Insta

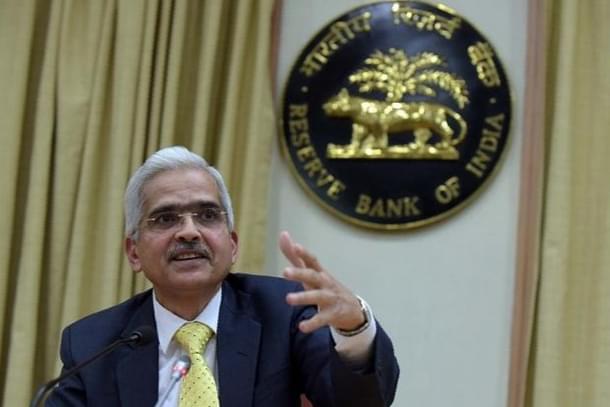

RBI Slashes Repo Rate By 25 Bsp To 5.15 Per Cent In Fifth Consecutive Cut; Reverse Repo Down To 4.9 Per Cent

IANS

Oct 04, 2019, 01:03 PM | Updated 01:03 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

To reverse the consumption slowdown and shore-up growth, the Reserve Bank of India on Friday (4 October) reduced key lending rates for the fifth consecutive time.

Accordingly, the the RBI's monetary policy committee (MPC) in its fourth policy review of the current fiscal reduced the repo, or short term lending rate for commercial banks, by 25 basis points to 5.15 per cent from 5.40 per cent.

Consequently, the reverse repo rate was revised to 4.90 per cent, and the marginal standing facility (MSF) rate and the bank rate to 5.40 per. Further, the Reserve Bank's Monetary Policy Committee continued its accommodative stance.

"The MPC also decided to continue with an accommodative stance as long as it is necessary to revive growth, while ensuring that inflation remains within the target," the policy statement said.

(This story has been published from a wire agency feed without modifications to the text. Only the headline has been changed.)