Magazine

Banking Clean Up: Much Done, Much Left

V Anantha Nageswaran

Jun 18, 2016, 11:28 AM | Updated 11:28 AM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

In the early hours of 15 March, Bloomberg uploaded an article on Indian banks with the this URL that tells its own story. The article mentioned upfront that the Reserve Bank of India (RBI) audit of India’s 50 banks, when concluded, would force banks to lay bare their hidden non-performing assets (NPA), stop making new loans to deadbeat borrowers and set aside more cash to cover their write-offs.

The article cites figures from a Credit Suisse report that banks had disclosed $131 billion or about 14 per cent of their total lending and that another $31 billion remained to be disclosed. That doesn’t sound too bad. More than 80 per cent of the stressed loans appears to have been already disclosed. However, the report says that the total amount of stressed loans (including unrecognised stressed loans) was around $198 billion, amounting to nearly 18 per cent of bank assets and little under 10 per cent of GDP.

The problem is big but there has been plenty of incremental action since the Union Budget was presented on February 28. Indeed, the action has been slowly picking up ever since the RBI held a meeting, in the closing months of 2015, to review the asset quality (AQR) of banks.

According to a presentation by S S Mundra, Deputy Governor of RBI, at the first Confederation of Indian Industries (CII) Banking Summit in February, the AQR threw up several ‘innovations’ that banks and their clients were resorting to, to avoid disclosing balance sheet rot.

It is good to refresh our memory for it provides a good foundation for many of the suggestions that follow later in this essay.

• Drawing power (DP) manipulations, Export Promotion Bank Guarantee (EPBG) abuse, funding satellite entities, devolved Letters of Credit (L/C), late adjustments etc

• Round tripping—last week to first week

• Short term overdraft (O/D) to repay; then O/D paid by fresh sanctions

• Sale of assets within groups inflated; same lenders

• Corporate Debt Restructuring (CDR); equity upfront/security creation/personal guarantees

• Interchanges: Non-fund-based to Fund-based

• Date of commencement of commercial operations (DCCO): Not achieved/ cosmetic/very small capacity

• Restructuring: Incomplete Techno-economic Viability (TEV) study

In a note to clients, Credit Suisse observes that since the AQR, inconsistency between banks on the classification of loans has actually gone up: “A recent CRISIL study (based on the top 100 borrowers across banks it rates) estimates Rs 1.4 trillion (30 per cent of current gross NPAs) of loans are still standard at some banks while they are recognised as NPA at others.” It would have been a surprise only if RBI had not come down on the banks with a heavy hand after these revelations.

RBI Wants Transparency

It is reasonable to assume that, notwithstanding the initial shock and price decline, financial markets and investors appreciate transparency on a problem as thorny and sticky as non-performing loans. Hence, RBI’s decision to force banks to disclose the full extent of problem loans is to be welcomed. For long, India has tried to find workaround solutions and there has been regulatory forbearance too with banks being allowed to restructure loans. Hence, India’s ability to handle the problem is not impaired but enhanced by the disclosure of the extent of the problem.

In a speech delivered on February 11, RBI Governor Raghuram Rajan made it clear that the central bank had taken the decisions it took on dealing with NPAs on bank balance sheets with the full support of the Government including at the highest level. That is why he could state categorically in that speech that given a choice between cleaning up and growth, the answer has to be in favour of cleaning up first. Both psychologically and economically, it made sense to seek to confront reality fully, so that it could be firmly put behind.

Unpopularity is a good sign

RBI’s determination to deal with the issue of bad debts in banks is apparently earning the Governor some unpopularity among bankers. In the Indian context, it is no bad thing to be unpopular because it suggests that he is doing something right. HDFC Chairman Deepak Parekh has remarked that too much of anesthesia could make the patient comatose. He is right. There has been too much anesthesia and hence bankers concerned have been in a state of coma on recovering the loans due. It is time for some shock therapy and surgery. RBI is now ready to wield the scalpel to remove the wound.

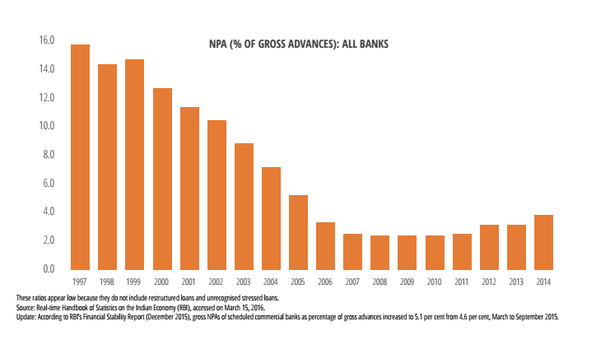

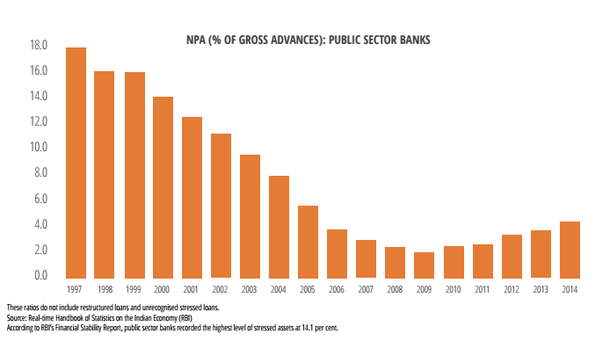

Citing an unnamed banker, chartered accountant and activist S. Gurumurthy wrote in New Indian Express that RBI was adopting a sledgehammer approach. In support of his assertion, he even stated that NPA ratios were higher between 2003 and 2011 and that they had been declining since then. Unfortunately, data do not back him up. The RBI website has data on gross and net NPA ratios for all categories of banks—private sector banks (old and new), public sector banks, foreign banks, etc. Data on gross NPA ratios are shown in the below two charts for two categories of banks—all banks and public sector banks.

The ratio was high in the initial years of the last economic cycle. Those high ratios were a legacy of the bad debt problem that started in the 1990s and they were already declining. The gross NPA ratio reached a low of 2.3 per cent in 2009 for all banks, and 2 per cent for public sector banks. Therefore, RBI data do not bear out the statement that “NPAs remained around 8-9 per cent from 2003 to 2011.”

Also, NPA problems do not show up in data concurrently but with a lag. They do not show up when the economic cycle is booming. The lending boom in the UPA years is now showing up as NPA. That is the point that R. Jagannathan made in his column in Swarajya in February. He picked the “banking sector scam” as the worst legacy of the UPA among the four: 2G spectrum auction, coal mine allocation, Commonwealth Games and bank loans.

The Government Chips In Too

Of course, the present government cannot throw up its hands and blame the previous government. One of the reasons for its election was precisely these scandals. To its credit, the government is not sitting tight. It might have been slow to move in the first year in office. It might have waited for the magic of economic growth to wave its wand and turn NPA into PA (performing assets). But, since September last year, it has been making slow but steady moves in the right direction.

First came the announcement of IndraDhanush, a package of measures to strengthen bank management and governance. It provided for private sector executives to be appointed to public sector banks. Bank of Baroda had become the first test case. Then, in February, the government constituted the Bank Boards Bureau to make board-level and top-management appointments to banks, removing the scope for personal favours and arbitrariness.

In the Budget, the Finance Minister seemingly disappointed with a relatively modest allocation of Rs 25,000 crore ($3.7 billion) for recapitalising banks. The hole in bank capital required a bigger fix. Then, RBI announced a measure to revalue bank real estate holdings. This was not a nod-and-a-wink approach. Having chosen a sledgehammer approach to put a value on NPA in line with international norms, RBI chose to throw a little lifeline to banks. However, the revaluation reserve from real estate assets will carry a 55 per cent discount. Yet, the measure would still add Rs 35,000-40,000 crore ($5.2-5.9 billion) to bank capital. Together, these two sums add up to something. Usha Thorat, former Deputy Governor of RBI, pointed out that RBI was perhaps deviating from its usual conservatism.

Extraordinary solutions are required for desperate times, and these are desperate times for the Indian banking sector. Then, over the weekend of March 12-13, Securities and Exchange Board of India (SEBI) announced that wilful defaulters would not be allowed to raise money in capital markets and that they cannot be appointed to corporate boards. Thus, it is clear that there has been no dearth of intent or action on the part of the government and regulators. They are acting in concert to address the issue. But, unfortunately, both intent and action may be there, but their scale and magnitude may still fall short because the problem is simply too big. The government needs to do more and so should RBI.

Revamping ARC

RBI is doing the right thing by adopting a combination of stick-and-carrot policies. It is forcing banks to come clean and yet has provided relief by permitting revaluation of real estate assets and counting part of it towards Tier 1 capital. At the same time, it needs to take a hard look at the existing mechanism for asset reconstruction.

In July 2015, it issued a notification with the instructions contained in The Securitisation Companies and Reconstruction Companies (Reserve Bank) Guidelines and Directions, 2003. If the senior management of RBI spent an hour going through it and reflecting on it for another hour, it would reach the conclusion that I did. The securitisation and asset reconstruction framework is a sham. It does not work. As it stands, it is nothing more than a parking place for banks’ NPA, helping them to delay taking cognisance of it. It is an enabler for “extend-and-pretend” on the part of banks. Banks sponsored these asset reconstruction companies (ARC), banks bought the securitisation receipts that they issued and banks prevented them from pooling bad debts that ARCs bought from different banks. They were extensions of banks.

The best read on this topic is the article Reconstructing Asset Reconstruction Firms by Tamal Bandyopadhyay in Mint, 9 October 2011. Bandyopadhyay had raised four specific issues:

• Allowing the transfer of assets among ARCs and permitting them to offer working capital support to industrial units under revival

• ARC to be allowed to take over and lease businesses too

• Allowing ARCs to pool bad assets from different banks. Without this, there is no concept of securitisation

• Capping sponsor banks’ exposures at 10 per cent, and keeping the nominees of the sponsors out of the acquisition and resolutions committees of the firms. These issues have been addressed partially by RBI, but with caveats. ARCs can transfer assets among themselves but there are restrictions. They cannot sell or lease businesses.

They can change or take over management of the businesses of the borrowers, again with riders. It is not clear if pooling of bad assets is permitted. Banks are not yet barred from sponsoring ARCs, but the 2016-17 Budget has opened the sector to 100 per cent foreign investment through the automatic route. An ARC can be wholly foreign-owned once the Budget proposal is notified. Foreign Portfolio Investors (FPIs) will be allowed up to 100 per cent of each tranche in securities receipts issued by ARCs, subject to sectoral caps. Until these measures take effect and investments happen, the system as it stands will be incapable of helping solve the NPA problem in India. As Bandyopadhyay put it quite eloquently, “the Indian ARC model encourages the worst kind of financial incest.”

The model is anathema to those who believe in what Einstein said: “We can’t solve problems by using the same kind of thinking we used when we created them.” The same ecosystem that created the problem cannot be part of the solution. More specifically, RBI needs to effect a clean break of the NPA from the banks that created them. Banks have to account for the NPA, provide for them, get rid of them, and move on. The ARC that buys the problem assets should be allowed to deal with them as it deems fit. There can be norms and guidelines for clawback of ‘excess’ recovery by the ARC for the selling financial institution. In other words, the ARC can be required to share excess ‘profits’ with the bank. But the excess has to be defined.

RBI should not rest content with the government allowing 100 per cent foreign ownership of an ARC. It should explicitly prohibit domestic banks from sponsoring ARCs, require them to dilute their stake from existing ARCs within a specified timeframe and bar them from the various operating committees of the ARCs.

RBI is worried that once the banks take problem assets off their books completely and move on, borrowers would buy them from the ARC at throwaway prices, cancelling their loans, in effect, at a steep discount and thus getting off the hook. This is a real risk and it cannot be entirely diversified away or eliminated. There is a need for realism. There is a larger economic benefit to moving on without being seen as doing explicit favours to favoured businessmen and women. The RBI notification of 1 July 2015 has some pragmatic guidelines on this matter:

“Promoters of the defaulting company/borrowers or guarantors are allowed to buy back their assets from the SCs/RCs provided the following conditions are met:

I. Such a settlement is considered helpful in

(i) minimising or eliminating the cost of litigation and the attendant loss of time;

(ii) arresting the negative impact of diminution in the value of secured assets which are likely to rapidly lose value once a unit becomes non-operational;

(iii) where the recovery/resolution process would appear to be rather uncertain and;

(iv) where such settlement will be beneficial for restructuring purposes.”

Clearly, there may be a risk of media scrutiny and CAG objections both to the sale of NPA by banks to ARCs and from ARCs to promoters of the defaulting company or borrowers, where such audit may be applicable. That is why it is important to conduct the process transparently, to keep them abreast of the process concurrently and to seek their approvals in real time.

Where it becomes clear that a borrower is about to get away with a cheap buyback of his own loan, the government or the regulator can step in and allow the purchase to go through under certain conditions such as capital formation and employment generation in the years ahead. In other words, the guiding principles should be transparency, pragmatism and larger economic interest with clear enforcement of accountability on the defaulting borrower. Without costs and consequences, unacceptable conduct will not cease. The cycle of bad debts will repeat itself periodically unceasingly.

“Equal Opportunity” Offender

That is why it is imperative that government leaders, on their part, take a leaf out of the book of the RBI Governor and court unpopularity. He took on bankers. He took on multinationals. He taunted them that they do not have scientists stationed in Cayman Islands. He has consistently criticised monetary policies in the West, particularly that of the Federal Reserve. He wants their policies to be rated as safe, neutral and dangerous for the world with colour codes. About a year ago, he wrote that western pharmaceutical companies were not justified in seeking to restrict generic drug manufacturers. In short, he seems comfortable being an equal opportunity offender. Political leaders in the government need to do the same to solve the banking sector problem. Indeed, one of the solutions to the NPA problem is to court unpopularity not just with bankers but with borrowers and even gratuitous advisors of the ‘Right’ kind or the wrong kind (‘Left’). For example, even as banks were moving courts to prevent him from leaving India, businessman Vijay Mallya fled with ease. It is a very disturbing thought that sections of the State are not in control of the government. There should be accountability for this. An extract from the interview of SBI Chairperson Arundhati Bhattacharya by Shekhar Gupta on NDTV 24x7’s Walk the Talk programme is adequate to give us a demoralising overview of the dysfunctional Indian State:

“For one particular villa (Mallya’s villa in Goa), which we were trying to get possession of, the High Court passed an order saying it should be done in three months. The order was issued to the Collector. The Collector held eight hearings and then went on leave. Normally, Collectors are supposed to take possession, not hold hearings. But this person held eight hearings…

“We approached the Attorney General and said we need to really take up (Kingfisher Airlines’ loan default) in the highest court. We were told we had to go through the Debt Recovery Tribunal. The next day we moved the tribunal, which did not provide any relief. We went to the High Court, which remitted it back to the tribunal, which did not give us the relief we are seeking… When something goes bad, resolution the world over happens in six-nine months’ time. Here it goes on for years.”SBI Chairperson Arundhati Bhattacharya

Take the case of the IDBI Bank. The government announced in the Budget that it might be willing to reduce its stake in the bank to below 50 per cent. The bank is not covered by the Bank Nationalisation Act. Yet, employees of the bank are resisting it. They engaged in a “tweet-maha-login” to protest the threat of privatisation. It is hard to find a rationale for it. Once the bank is privatised, there is better scope for career growth and material rewards. The threat of job loss is remote since India needs more and not less banks. Credit intermediation is not yet pervasive in the country. The economy can and will grow much more, necessitating more and not less banking. The only reason that remains, once we eliminate these, is that the employees are happy with the lack of accountability in the public sector; they are reluctant to subject themselves to scrutiny for higher productivity.

Enforcing accountability is not costless. It requires leadership that is willing to trade off short-term popularity for long-term national interest. Leadership is about making decisions. Decisions involve choices and trade-offs. When these are made with consistent application of values and ethical norms, the credibility of the decisions and of the leadership will be enhanced. They will deliver results too. But, it will take time which may transcend electoral cycles. So, risks need to be taken. There is no reward without risk. But risk means the rewards need not always be pleasant. In the short term, there could be adverse economic consequences resulting in unpopularity. But, with communication and conviction, such risk taking might even turn out to be electorally rewarding. What is going on now in Brazil is worth watching. The country is pursuing corruption cases without any bias. The economy is paying a price. It contracted in 2015 and a repeat in 2016 is likely. Yet, its dogged pursuit of corrupt deeds and corrupt individuals without exception deserves admiration. The country will emerge stronger for all the labour. One of the most senior businessmen in the country has been sent to jail for 19 years. Bloomberg columnist Andy Mukherjee believes that there is a good chance of decent behaviour from India Inc if corporate honchos in India were accorded a similar treatment for their crimes. Former President Lula Da Silva has been charged with money laundering for owning a beachfront apartment. Doubtless, there is plenty of scope for enforcing accountability in India.

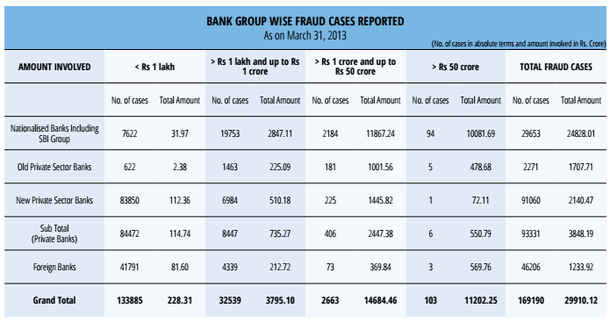

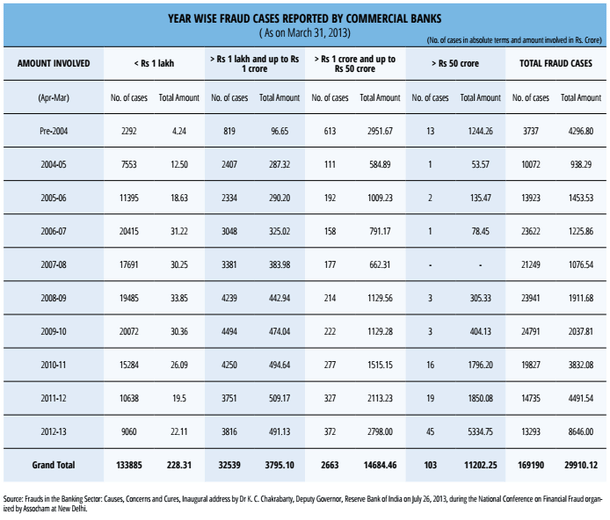

The two tables are extracted from a speech given by K.C. Chakrabarty, former Deputy Governor of RBI in 2013, tell their own story. Frauds involving larger sums have increased over the years and the bulk of them occurs in public sector banks. In his speech, Chakrabarty had made several suggestions for fixing accountability in bank management. Of course, he leaves out fixing responsibility for political interference in loan disbursements. Data in the tables do not distinguish between fraud cases arising from political interference and those arising from internal malfeasance.

To insulate the banking sector from political pressure, this government has taken two important steps that deserve more praise than accorded. They are the creation of a Bank Boards Bureau and the promise of non-interference in banks’ commercial decisions. The second one—non-interference—needs to be institutionalised. Reducing the government stake below 50 per cent would make interference very difficult, if not impossible. Efforts expended in arriving at a consensus on this would be worth their while. It is also a matter of political risk taking, as discussed earlier.

There has been a flurry of activity in recent months. More can and remains to be done. Fresh thinking is needed on the constitution and management of ARCs. Pragmatism in plenty is needed on the part of the regulator and government. Commentariat and watchdog agencies, in particular, should resist the temptation to adopt a lynch mob attitude, aided by hindsight wisdom, towards policy decisions. The government needs to fix accountability on the part of bank management and borrowers. Political accountability would be even better. Is there a guarantee that these steps would help India put the banking crisis behind it? There are no guarantees in real life. Certitude is better left to op-ed writers and academics blessed with a high hubris quotient. Policymakers have to be prepared to experiment, abandon and innovate as they go along, accepting the uncertain nature of the outcomes. Luck plays a part because economic growth is as important as enforcement for resolving banking crises. Even those companies which have been trying to dispose of their assets to reduce debt are not finding it easy to do so. The government would love to be “third time lucky” with the monsoon and would prefer to see the global crude oil price remain low. They too are important ingredients in the resolution process.

There is one certainty, however. A crisis is too important to be wasted, as an Obama aide remarked in November 2008, at the peak of the global financial crisis. By most accounts, America wasted the crisis. But the Indian government can do much better. Indeed, this is as good a time as any to prepare the country’s banking sector for the new millennium by changing its very character. As a share of its economy, India’s banking sector is very small compared to its peers. Further, it has been stagnant at about 75-80 per cent of GDP since 2007. At one level, it is not a bad thing, as an excessively large size of the banking system is a source of systemic risk. However, in the case of India, it lags even developing economy peers. Failure to act will be a failure of imagination and courage—desirable qualities in leaders who think about the next generation and not just the next election.

It is appropriate to close with a view from Bloomberg since we began the piece with them. Michael Schuman wrote on February 24:

While the Chinese regime can in theory implement reforms with clinical efficiency, India’s tumultuous democracy ties up change in endless debates and dissent, making effective governance practically impossible…Michael Schuman

Yet this distinction between China and India has always been simplistic, and in light of current events, it’s even less applicable today. As both countries confront economic headwinds abroad and structural weaknesses internally, India’s more flexible and transparent democracy is looking better suited to tackling many problems than China’s tightly wound system…Michael Schuman

While Rajan is actively forcing Indian banks to acknowledge their problems and make provisions for them, Zhou and his comrades are running the risk of adding to China’s pile of bad loans… Investors erroneously assume that India’s leaders are hamstrung by democratic politics while Chinese cadres, immune from such pressures, can craft policy in the best interests of the economy. But the continuing explosion of debt in China is very much the result of internal politics…Michael Schuman

While Rajan is actively forcing Indian banks to acknowledge their problems and make provisions for them, Zhou and his comrades are running the risk of adding to China’s pile of bad loans… Investors erroneously assume that India’s leaders are hamstrung by democratic politics while Chinese cadres, immune from such pressures, can craft policy in the best interests of the economy. But the continuing explosion of debt in China is very much the result of internal politics…Michael Schuman

“India can benefit from the multifaceted nature of its governing system. Even if New Delhi is paralyzed by political wrangling, other players in the economy have the authority to step in and fix problems. Rajan can harangue banks to clean up because he heads a truly independent central bank. In the Chinese system, Zhou enjoys no such freedom of action… In that great contest between India and China, conventional wisdom doesn’t always apply.”Michael Schuman

For India’s sake, may the Reserve Bank of India Governor—not the banking crisis—have the last laugh.

This article was published in the May 2016 Issue of Swarajya Magazine. To subscribe, click here.

V. Anantha Nageswaran has jointly authored, ‘Can India grow?’ and ‘The Rise of Finance:Causes, Consequences and Cures’