News Brief

Vivad Se Vishwas Scheme Aimed At Ending Direct Tax Disputes Yields Rs 72,480 Crore For Union Government

Swarajya Staff

Nov 19, 2020, 12:34 PM | Updated 12:34 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

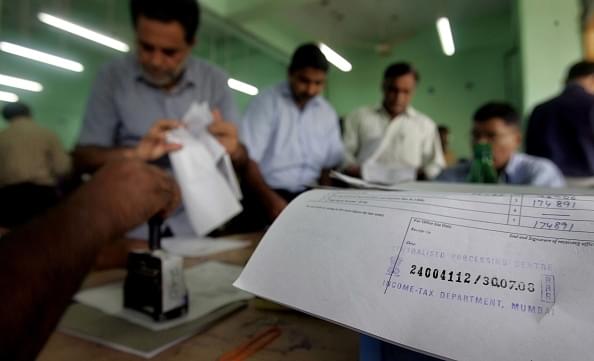

The Union government has garnered Rs 72,480 crore so far through the direct tax dispute resolution scheme Vivad Se Vishwas, Livemint reported.

A total of 45,855 declarations have been filed under the scheme, involving disputed tax demand of Rs 31,734 crore till November 17.

Central public sector companies are also settling their disputes totalling Rs 1 lakh crore under the scheme.

Sources said so far tax of Rs 72,480 crore has been paid by the CPSUs and taxpayers against the disputed demand under the scheme.

Vivad Se Vishwas is a direct tax scheme announced in Budget 2020, for settling tax disputes between individuals and the income tax department.

In her Budget speech on February 1, Finance Minister Nirmala Sitharaman had said that “in the past our Government has taken several measures to reduce tax litigations.

In the last budget, Sabka Vishwas Scheme was brought in to reduce litigation in indirect taxes. It resulted in settling over 1,89,000 cases”. She then unveiled the Vivad se Vishwas Scheme, which was to do for direct tax related disputes exactly what Sabka Vishwas did for indirect tax related disputes.

The scheme provides for settlement of disputed tax, disputed interest, disputed penalty or disputed fees in relation to an assessment or reassessment order on payment of 100 per cent of the disputed tax and 25 per cent of the disputed penalty or interest or fee.

The taxpayer is granted immunity from levy of interest, penalty and institution of any proceeding for prosecution for any offence under the Income Tax Act in respect of matters covered in the declaration.

In order to provide more time to taxpayers to settle disputes, earlier the date for filing declaration and making payment without additional amount under Vivad se Vishwas was extended from March 31, 2020 to June 30, 2020. Later again, this date was extended to December 31, 2020.

Therefore, earlier both the declaration and the payment without additional amount under the Vivad se Vishwas were required to be made by December 31, 2020. The payment date has since being extended to March 2021.