World

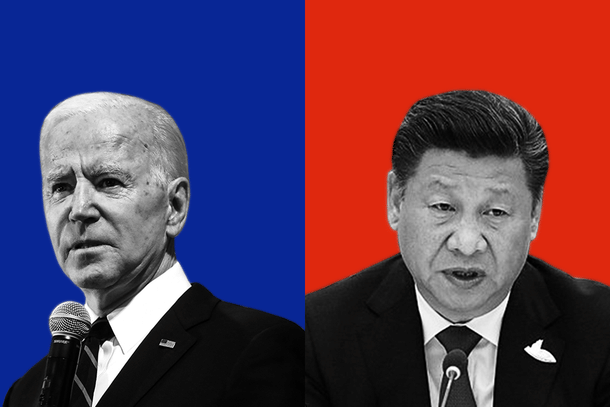

White House Is Destroying China's Semiconductor Ambitions, One Policy Move At A Time

Tushar Gupta

Mar 01, 2023, 02:29 PM | Updated 02:29 PM IST

Save & read from anywhere!

Bookmark stories for easy access on any device or the Swarajya app.

Continuing with its export control spree against China, White House has ushered more trouble for Beijing’s semiconductor manufacturing ambitions.

As per the rules of the Commerce Department, announced earlier this week, chipmakers will have to commit to no expansion in China for the next ten years if they want to be eligible for the funds, around $39 billion, under the United States CHIPS and Science Act.

The move by the Commerce Department, advocated as a safeguard, was to ensure that producers do not abuse their position.

While the Commerce Department did not single out China, they stressed on foreign countries of concern.

They stated that the companies manufacturing in the US must not engage in any joint research or technology licensing on sensitive products with companies originating in these countries of concern.

As of 30 November, 2022, the countries of particular concern under the state department include Burma, China, Cuba, Eritrea, Iran, the Democratic People’s Republic of Korea, Nicaragua, Pakistan, Russia, Saudi Arabia, Tajikistan, and Turkmenistan.

Already under fire by the export controls announced last October, China would find it harder to retain companies in the next decade, especially as the demand for advanced chips grows.

Unable to expand or work with corporations and technologies originating from the US, companies in China would be reduced in capacity and capability, only producing basic chips.

The US, however, would want to emerge as the world’s sole destination for the manufacturing of advanced chips, after Taiwan.

In October 2022, the US Commerce Department, under the Biden administration, announced a set of sweeping instructions, aimed at disrupting China’s manufacturing dominance in the supply chain sector.

The Biden administration announced that it would impose restrictions on 31 Chinese companies, research institutions and related groups effective 21 October, effectively blocking their ability to obtain core US technologies.

The focus was also on ensuring that the Chinese do not get access to chip technology that can be deployed for military use.

If the semiconductor manufacturing process was broken down into several components, the Chinese had negligible share in chip design (electronic design, intellectual property rights), and production of equipment.

What worked for China as a manufacturing base was to ensure infrastructure for large-scale assembling and testing, backed by subsidies from Beijing, and therefore lower costs for the procuring companies. With the restrictions from the US, the discount party will also cease to exist, hampering long-term production plans.

Even if one were to assume that the export controls by the White House would put the Chinese on the path of chip atmanirbharta, the future is not that simple.

When it comes to the software tools used to design the chips, China’s market share is less than 1 per cent; 1 per cent for the tools used to fabricate the chips, 5 per cent when it comes to chip design, 4 per cent of the world’s silicon wafer supplies, and only 7 per cent when it comes to fabricating chips.

The world’s largest factory, for decades, was almost entirely dependent elsewhere for chips.

Another reason to not allow companies manufacturing in the US to expand in China, would also be the forced mergers.

For instance, in July 2015, China’s Tsinghua Unigroup attempted to buy Micron for $23 billion. The purchase, had it gone through, would have been one of the biggest transactions ever between the US and China.

The same group then tried picking up a significant stake in a US company making NAND chips. Probably, the US regulators were worried about the Chinese forcing technology sharing by picking up shares in companies building in the US.

Beyond chipmaking, the machinery involved is another emerging battleground in itself. For instance, US companies like Applied Materials, Lam Research, and KLA are involved in the production of machinery used in the manufacturing of high-end chips.

With US’ restrictions, companies in China can’t access this machinery, and companies building in the United States, outside the restriction list, cannot expand in China; a double whammy.

Japan does build some competitive machinery, but would they want to give up manufacturing leverage?

The chip supply chain wars will only intensify going further. While China’s best hope would be to replicate the softwares, design tools, and chip making machinery that is being deployed by the US companies, they’d be playing a difficult catch-up game.

Even if they were able to develop an indigenous EUV lithography machine, similar to the one by ASML with over 457,000 unique components, they’d have exhausted billions of dollars, lost years worth of production, and chances are, by that time, new advanced technologies would be in play.

As things stand today, the White House, under President Joe Biden, and inheriting the trade policy from President Donald Trump, is taking Beijing to the cleaners on semiconductors.

Not only because the US holds the technology and intellectual advantage, but also because the Chinese, for years, did not realise the Achilles’ Heel of their production process; the chips.

The Chinese were too busy offering a cheap manufacturing destination to care for the most important components in that very production process.

Beijing has now fallen in the trap it had used against the West for decades.

Tushar is a senior-sub-editor at Swarajya. He tweets at @Tushar15_