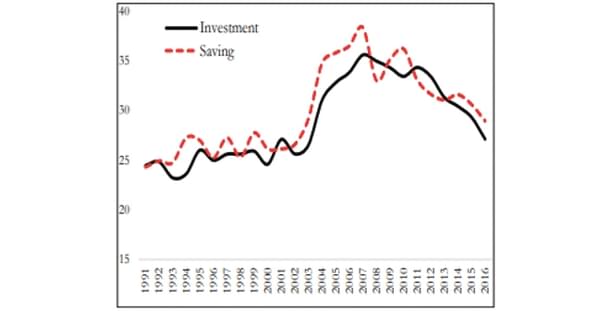

One of the most important reasons for this decline in growth has been the decreasing investment rate in the country since the year 2009. (Exhibit 1)

Therefore, for India to be back on its path to economic growth, it needs more than just the short-term monetary and fiscal stimulus.

Rather, it needs a calibrated approach and a well-envisioned route to long term recovery.

China, for example, witnessed its tremendous rise as a superpower on investment, infrastructure and manufacturing, and India as it seems has barely managed to scratch the surface on these three fronts.

The present government to address these issues launched the ‘National Infrastructure Project’ — which arguably has been the government’s most ambitious undertaking to revive the ailing Indian economy and transform India to a five trillion-dollar economy by 2024.

The project envisaged an investment of Rs 111 lakh crore into the infrastructure projects across sectors like energy, infrastructure, logistics, agriculture and telecommunications to give a new push to the ailing economy.

However, the exogeneous shock of Covid-19 pandemic disrupted the plans and the focus has shifted to lives from livelihoods.

The efforts of the government meandered from growth-led investments to actions aimed at containing the pandemic and support the flagging economy.

However, with the focus shifting towards economic growth once again, the growth debate has come to haunt the government. The question of ‘how do we get back on track with the National Infrastructure Pipeline and revive growth in the economy’ has come to the forefront.

The NIP project was allocated Rs 13.6 trillion in the present financial year and Rs 19.5 trillion in the subsequent financial years of 2021-22, 2022-23 with 80 per cent of these total estimated investments to be financed by the government.

However, with the pandemic spreading its wings across the country, things became messy. The 68-day strict lockdown has resulted in GDP contraction of 23.9 per cent and the fiscal deficit crossed 103 per cent of the budgeted estimate for the year 2020-21, leaving the government in no position to fund new projects amidst the health crisis.

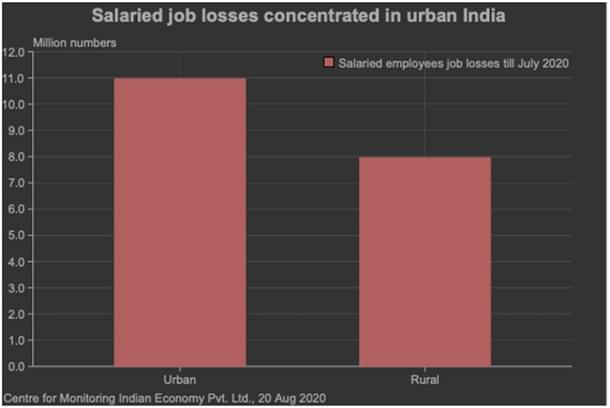

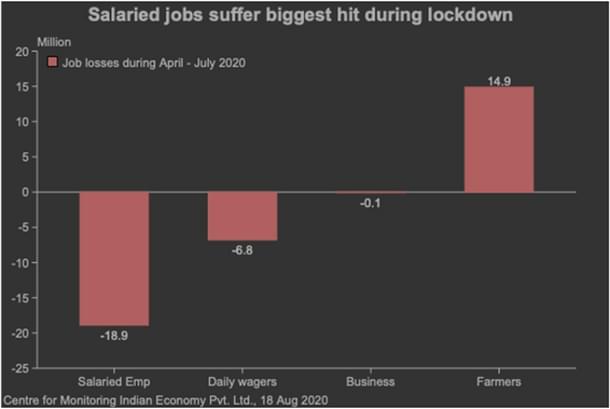

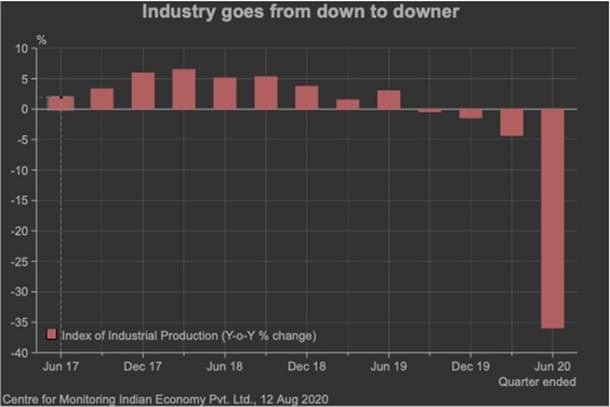

Further, the collection of taxes also witnessed a record decline with GST revenues halved in the June quarter (due to sharp decline in industrial activity (See Exhibit 4) and income tax and corporate tax collections going down to 36 per cent and 23 per cent respectively (as nearly 19 million people losing jobs and corporate taxes coming down to 23 per cent. (Exhibits 2 and 3).

Going by these trends, it has been quite obvious that the government might not be able to contain its deficit target for the year and will need to borrow to keep sustaining the economy.

As per estimates, the borrowed amount could reach as high as Rs 12 lakh crore taking the country’s debt to GDP ratio to around 87 per cent.

With such financial constraints, the investment plans on the NIP project seem to get a push back, particularly from the state governments, which are in an even more dismal condition resource wise.

In midst of this crisis, the government still needs to look out for ways to go on with the NIP and bring in investments, as it seems the only way to boost the economy for now.

Going by these trends, it has been quite obvious that the government might not be able to contain its deficit target for the year and will need to borrow to keep sustaining the economy.

As per estimates, the borrowed amount could reach as high as Rs 12 lakh crore taking the country’s debt to GDP ratio to around 87 per cent.

With such financial constraints, the investment plans on the NIP project seem to get a push back, particularly from the state governments, which are in an even more dismal condition resource wise.

In midst of this crisis, the government still needs to look out for ways to go on with the NIP and bring in investments, as it seems the only way to boost the economy for now.

The Way Forward

Raising resources amidst the Covid-19 outbreak would require an innovative and calibrated approach.

To start with, the government could look at provident funds and insurances for investments as these are becoming more and more organised.

LIC for instance is readying up a Rs 125,000 crore fund to invest in the India based infrastructure projects.

Similarly, Indian merchant banks have also opened fund houses that operate on international standards, which can help the government to raise funds for the projects in near future.

Second, the government can also move towards foreign pension funds as these have always shown interest in the Indian brownfield projects.

However, the green field projects have received lesser interest among foreign funding agencies due to the prevalence of red tape in the country.

These funds have rarely been involved in green field projects in India and even if they did at the rarest of times, it was only through partnership with a strong Indian corporation.

The Indian government could therefore look at completing the primary construction (green field projects) in the NIP through the Indian rupees and once the asset construction is completed the government can raise funds in dollars to operationalise the project in the subsequent phases (brown field projects).

One great example of this successful model is infrastructure investment trust which had attracted a lot of money from foreign funds.

However, with all these steps, the government must keep in mind that the raised money needs to be paid.

Therefore, the government ought to move away from freebie culture that is prevalent across India. The way forward for the development of world-class infrastructure should not be through tax revenues but through public money.

Apart from the monetary hurdles, the government, to get its economy back on track will also have to focus on the policy paralysis it has been facing for years.

Poor institutional quality, regulatory hurdles and clearances cuts through every step in a construction project in India.

Approval delays relating to land acquisitions, environmental clearance, contracting and court delays on PILs which have been another major deterrent to project competition must be addressed for private contractors to seamlessly continue with the construction work and complete projects on time.

Further, the line ministries involved in these projects should take larger responsibilities to facilitate smooth operations of the project and provide the implementation agencies all necessary help and guidance in the process.

Ministry of Programme Implementation, which once used to be ministry in the central cabinet responsible for tracking the status of various ongoing projects across the country, is no longer existent.

Therefore, a similar agency should be incorporated not only to track the progress and adhere to deadlines but also be responsible for co-ordination between state governments, line ministry, inter-ministerial Centre-state co-ordination on various matters pertaining to issues from approvals to financial closure and so on.

This would facilitate a better understanding and faster implementation of projects that has various stakeholders at different levels. Design lapses have also resulted in a huge number of project delays in India.

For example, the New Howrah Bridge in Kolkata took 22 years to complete. One of the major reasons that led to this delay in construction has been poor design planning in India. Design per se has been one of the most neglected criteria of the government while conceptualising a project leading to long delays while countries like Japan and China spend most of the time in design planning ahead of the project.

India, in order to compete with these countries, will have to put its infrastructure design mechanisms in place to reduce the delays in completion of projects.

Last but not the least, India Investment Grid (IIG) launched by the government as a platform to track real time updates on infrastructure projects needs more clarity in terms of information and just the headline numbers on sector wise investment amount allocated will not solve the issue.

Information like clarity on the specific projects are going to be on bid in the next 12 months, the process clarity to go about them, line ministries involved, role of state government etc, should be updated in the IIG database to provide greater clarity to the private stakeholders, who are interested to participate in different projects.

The Covid-19 pandemic has caused a major slowdown in India, but its inherent resilience and capabilities will help it transform into a new India with an accelerated growth path fuelled by infrastructure.

With these steps, it is expected that the NIP, which covers both economic and social infrastructure projects, will improve project preparation, attract investments (both domestic and foreign) into infrastructure, and will be a successful institution by the government for attaining the target of becoming a $5 trillion economy by 2025.

This article first appeared on ORF, and has been republished here with permission. The views expressed above belong to the author.