Insta

Chartered Accountancy Body ICAI Issues Official Gazette Notification To Implement UDIN For CA Practitioners

Swarajya Staff

Aug 09, 2019, 02:39 PM | Updated 02:39 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

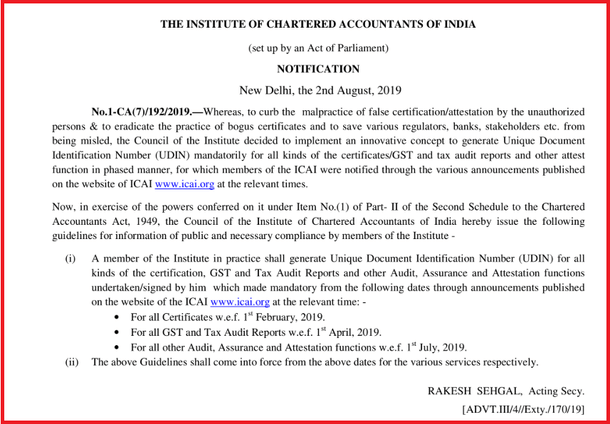

In a notification dated 2 August published in the Gazette of India, the Institute of Chartered Accountants of India (ICAI) officially notified the directives for the Unique Document Identification Number (UDIN) made compulsory for Chartered Accountants (CA), Tax Scan has reported.

Here is a copy of the notification:

As per the notification, the UDIN was mandated to curb the malpractice of fake attestations by unauthorised persons and eliminate bogus certificates affecting various taxation stakeholders.

The notification informs that all practising CAs would have to generate an UDIN for all forms of tax certifications and audits. The implementation began from 1 February in a phased manner but was extended to all forms of audits and attestations from 1 July.

These guidelines have been issued by ICAI in accordance with the power vested in it under Item No.(1) of Part- II of the Second Schedule to the Chartered Accountants Act, 1949.